What are penny stocks? How these 10 healthcare penny shares have fared YTD

[ad_1]

Penny stocks have always been among the most talked about stocks in the investing world. These shares trade at lower values, generally less than one dollar per share and represent publicly traded firms with low market capitalisations. Despite being mostly illiquid and associated with high volatility, penny stocks manage to attract a section of investors, thanks to their potential ability of making wild gains.

Their inherent ability to surprise with significant gains during a bull market is one of the main reasons behind their popularity. There have been instances when penny stocks have delivered quick gains to the shareholders in comparatively small periods. However, investors must never lose sight of the fact that penny stocks also carry high risks.

As already mentioned, since penny stocks are not liquid, investors may face challenges while finding a price that accurately reflects the market. It is also challenging to sell such stocks because investors may not find buyers when needed. Additionally, investors may also find it cumbersome to find information on corporate performance of some penny stocks as often very little information about them is available.

Therefore, a high level of research is needed while trading in penny stocks.

Healthcare penny stocks

Healthcare constitutes a critical part of the Australian economy. The country’s healthcare sector employs a large number of employee and hence, comes with high growth opportunities.

Just like any other sector, healthcare is also dividend into several segments, including biotech, pharmaceuticals, medical equipment, hospitals, medical devices, telemedicine, and health insurance. These segments have recorded significant growth in the past few years, especially during the period hit by the COVID-19 pandemic.

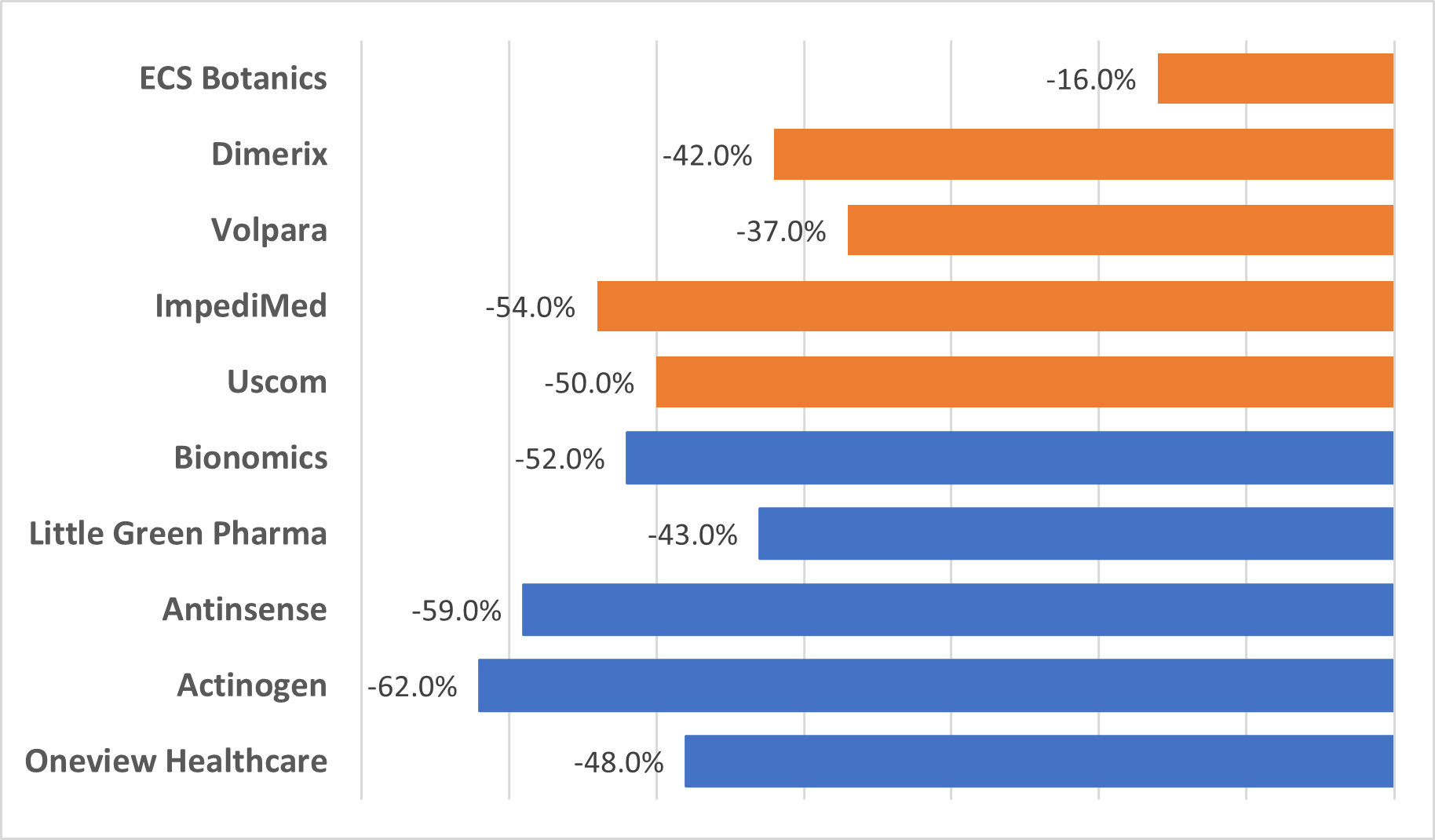

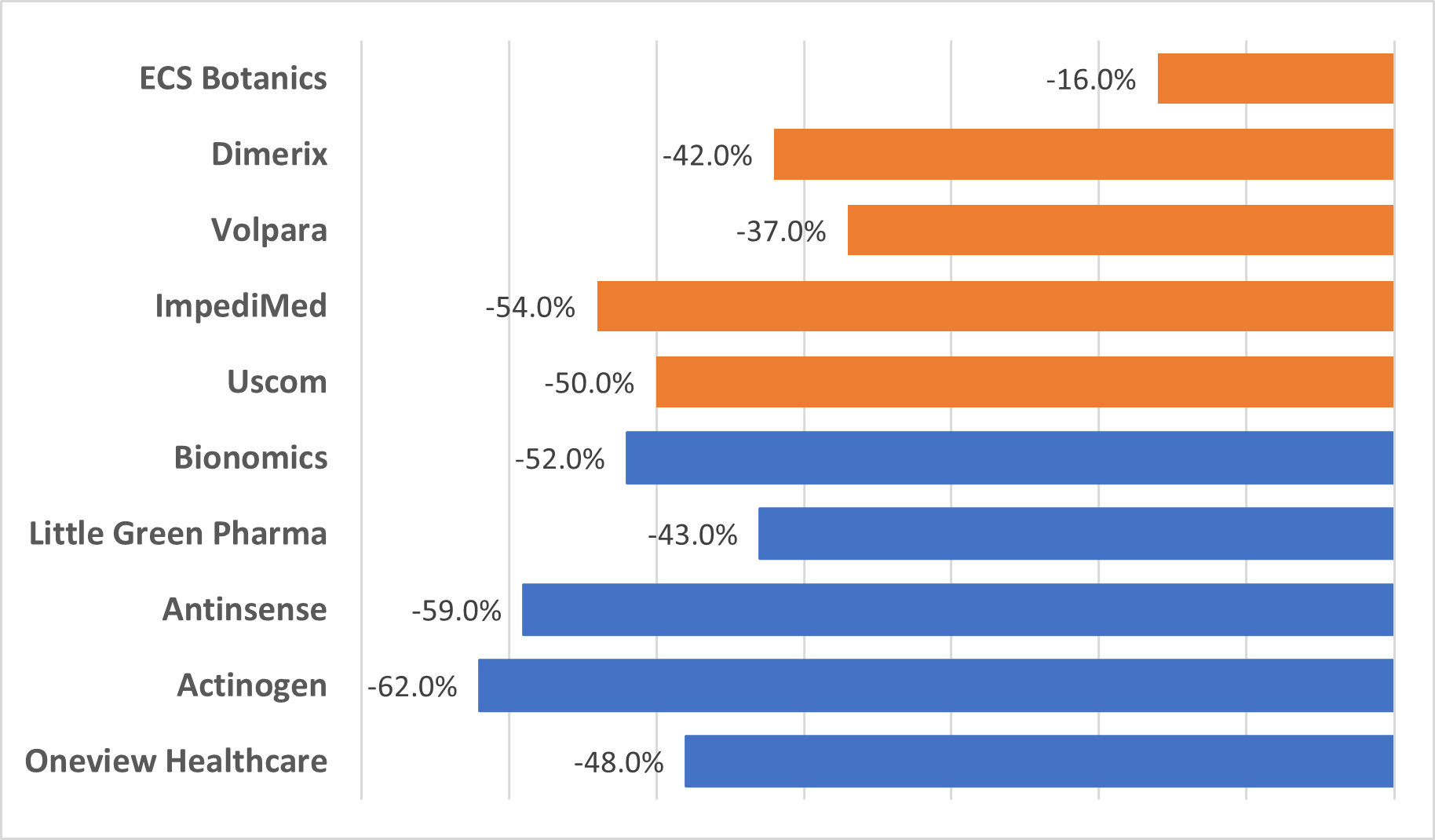

On this note, let us look at the performance of 10 ASX-listed healthcare stocks on a year-to-date (YTD) basis.

Source: © Outline205 | Megapixl.com

Oneview Healthcare PLC (ASX:ONE)

Oneview Healthcare provides software platforms to healthcare firms. The share price has declined over 48% on a YTD basis. In the past 12 months, the stock has fallen over 64%; while in the past month, the share price has fallen over 15%.

Actinogen Medical Ltd (ASX:ACW)

Actinogen Medical provides treatment for cognitive impairment associated with neurological diseases. The share price has declined over 62% on a YTD basis. In the past 12 months, the stock has plummeted 25%. However, the ACW share price has risen over 34% in the past month.

Antisense Therapeutics Ltd (ASX:ANP)

Antisense Therapeutics sells antisense pharmaceuticals. The ANP share price has dipped 59% on a YTD basis. The share price has fallen nearly 9% in the past month.

Little Green Pharma (ASX:LGP)

Little Green Pharma is a medical cannabis firm. The share price has dropped over 43% on a YTD basis. In the past 12 months, the stock has tumbled more than 53%. However, in the past month, the LGP share price has surged more than 6%.

Bionomics Ltd (ASX:BNO)

Bionomics is a clinical stage biopharmaceutical firm. The share price has dipped over 52% on a YTD basis. In the past 12 months, the stock has dropped more than 71%. The stock’s past-month return stands at 4%.

Uscom is a manufacturer of cardiac monitoring devices. The UCM share price has dipped 50% on a YTD basis. In the past 12 months, the stock has plunged 57%, and declined over 14% in the past month.

ImpediMed Ltd (ASX:IPD)

ImpediMed is a medical software technology firm. The share price has dipped 54% on a YTD basis. In the past 12 months, the stock has fallen 22%. The stock rose 30% in the past month.

Volpara Health Technologies Ltd (ASX:VHT)

Volpara Health provides digital health solutions. The share price has dropped over 37% on a YTD basis. In the past 12 months, the stock has fallen 40%. The stock surged more than 15% in the past month.

Dimerix develops new therapeutic treatments. The share price has dropped over 42% on a YTD basis. In the past 12 months, the stock has plunged 35%. However, the stock has offered more than 10% return in the past month.

ECS Botanics Holdings Ltd (ASX:ECS)

ECS Botanics operates in the Australian hemp market. The share price has dropped over 16% on a YTD basis. In the past 12 months, the stock has fallen over 37%. The stock has surged 25% in the past month.

Image Source: © 2022 Kalkine Media®

Be careful while investing in penny stocks

While there may have been several instances of penny stocks turning multibaggers in no time, it is not easy to spot such stocks. Only detailed research, patience, high risk-taking ability, and long stock market experience can increase chances of finding such stocks. Investors should clearly understand that investing in penny stocks is not similar to investing in regular stocks. Penny stocks are a different ballgame altogether and hence follow different rules.

So, before taking a plunge in penny stocks, it is necessary to keep in mind the following points:

Don’t overinvest in penny stocks

Since penny stocks are low-priced stocks, new investors seeking large gains may get trapped into investing a large chunk of their hard-earned money in them. Although it is easier to build 100% profits in a stock priced at AU$1 than AU$100, there are also chances of losing the entire sum in no time. So, experts advise not to park more than 3% to 5% of investment corpus in these stocks.

Detailed research and lot of patience

Spotting a high potential penny stock requires detailed research and lot of patience since these come with inadequate information and low liquidity. Investors would be required to research at least 30-40 companies before they find something worthwhile.

The other point is to closely track the trading volume of specific penny stocks for the last six to 12 months. Any irregular spike in volume may result due to manipulation and not high liquidity. Investors must not forget that a significant part of the shareholding of the penny stocks remains with promoters who are not willing to be buyers. Therefore, there are not many takers for such stocks.

Stop-loss

Last but not the least, investors should be careful while investing in penny stock since these are highly volatile. It is advised to always trade in penny stocks with strict stop-loss targets. Unlike regular stocks, the temptation to invest in penny stocks when their prices are correcting sharply can be dangerous.

NOTE

- Since penny stocks carry high risks, one needs to do some research before taking any exposure in them.

- High dividend-paying shares are not good always. A stock’s dividend yield might be on the higher side due to a significant fall in its stock price, implying financial trouble that could impact its ability to deliver future dividends.

[ad_2]

Source link

Penny stocks have always been among the most talked about stocks in the investing world. These shares trade at lower values, generally less than one dollar per share and represent publicly traded firms with low market capitalisations. Despite being mostly illiquid and associated with high volatility, penny stocks manage to attract a section of investors, thanks to their potential ability of making wild gains.

Their inherent ability to surprise with significant gains during a bull market is one of the main reasons behind their popularity. There have been instances when penny stocks have delivered quick gains to the shareholders in comparatively small periods. However, investors must never lose sight of the fact that penny stocks also carry high risks.

As already mentioned, since penny stocks are not liquid, investors may face challenges while finding a price that accurately reflects the market. It is also challenging to sell such stocks because investors may not find buyers when needed. Additionally, investors may also find it cumbersome to find information on corporate performance of some penny stocks as often very little information about them is available.

Therefore, a high level of research is needed while trading in penny stocks.

Healthcare penny stocks

Healthcare constitutes a critical part of the Australian economy. The country’s healthcare sector employs a large number of employee and hence, comes with high growth opportunities.

Just like any other sector, healthcare is also dividend into several segments, including biotech, pharmaceuticals, medical equipment, hospitals, medical devices, telemedicine, and health insurance. These segments have recorded significant growth in the past few years, especially during the period hit by the COVID-19 pandemic.

On this note, let us look at the performance of 10 ASX-listed healthcare stocks on a year-to-date (YTD) basis.

Source: © Outline205 | Megapixl.com

Oneview Healthcare PLC (ASX:ONE)

Oneview Healthcare provides software platforms to healthcare firms. The share price has declined over 48% on a YTD basis. In the past 12 months, the stock has fallen over 64%; while in the past month, the share price has fallen over 15%.

Actinogen Medical Ltd (ASX:ACW)

Actinogen Medical provides treatment for cognitive impairment associated with neurological diseases. The share price has declined over 62% on a YTD basis. In the past 12 months, the stock has plummeted 25%. However, the ACW share price has risen over 34% in the past month.

Antisense Therapeutics Ltd (ASX:ANP)

Antisense Therapeutics sells antisense pharmaceuticals. The ANP share price has dipped 59% on a YTD basis. The share price has fallen nearly 9% in the past month.

Little Green Pharma (ASX:LGP)

Little Green Pharma is a medical cannabis firm. The share price has dropped over 43% on a YTD basis. In the past 12 months, the stock has tumbled more than 53%. However, in the past month, the LGP share price has surged more than 6%.

Bionomics Ltd (ASX:BNO)

Bionomics is a clinical stage biopharmaceutical firm. The share price has dipped over 52% on a YTD basis. In the past 12 months, the stock has dropped more than 71%. The stock’s past-month return stands at 4%.

Uscom is a manufacturer of cardiac monitoring devices. The UCM share price has dipped 50% on a YTD basis. In the past 12 months, the stock has plunged 57%, and declined over 14% in the past month.

ImpediMed Ltd (ASX:IPD)

ImpediMed is a medical software technology firm. The share price has dipped 54% on a YTD basis. In the past 12 months, the stock has fallen 22%. The stock rose 30% in the past month.

Volpara Health Technologies Ltd (ASX:VHT)

Volpara Health provides digital health solutions. The share price has dropped over 37% on a YTD basis. In the past 12 months, the stock has fallen 40%. The stock surged more than 15% in the past month.

Dimerix develops new therapeutic treatments. The share price has dropped over 42% on a YTD basis. In the past 12 months, the stock has plunged 35%. However, the stock has offered more than 10% return in the past month.

ECS Botanics Holdings Ltd (ASX:ECS)

ECS Botanics operates in the Australian hemp market. The share price has dropped over 16% on a YTD basis. In the past 12 months, the stock has fallen over 37%. The stock has surged 25% in the past month.

Image Source: © 2022 Kalkine Media®

Be careful while investing in penny stocks

While there may have been several instances of penny stocks turning multibaggers in no time, it is not easy to spot such stocks. Only detailed research, patience, high risk-taking ability, and long stock market experience can increase chances of finding such stocks. Investors should clearly understand that investing in penny stocks is not similar to investing in regular stocks. Penny stocks are a different ballgame altogether and hence follow different rules.

So, before taking a plunge in penny stocks, it is necessary to keep in mind the following points:

Don’t overinvest in penny stocks

Since penny stocks are low-priced stocks, new investors seeking large gains may get trapped into investing a large chunk of their hard-earned money in them. Although it is easier to build 100% profits in a stock priced at AU$1 than AU$100, there are also chances of losing the entire sum in no time. So, experts advise not to park more than 3% to 5% of investment corpus in these stocks.

Detailed research and lot of patience

Spotting a high potential penny stock requires detailed research and lot of patience since these come with inadequate information and low liquidity. Investors would be required to research at least 30-40 companies before they find something worthwhile.

The other point is to closely track the trading volume of specific penny stocks for the last six to 12 months. Any irregular spike in volume may result due to manipulation and not high liquidity. Investors must not forget that a significant part of the shareholding of the penny stocks remains with promoters who are not willing to be buyers. Therefore, there are not many takers for such stocks.

Stop-loss

Last but not the least, investors should be careful while investing in penny stock since these are highly volatile. It is advised to always trade in penny stocks with strict stop-loss targets. Unlike regular stocks, the temptation to invest in penny stocks when their prices are correcting sharply can be dangerous.

NOTE

- Since penny stocks carry high risks, one needs to do some research before taking any exposure in them.

- High dividend-paying shares are not good always. A stock’s dividend yield might be on the higher side due to a significant fall in its stock price, implying financial trouble that could impact its ability to deliver future dividends.