The Great Recession, Part Deux? Evidence From the S&P 500, Treasury Bonds, Mortgage-backed Securities And The Unemployment Rate (Doesn’t Look Good) – Confounded Interest – Anthony B. Sanders

Are we looking at The Great Recession, Part Deux?

First, let’s look at the S&P 500 index since August 24, 2020 (white line) and compare that to just before The Great Recession 04/15/06 – 05/17/08. They look pretty similar.

Second, let’s look at returns on long-term US Treasuries (10yr+, white line) and US mortgage-backed securities (gold line) since The Fed undertook “Operation Crush Inflation!” (green line).

I saw The President’s press secretary fielding questions about the declining stock returns and impending recession. She responded “But the labor market is strong!” Well, Ms. Karine Jean-Pierre, I am sure President’s Biden economic advisor Jared Bernstein told you unemployment was at a very low level just prior to 1) The Great Recession and 2) The Great Covid-shutdown Recession). So, claiming that the US employment market is strong economy ignores that unemployment will surge if the economy slows … which is what The Fed is trying to do.

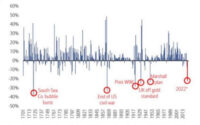

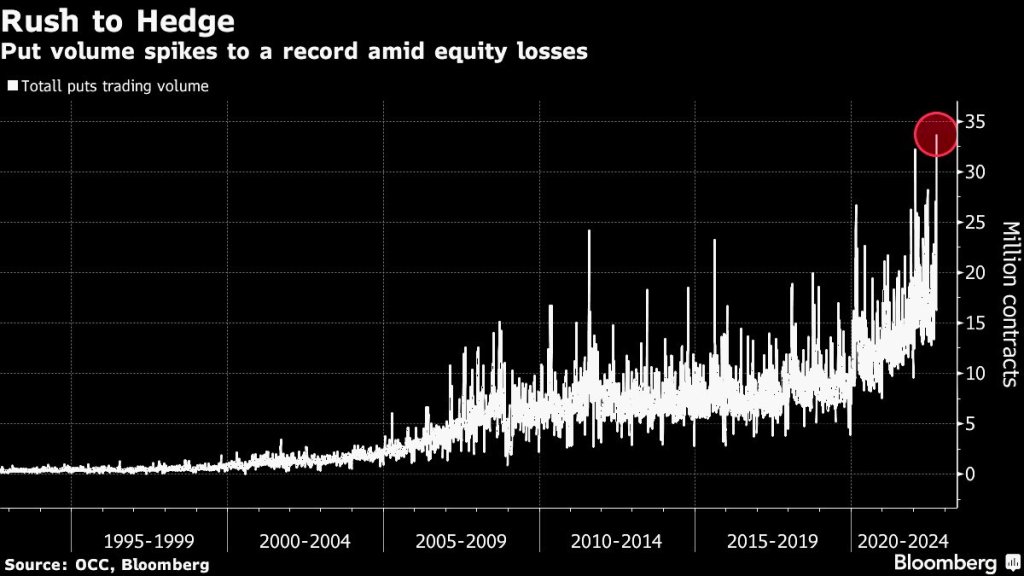

There is a rush to hedge the downside with The Fed tightening the monetary noose.

Unfortunately, KJP’s feeble answers to the shriveling economy remind me of The Office episode when Dunder-Mifflin’s CEO said that “Dunder-Mifflin is still a strong economy.”

Here is a photo of Joe Biden with his press secretary explaining that the US economy is still strong.

[ad_2]

Source link