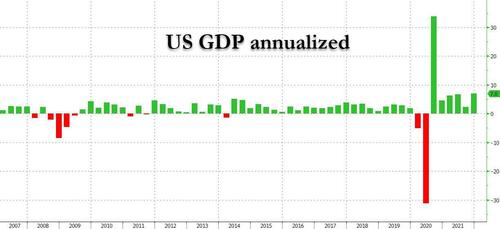

US GDP Grew 7.0% In Second Estimate Of Q4 Growth

While there are far more pressing matters at hand, moments ago the BEA reported its second estimate of Q4 GDP which came in just as expected at 7.0%, up from the 6.9% reported in the first estimate.

Personal consumption rose 3.1% in 4Q after rising 2.0% prior quarter; this missed estimates of a 3.4% increase.

The fourth quarter increase in real GDP primarily reflected increases in inventory investment, exports, consumer spending, and business investment that were partly offset by decreases in both federal and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased. Some more details from the report:

- The increase in inventory investment primarily reflected increases in retail(led by motor vehicle and parts dealers) and wholesale (led by durable goods industries).

- The increase in exports reflected increases in both goods (led by consumer goods) and services (led by travel).

- The increase in consumer spending primarily reflected an increase in services(led by health care, financial services and insurance, and transportation). Consumer spending for goods also increased (led by recreational goods and vehicles).

- The increase in business investment primarily reflected an increase in intellectual property products (led by research and development as well as software)that was partly offset by a decrease in structures (led by commercial and health care).

- The decrease in federal government spending primarily reflected a decrease in defense spending on intermediate goods and services (led by services).

- The decrease in state and local government spending reflected a decrease in gross investment (led by new educational structures)

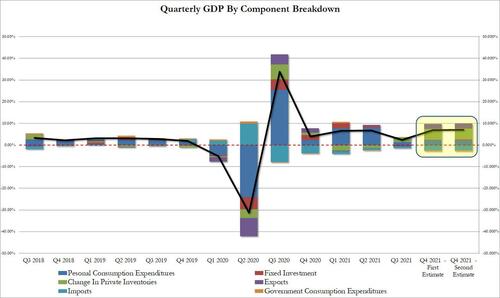

Numerically, this is how the 6.990% GDP number:

- Personal consumption added 2.13%, down from the 2.25% in the first estimate

- Fixed investment contributed 0.48%, higher than the 0.25% initially

- Change in private inventories was unchanged at 4.90%

- Net trade was virtually flat, subtracting -0.07% from the bottom line number, vs a 0.0% print in the first estimate.

- Government consumption subtracted slightly less than initially estimated, or -0.45% vs -0.51% in the 1st estimate.

And visually:

On the inflation front, the GDP price index rose 7.1% in 4Q after rising 6.0% prior quarter; this was slightly above the 6.9% estimate; the closely watched core PCE q/q rose 5.0% in 4Q after rising 4.6% prior quarter; this also printed higher than the expected 4.9%.

Overall, the report is largely meaningless as attention has long since turned to how the US economy is performing in Q1 and onward, and it is here that as discussed earlier, storm clouds are gathering; and should the Ukraine war send commodity prices even higher, the resulting global slowdown will surely tip the US into a recession.

[ad_2]

Source link