Why Is Inflation Here To Stay

The leaders of the European Central Bank (ECB) and the U.S. Federal Reserve (Fed) have long promised us that their lax monetary policy would not lead to inflation, and that we should not worry, that it would be “transitory”. They now concede that the transitional period could be prolonged, but continue to sell us the “return to normal”. Well, no, inflation will last, and here’s why.

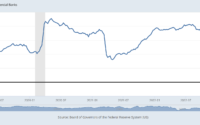

The rapid growth of money creation, which we see in the explosion of the ECB and Fed balance sheets, is partly consumed directly (transaction money), which pushes up the prices of goods and services. The extra money makes the price tags go up, this is the most basic mechanism of inflation.

But the share of money that is saved also has an effect: when it is invested in government bonds (via life insurance for individuals, for example), it pushes up the price (which translates into a lower interest rate). When it is invested in shares, the price rises, and the same goes for real estate, the art market…

The money that is placed on financial and real assets makes their prices rise, which also constitutes “inflation”, not in the strict sense of the word, of course, since statistical organizations only take consumer goods into account, but all the same, and households feel it painfully when they have to buy their home.

The other effect of this increase in money is the depreciation of the exchange rate, which makes imported goods more expensive. We see this in several emerging countries (Turkey, 30% depreciation against the dollar, 20% inflation in 2021), a little in Japan, not yet on the euro but it is to be followed.

The other major cause of inflation does not come from central banks, but from a major shift in Western countries: the energy transition. It will cost a fortune! On the one hand, there is capital destruction (coal-fired power plants and – to a certain extent – gas-fired power plants, combustion engine cars, oil exploitation), and on the other hand, massive investments (renewable energies, electric cars, insulation) with low profitability. As a Natixis study states, “these investments can only be made if long-term interest rates are low […] The energy transition, which will reduce household purchasing power due to higher and more variable energy prices, will then probably drive the ECB to maintain an expansionary monetary policy.”

According to many economists, there will be no sustainable inflation because there is no price-wage spiral like in the 1970s, in which one dragged down the other. But that was a different model, a different era. It is true that wages are not increasing, or not very much, which is destructive for purchasing power, but the money created ex nihilo feeds the economic “machine”: employees paid to do nothing during lockdowns (in Europe), companies kept alive with government subsidies or thanks to zero-interest rates (zombie-companies), massive subsidies for the energy transition (renewables, electric cars, insulation), vast infrastructure renovation programs (in the United States), etc. We should not focus on wages. An income-price spiral is being set up and will fuel and propel prices for a long time! Inflation is here to stay and, as history shows, to destroy our economies.

Reproduction, in whole or in part, is authorized as long as it includes a link back to the original source.

[ad_2]

Source link