EMERGING MARKETS-Currencies jump as dollar slides after U.S. inflation data

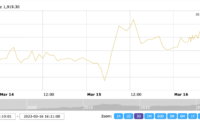

By Susan Mathew Jan 12 (Reuters) – Emerging market currencies jumped on Wednesday after data showed U.S. December inflation rose in line with expectations, calming hawks who had started to price-in four interest rate hikes by the Federal Reserve this year. Expectations of a first rate hike in March strengthened as the data showed the 7.0% annual increase in U.S. inflation was the largest in nearly four decades. The dollar hit session lows, extending losses logged after Fed Chair Jerome Powell on Tuesday stuck to a previously signaled stance on monetary policy. “The (U.S. inflation) number matched expectations…(but) that is still problematic because the Fed will have pressure on them to move more quickly and forcefully than they would have liked,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. “The Fed is going to be forced to raise rates in March.” Most emerging market currencies hit session highs, with South Africa’s rand jumping 1% to near two-month highs. Russia, in the thick of geopolitical tensions as its holds talks with the West over its military build-up near Ukraine, saw the rouble rise 0.3% after a mostly steady performance earlier in the session. In Latin America, Brazil’s real rose 0.2%, after trading steady to lower ahead of the data release, while Mexico’s peso firmed as much as 0.4%. With copper and oil prices rising, the currencies of Chile and Colombia rallied, with the latter hitting one-month highs. Brazil’s central bank has taken the necessary steps to ensure inflation targets are met for 2022, 2023 and 2024, its chief Roberto Campos Neto said on Tuesday, reaffirming it is appropriate to advance the process of monetary tightening significantly into restrictive territory. Brazil’s monetary policy committee has been the most aggressive in the world, raising the policy rate by 725 basis points last year. COVID-19 worries continued, with several countries including Turkey and Mexico reporting a record rise in daily cases, while China has been increasing curbs. Data from the Institute of International Finance showed net capital flows to emerging markets rose last month from November but fell more than 75% year-on-year, with China the main recipient as investors fear other economies will continue to underperform due to the pandemic. Shares of troubled Mexican airline Aeromexico were eyed after its creditors overwhelmingly approved the company’s restructuring plan as part of its efforts to emerge from bankruptcy. The stock tumbled more than 50% last month and made wild swings since, after a tender offer valued it at a fraction of its market capitalization. Key Latin American stock indexes and currencies at 1426 GMT: Stock indexes Latest Daily % change MSCI Emerging Markets 1265.92 1.84 MSCI LatAm 2165.67 1.48 Brazil Bovespa 105176.23 1.35 Mexico IPC – – Chile IPSA 4446.10 1.16 Argentina MerVal 84964.43 0.309 Colombia COLCAP 1422.57 2.03 Currencies Latest Daily % change Brazil real 5.5604 0.34 Mexico peso 20.3324 0.21 Chile peso 826.2 0.21 Colombia peso 3962.91 0.63 Peru sol 3.8863 0.27 Argentina peso 103.6300 -0.06 (interbank) (Reporting by Susan Mathew in Bengaluru; Editing by Kirsten Donovan)

[ad_2]

Source link