Gold Hub/Staff/1-13-2022

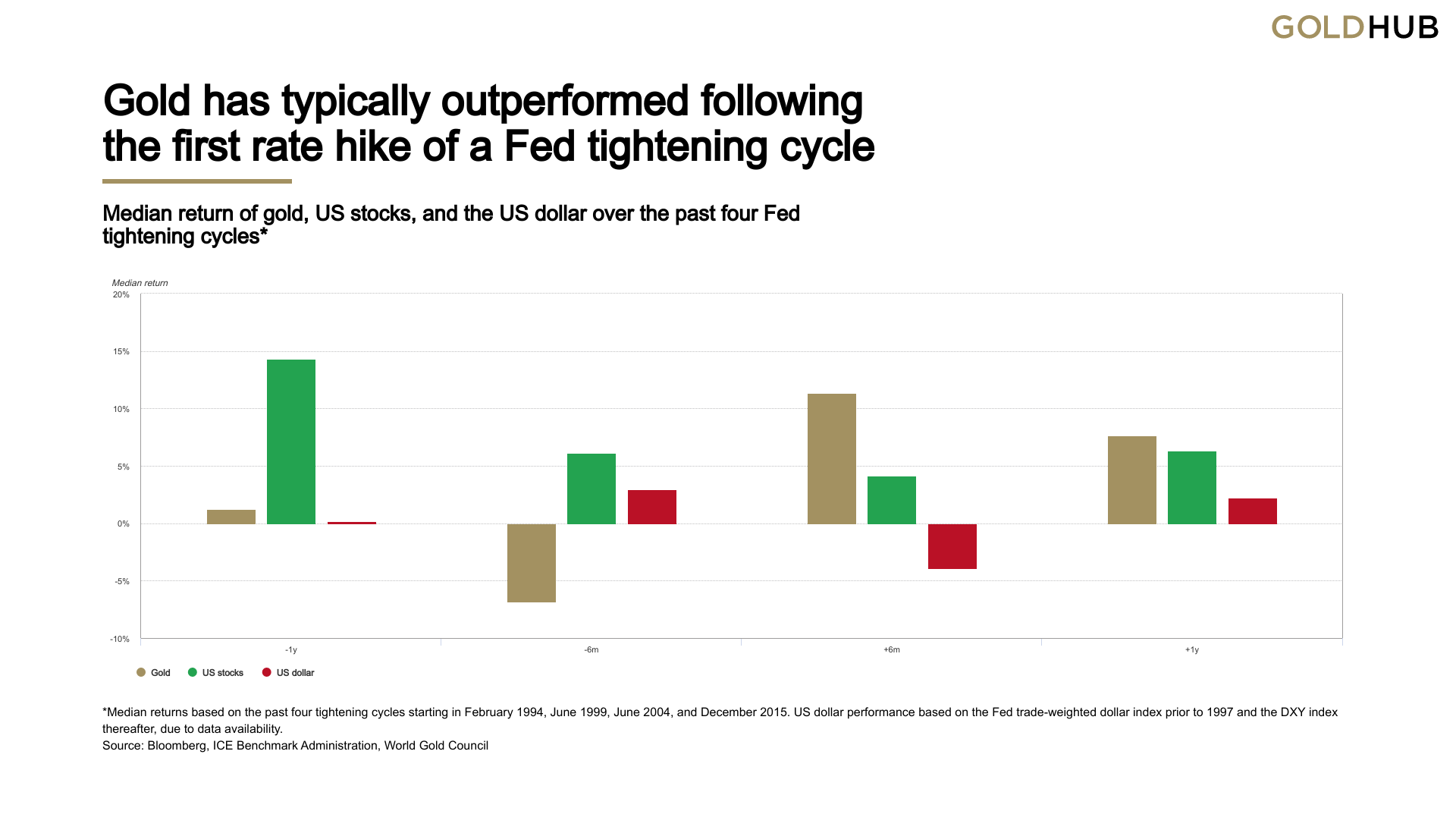

“Dot-plot projections suggest that year-ahead Fed expectations have significantly exceeded actual target rates. More importantly though, financial market expectations of future monetary policy actions – expressed through bond yields – have historically been a key influence on gold price performance. Consequently, gold has historically underperformed in the months leading up to a Fed tightening cycle, only to significantly outperform in the months following the first rate hike. (See below) Gold may have partly been aided by the US dollar which exhibited the opposite pattern. Finally, US equities had their strongest performance ahead of a tightening cycle but delivered softer returns thereafter.”

USAGOLD note: The World Gold Council offers a comprehensive review of gold’s prospects for 2022. In essence, it sees rising rates as a headwind for gold, but with limited effect along a six-month to one-year timeline.

Chart courtesy of the World Gold Council • • • Click to enlarge