Crescat Capital/Kevin Smith and Tavi Costa/12-27-2022

“While we are not calling for an immediate return to a gold standard monetary system, we believe that with the increasing general public awareness of how untrustworthy fiat currencies become, central banks will be forced to drastically improve the quality of their international reserves in order to restore their credibility. In such scenario, some countries might opt to own crypto assets like Bitcoin. However, more than any other asset in the planet, we think central banks will opt first for gold as it is likely to rekindle its role that it has served for 1000s of years across almost all governments and countries on the planet for that purpose. Central bank accumulation of precious metals is likely to play a major role in driving demand for these assets. While some central banks have started this process already, it is yet to become a new macro trend.”

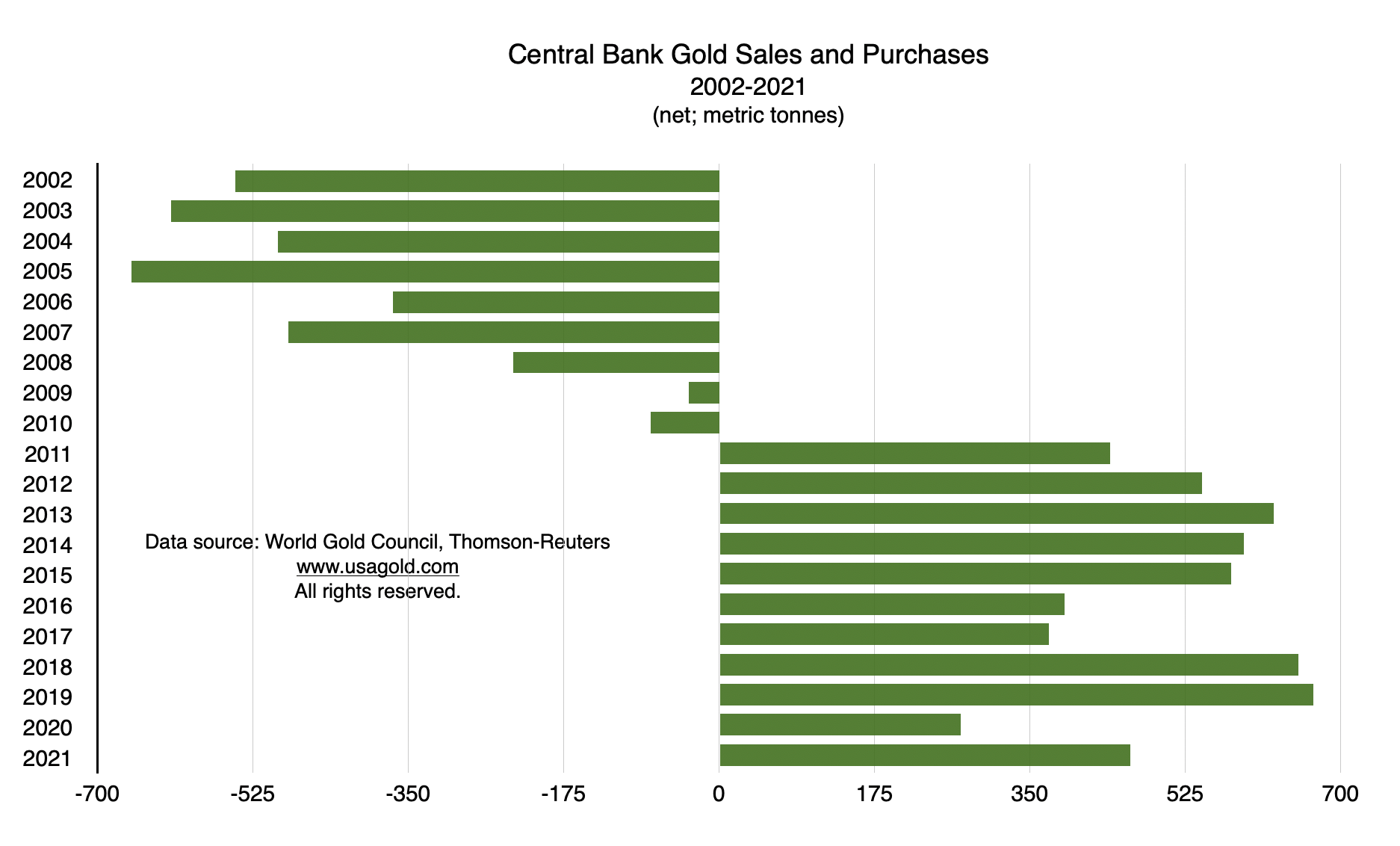

USAGOLD note: In keeping with Crescat’s analysis, the World Gold Council reports an 82% increase in central bank gold holdings in 2021 to 30-year highs. Acquisitions for the full year 2021 were 463 metric tonnes – growth well above last year’s but shy of banner years in 2018 (652 tonnes) and record-year 2019 (669 tonnes.)