US Services Sector Slumps To 18-Month Lows, Firms Passing Higher Costs On To Customers

Following yesterday’ dismal data from Markit/ISM on the manufacturing side of the US economy, analysts expected this morning’s services sector surveys to show further deterioration after last month’s tumble.

-

Markit US Services fell from 57.6 in December to 51.2 in January – the lowest since Aug 2020. However, the final print was marginally above the flash print of 50.9.

-

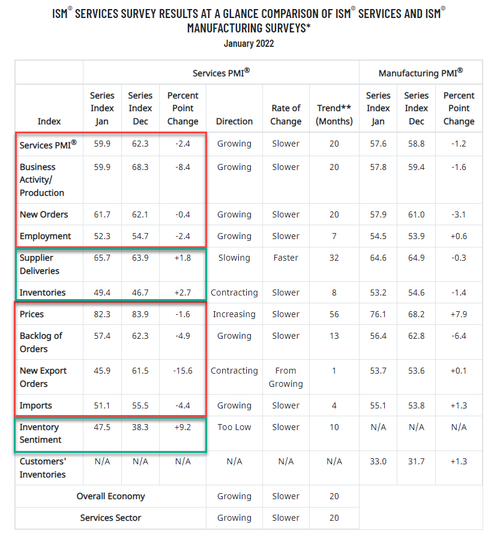

PMI Services fell from 62.3 in December to 59.9 in January – the lowest since Feb 2921. However this was above the expected 59.5 print.

All of which syncs with weak economic surprise data…

Source: Bloomberg

It seems the ‘soft’ survey data is once again catching down to the ‘hard’ economic data reality.

Although there were signs that cost pressures eased during January, companies were able to pass on higher costs to clients through the fastest rise in output charges for three months.

So overall, its a quadruple whammy as both Markit and ISM and services and manufacturing all saw weakening growth for the second straight month…

Under the hood, new export orders collapsed…

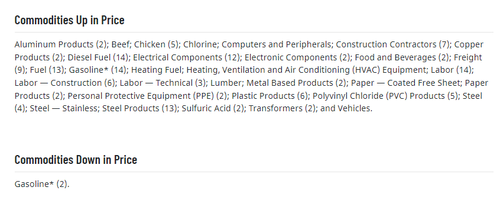

Interestingly, only Gasoline prices were seen as lower in January…

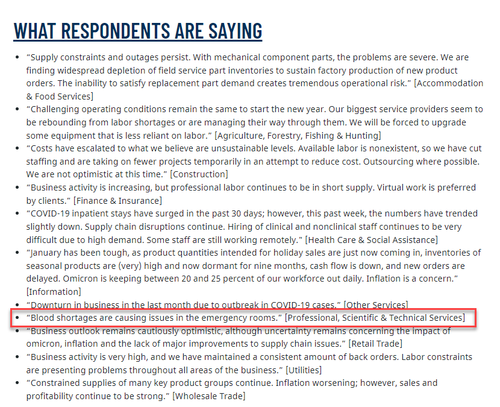

Shortages are mentioned everywhere… even blood!

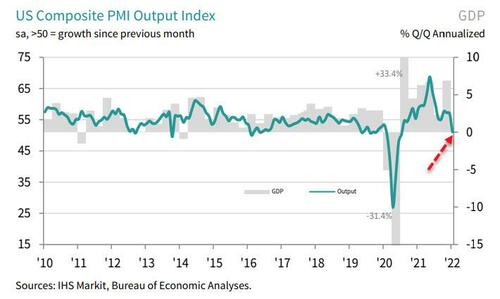

The IHS Markit US Composite PMI Output Index posted 51.1 in January, down notably from 57.0 in December. The upturn was the slowest since July 2020 as manufacturers and service providers registered a considerable slowdown in growth momentum.

And this implies zero economic growth…

Commenting on the latest survey results, Chris Williamson, Chief Business Economist at IHS Markit, said:

“The US economy has been hit hard by the Omicron variant at the start of 2022, with growth faltering to the weakest for 18 months to signal a near-stalling of the recovery. All broad sectors of the economy reported business activity to have been adversely affected by the surge in virus cases, though the slowdown was led by the sharpest drop in activity for consumer services recorded since December 2020 as virus-related health protection measures were tightened to the highest since May of last year.

“As well as the demand-dampening effect of the virus, businesses are facing multiple headwinds, including labor shortages, supply chain issues, rising costs and soaring inflation, combined with concerns over the future resilience of demand amid rising interest rates and reduced fiscal support, all of which point to economic growth slowing sharply in the first quarter.”

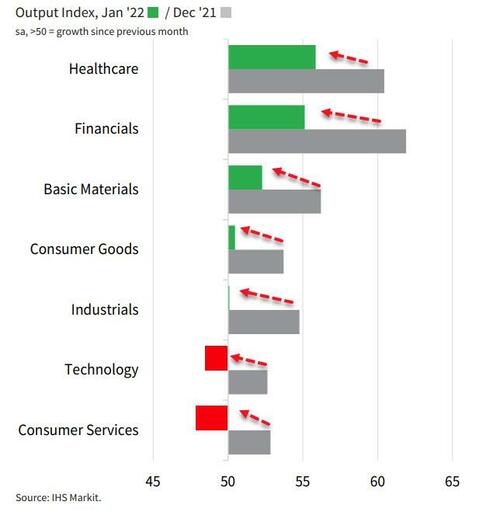

Finally, on a side note, Markit’s Sector Survey showed growth slowing in every sector (and

The latest survey pointed to renewed declines in business activity in the Consumer Services (47.9) and Technology (48.5) sectors. Consumer service providers widely noted that the Omicron variant had led to shrinking demand and customer cancellations due to COVID-19.

Seems like time to start hiking rates, right?

[ad_2]

Source link