Credit Bubble Bulletin/Doug Noland/2-4-2022

“The global central bank community has been wrong on inflation. Their analysis lacked objectivity and analytical vigor. Groupthink. Flatfooted. That policymakers would so misjudge on something fundamental to monetary management is a major blow to credibility. And not to be on guard after unleashing trillions of new ‘money’ is inexcusable. The inevitable serious fallout seemed to begin this week.

The global inflation problem has been obvious for months, though central bankers were loath to upset the markets. They were hoping it would resolve itself. In the pinnacle of ‘asymmetric’ monetary policy, central bankers have been eager to move immediately with previously unimaginable monetary stimulus. Yet fear of market disruption compelled the most gradual approach to the unwinding of stimulus measures (i.e. the Fed and ECB continue today with QE programs).

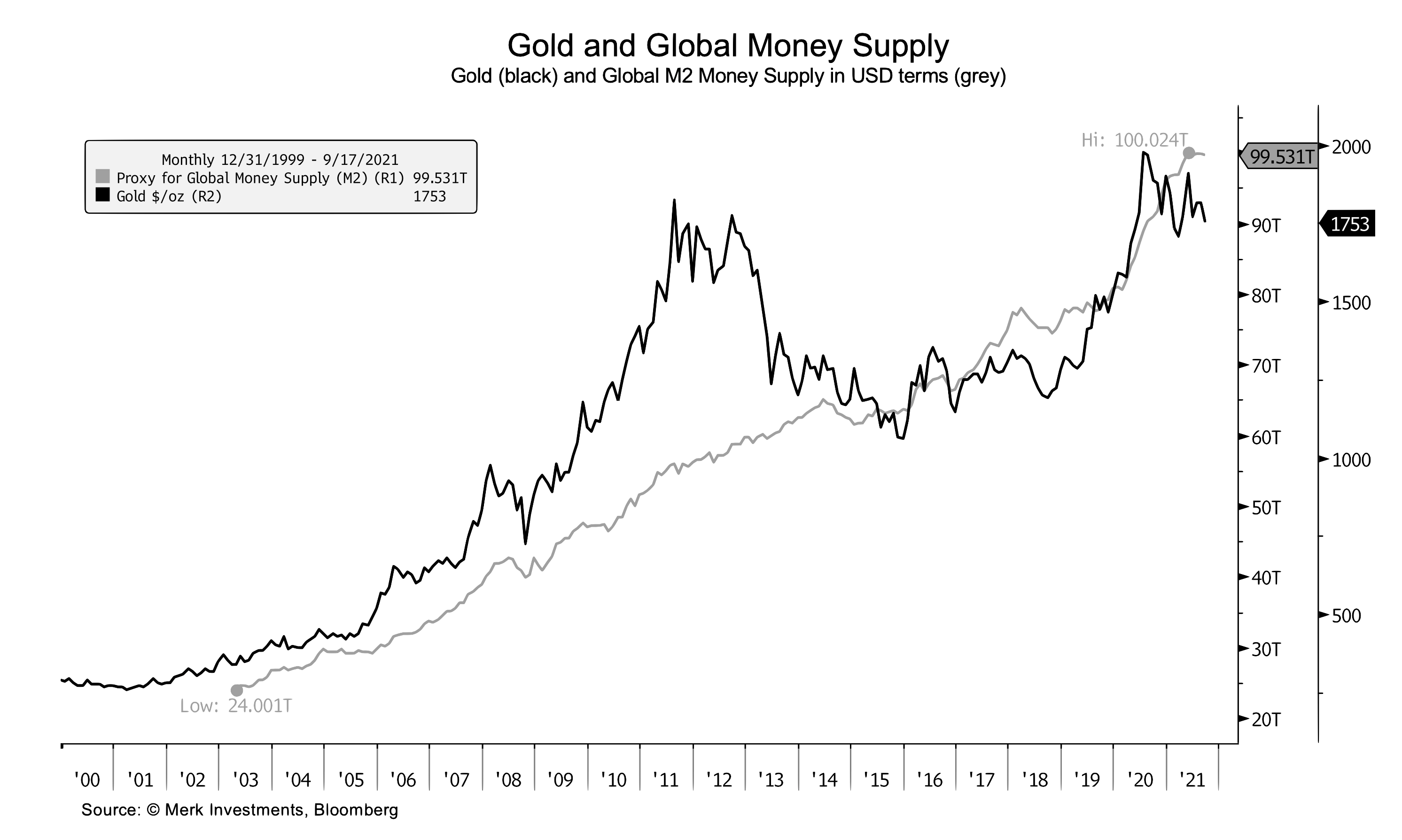

Chart courtesy of Merk.com

Monetary inflation went much too far – then ran amuck. Over the past two years, unprecedented monetary stimulus pushed speculative asset Bubbles into historic manias. It also stoked inflationary dynamics that had already attained significant momentum from years of loose finance. Focused on market fragilities, central bankers were willing to dismiss inflation risk and stick with their newfound gradualist doctrine. And gradualism played an integral role in promoting only greater market excess, while ensuring dangerously deep-rooted inflation.”

USAGOLD note: The core theme for Doug Noland’s latest posted Saturday ……