Dangers of High Global Debt

“The world economy today is characterised by a larger quantity of debt, relative to its level of income, than at any time in recorded history. … In the advanced economies, the average total debt of the household, business and government sectors has grown steadily and now exceeds 250% of GDP. In the emerging markets, the same average has risen more quickly in recent years and now stands at about 150% of GDP. The world is therefore highly levered in terms of its overall debt-to-income ratio … The economic dislocations caused by the Covid-19 pandemic have jolted debt ratios even higher, raising even more concerns about future debt burdens and their potential dangers, but in many respects this crisis has only served to accelerate preexisting debt trends.”

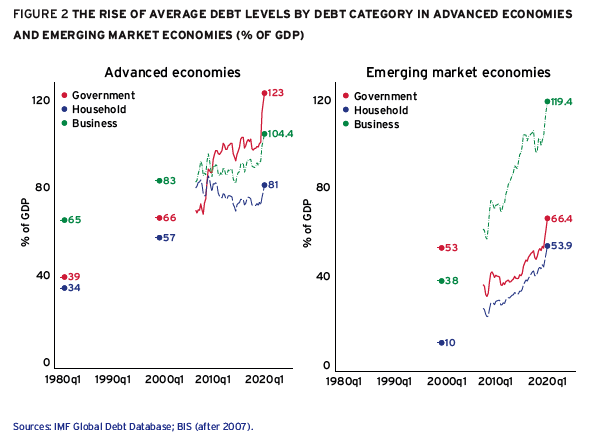

These are some of the opening comments from Laurence Boone, Joachim Fels, Òscar Jordà, Moritz Schularick and Alan M. Taylor in their report “Debt: The Eye of the Storm” (Geneva Reports on the World Economy 24, Centre for Economic Policy Research, 2022). Here’s a figure showing the patterns. It’s interesting to note that in advanced economies, business debt exceeded government debt in 1980 and 2000, but now government debt has taken the lead. However, in the emerging market economies, government debt used to be the highest category, while business debt has now by far taken the lead.

In 1970, cross-border debt claims represented much less than 100% of GDP in most advanced and emerging market economies. These ratios more than doubled in almost all advanced economies by 2015 and drifted up by almost as much in most emerging markets. Notable outliers include major financial centres such as the United Kingdom and the Netherlands, where not all liabilities are of resident end-debtors, and heavily debt-laden Greece, which is now classified as an emerging market. We can thus see that over time, the ever-larger debt stocks in the world have not just landed in the hands of other domestic creditors but have also increasingly been absorbed in the portfolios of overseas creditors, another trend which also now stands at an historically high level.Another change is the rise in cross-border debt claims:

A central insight of the argument is that the quantity of debt is rising at the same time that the price of debt–the interest rate–has been falling. That combination of a higher quantity and a lower price is a giveaway that the effects are being driven by an increase in supply: in this case, a rise in the global supply of savings: “These data have persuaded most economists that the savings glut is the key global macroeconomic story of our times. To a first approximation, the urge of creditors to acquire more and more debt has outpaced any shifts in borrowers’ desire to issue debt, leading to a shifting credit market equilibrium with ever-higher quantities of debt and ever lower real interest rates.”

The authors argue that the rise in global saving can be accounted for by three overlapping factors. Global populations have aged, and the middle-aged and elderly tend to have more saving than young. Inequality of incomes has risen around the world, and those with higher incomes tend to save a greater share of income. And a rise in saving in certain parts of the world (for example, think Japan and China) has driven higher cross-border debt flows. They go through detailed discussion of household, corporate, and public-sector debt.

Overall, how much should this rise in debt be feared? Perhaps unexpectedly, these authors argue that the combination of high saving, high debt, and low interest rates seems fairly sustainable. They write in the conclusion:

In sum, the picture that this report paints is one of cautious and perhaps unexpected optimism. As long as credit supply remains plentiful relative to debt issuance, and thus interest rates remain low, higher levels of debt are sustainable. We are not blind to the challenges policymakers will have to face. Nor are we blind to the possibility, in a world awash with debt, that negative shocks will generate more bouts of instability, which will inevitably spill over onto innocent bystanders in a globalised economy. However, the trends behind the oversupply of credit will likely continue for a long time. Debt should not be ignored. But neither should it be feared.

The authors do suggest that there will be areas of excessive corporate and household borrowing, but this has always been true from time to time. The main concern they point out is public debt:

Arguably the greatest challenge will be the management of public debt in the years to come. … The levels remain manageable in most countries, not least given current interest rates. However, the legacy debts from two big crises within the last 10 to 15 years, in some cases decades of mismanagement of public spending, and the substantial burdens of public spending anticipated by governments in the years to come make the medium-term challenges appear enormous. Countries need to maintain the necessary fiscal space to manage future shocks while at the same time financing the transition to greener economies as well as the pension and health demands of ageing populations. As long as interest rates stay low and growth returns to a healthy pace, scenarios are possible where these new demands on public spending can be met while stabilising the public debt-to-GDP trajectory.

You can decide for yourself how much comfort to take from the “if this, then scenarios are possible” kind of thinking.

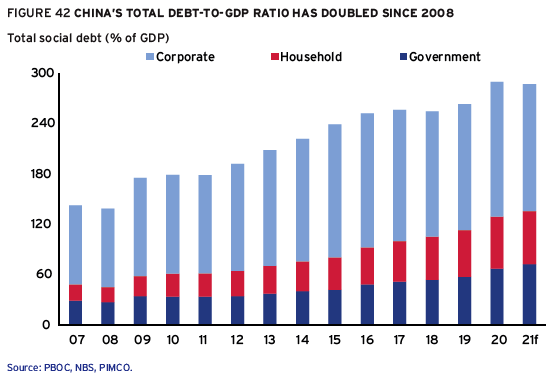

The report also emphasizes that the large global economy most exposed to debt concerns is probably China. The rise in debt in China has been particularly striking.

Even for China, the report suggests that while certain sectors like real estate developer loans are clearly under stress, an overall “hot” financial crisis seems unlikely. One reason is that China’s high debt also reflects high domestic savings in China: thus, the outflow of international capital that has caused such problems for other indebted economies will not be a problem in China. Another reason is that so much of China’s debt is, in one way or another, state-owned. The report notes about debt in China:

“[State-owned enterprise] debt is thus close to 100% of GDP. In addition, central government and local government debt together account for close to 70% of GDP. Meanwhile, the lenders to SOEs, highly indebted local governments and quasi-fiscal local government investment vehicles are banks that are directly or indirectly controlled by regulators and hence the government. This implies that ‘extend and pretend’, controlled defaults and gradual recognition of non-performing loans (NPLs) are the norm, rather than large-scale

sudden lending stops.”

In other words, China’s debt is a real problem, but China has policy tools to avoid a meltdown. My own sense is that this is a report where one does well to consider the caveats: if saving rates stay high, if interest rates stay low, if growth recovers from the pandemic shock, if most of the borrowing has been done wisely, if policymakers response to localized debt issues appropriately as they arise, if no major global events require a surge of new borrowing–then the current levels of debt can work out fine. When the number of “ifs” exceeds two or three, I tend to worry.

[ad_2]

Source link