China almost certainly owns more gold than the US – here’s why that matters – Business News Press

In case you thought the West was unprepared for inflation – or certainly for Russia – wait and see simply how unprepared it’s for this bombshell.

That is the largest story in world finance, and but no person, bar your intrepid blogger, is reporting on it.

For these with out the eye spans to learn all the way in which to the tip, let’s reduce to the chase and get the principle level out upfront: China has extra gold than the US.

Why China may need to personal much more gold than it’s admitting

We’ve seen many examples over the previous couple of many years of how the US weaponises the greenback, exploiting its standing as world reserve foreign money.

The sanctions on Russia and its removal from the Swift messaging system this week are maybe essentially the most dramatic instance of all. Russian civilians have had their wealth decimated (actually, in all probability considerably greater than decimated for many) nearly in a single day.

China will likely be certainly watching all of this, studying from Russia’s errors and pondering it must de-dollarise as swiftly and discreetly as attainable. Whether or not to guard its residents’ wealth or its nationwide pursuits, China can’t be beholden to a banking system that’s run by the West – the US particularly – and which is one in all their weapons of conflict.

Each Russia and China have recognized they have to de-dollarise for some appreciable time, which is why each have been so steadily growing their gold holdings.

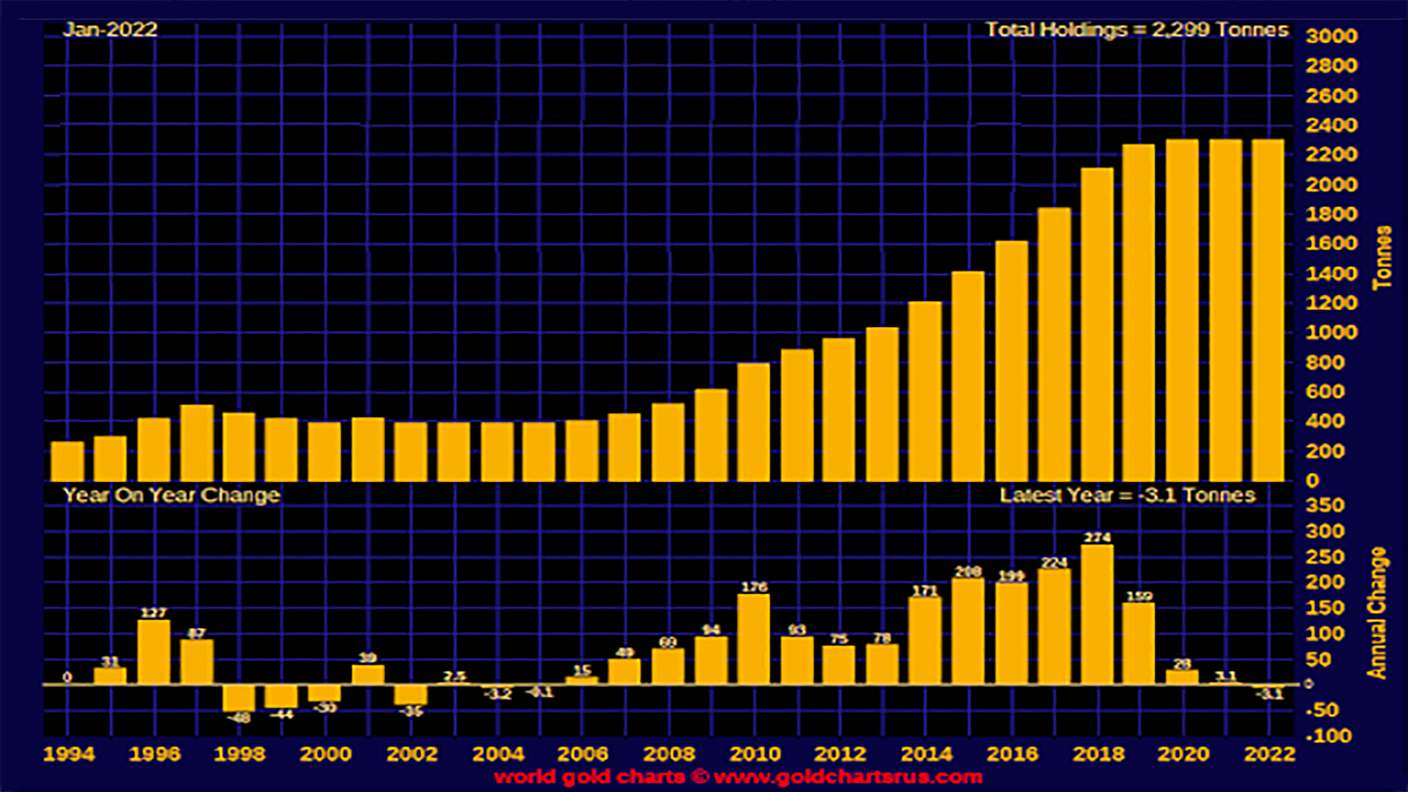

Let’s begin with Russia’s gold. The chart is courtesy of Nick Laird of goldchartsrus.com and it reveals the Russian Central Financial institution’s accumulation to at the moment’s determine of, give or take, 2,300 tonnes – roughly 74 million ounces (there are 32,150 troy ounces in a tonne).

That makes Russia, in keeping with official figures at the least, the fifth-largest gold proprietor on the planet.

The desk beneath, courtesy of the World Gold Council, reveals the highest 19 homeowners of gold, additionally their international trade reserves and their proportion allocation to gold. The US has essentially the most – 8,134 tonnes – adopted by Germany, Italy, France and Russia.

The UK sits proudly in seventeenth place. Behind Kazakhstan, Turkey and Uzbekistan. Thanks Gordon Brown.

|

Nation |

FX reserves $m |

Whole reserves $m |

Gold holdings % |

Gold reserves Oz (m) |

Gold reserves (tonnes) |

|

|

1 |

USA |

239,485 |

695,225 |

65.55 |

455,741 |

8,133.5 |

|

2 |

Germany |

99,513 |

287,732 |

65.41 |

188,219 |

3,359.1 |

|

3 |

Italy |

83,583 |

220,966 |

62.17 |

137,383 |

2,451.8 |

|

4 |

France |

102,439 |

238,954 |

57.13 |

136,515 |

2,436.4 |

|

5 |

Russian |

485,462 |

614,255 |

20.97 |

128,793 |

2,298.5 |

|

6 |

China |

3,264,064 |

3,373,233 |

3.24 |

109,169 |

1,948.3 |

|

7 |

Switzerland |

1,019,165 |

1,077,439 |

5.41 |

58,274 |

1,040.0 |

|

8 |

Japan |

1,358,141 |

1,405,543 |

3.37 |

47,402 |

845.9 |

|

9 |

India |

598,057 |

639,736 |

6.52 |

41,679 |

743.8 |

|

10 |

Netherlands |

28,229 |

62,547 |

54.87 |

34,318 |

612.4 |

|

11 |

Taiwan |

544,899 |

568,636 |

4.17 |

23,7367 |

423.6 |

|

12 |

Kazakhstan |

13,407 |

35,664 |

62.41 |

22,257 |

397.2 |

|

13 |

Turkey |

81,176 |

103,186 |

21.33 |

22,010 |

392.8 |

|

14 |

Uzbekistan |

13,070 |

34,558 |

62.18 |

21,489 |

383.5 |

|

15 |

Portugal |

11,606 |

33,042 |

64.88 |

21,436 |

382.6 |

|

16 |

Saudi Arabia |

465,059 |

483,161 |

3.75 |

18,102 |

323.07 |

|

17 |

UK |

175,879 |

193,265 |

9 |

17,386 |

310.3 |

|

18 |

Lebanon |

19,430 |

35,501 |

45.27 |

16,072 |

286.8 |

|

19 |

Spain |

75,479 |

91,256 |

17.29 |

15,778 |

281.6 |

The nation we’re specializing in at the moment is the one in sixth place on that desk, China.

Right here’s why China’s gold reserves should be far greater than official knowledge suggests

First, contemplate China’s US greenback holdings – over three trillion of them. That’s greater than the UK’s annual GDP. Its US greenback holdings eclipse these of each different nation; China isn’t going to need these to go to zero – not but, anyway.

Then contemplate its gold holdings. It has 1,948 tonnes, barely 3% of its international trade reserves. The US’s gold holdings equate to over 65% of its reserves.

What if China have been to strategy that stage?

Nicely, my argument is that China has far more gold than it says it does.

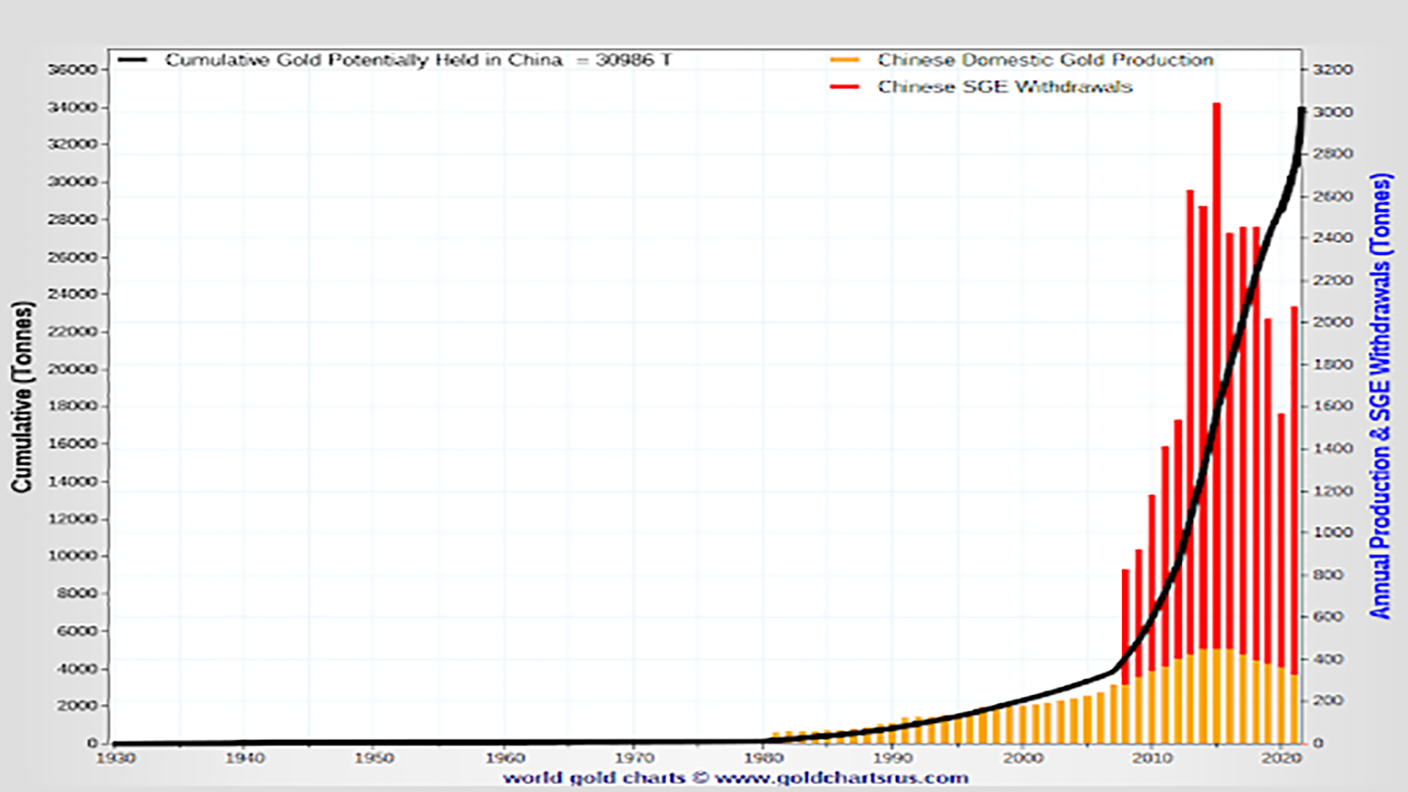

There are two elements to this argument. First, China’s gold mining. In 2007, China overtook South Africa because the world’s largest gold producer. It has remained so ever since. This previous decade it has produced about 15% of all of the gold mined on the planet.

Since 2000, China has mined roughly 6,830 tonnes. Over half of Chinese language gold manufacturing is state-owned – the China Nationwide Gold Group Company alone accounts for 20%. And China retains the gold it mines – the export of home mine manufacturing isn’t allowed.

I say that quantity once more: 6,830 tonnes. Already that official 1,948 determine appears very doubtful.

With reserves in decline at house, Chinese language mining firms have additionally been shopping for belongings overseas, throughout Africa, South America and Asia. Worldwide manufacturing exceeds home manufacturing – by about 15 tonnes in 2020.

Second, there may be the truth that, in addition to being the largest producer, China is the world’s largest importer. Gold imports by way of Switzerland and Dubai should not all the time declared, however we do know that by way of Hong Kong alone, over 6,700 tonnes have entered the nation since 2000.

Add that to cumulative gold manufacturing since 2000, and also you get a determine over 13,500 tonnes.

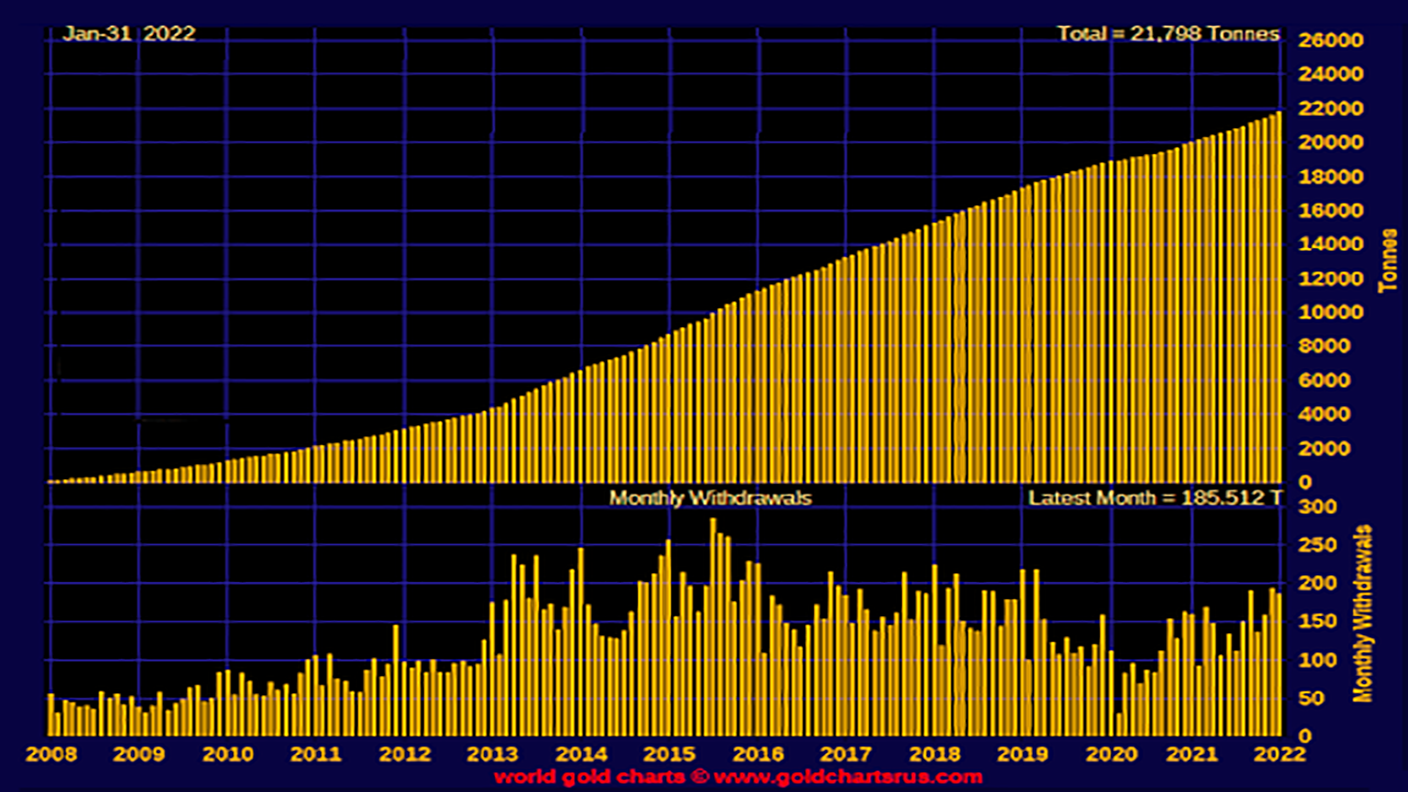

Whether or not imported, mined or recycled, a lot of the gold that enters China goes by means of the Shanghai Gold Change (SGE), together with the gold imported from Hong Kong. So SGE withdrawals – for which we do have numbers – can act as one thing of an approximation for demand. And it’s attainable to get numbers for SGE withdrawals: since 2008, nearly 22,000 tonnes have been withdrawn from the SGE.

Then now we have so as to add gold held in China, whether or not as bullion or jewelry, earlier than 2000. The World Gold Council estimates a determine of two,500 tonnes in privately-held jewelry. Added to home mining and official reserves, you get a determine of round 4,000 tonnes.

Cobble all of it collectively – cumulative manufacturing, imports and current inventory – and also you arrive at a determine not far off 31,000 tonnes.

I’ve spoken to a number of the world’s prime analysts – Ross Norman, Bron Suchecki and Koos Jansen – and so they all arrive at related estimates. Alasdair McLeod of Goldmoney thinks it’s greater nonetheless.

So why would China preserve its gold reserves quiet?

However there may be extra, as Ross Norman factors out.

Not all gold getting into China is accounted for by SGE withdrawals. The Individuals’s Financial institution of China (PBOC), the central financial institution, likes to purchase 12.5kg bars, which don’t commerce on the SGE. The PBOC typically makes use of dollars on exchanges in London, Dubai and Switzerland, whereas the SGE sells its gold in yuan.

The Chinese language military, too, owns gold and doesn’t should declare its purchases. And there are different state companies, as properly: the State Administration of International Change and China Funding Company – the sovereign wealth fund, for instance.

How a lot of this gold is state owned? Norman guesses 50%; Suchecki, previously of the Perth Mint, says 55%.

At 50%, the implication is that China owns over 15,000 tonnes – closing in on double the US.

“Chinese language Central Financial institution gold holdings have apparently been fully unchanged since mid-2019 at 1,948 tonnes,” Ross Norman tells me. “However few of us imagine that. Put an extra zero on the tip (19,480 tonnes) and I shouldn’t be stunned if that’s not a lot nearer to their official holdings”.

Alasdair McLeod goes one stage additional. “The PRC in all probability has as a lot as 30,000 tonnes hidden in varied accounts, however not declared as official reserves”.

Whether or not ten, 15 or 30,000 tonnes, there isn’t a manner China can declare such giant holdings. Not but anyway – it could trigger an undesirable surge in each the yuan and the gold value. The federal government’s $3.2trn of US greenback international trade reserves can be devalued.

“I don’t suppose China must brag about its largesse,” says Norman. “In any case, a stronger foreign money because of that reserve backing can be counter-productive, as it could confer aggressive drawback”.

What’s extra, to declare a lot gold can be a direct problem to American supremacy, which China might be not but prepared for. Parity first, then supremacy.

For now they comply with Deng Xiaoping’s doctrine of “we should not shine too brightly.” Its declared 1,948 tonnes is, maybe, the naked minimal it might declare and look credible. However a mere 3% of China’s foreign exchange reserves in gold? Pull the opposite one.

If China decides to weaponise cash, because the US has accomplished, all it has to do is declare its gold holdings, even perhaps partially again the yuan with them. Discuss was, at one stage, its central bank digital currency (CBDC) can be partially gold backed.

Unbacked Western cash dangers dropping quite a lot of its buying energy in such an occasion. To again Western fiat even partially with gold would imply a dramatic upwards revaluation of gold – into the tens of 1000’s.

However that’s the card China now has with its 20 years of relentless accumulation. He who owns the gold, makes the principles.

Dominic’s movie, Adam Smith: Father of the Fringe, concerning the unlikely affect of the daddy of economics on the best arts pageant on the planet is now available to watch on YouTube.

rn

[ad_2]rn

Source link ","author":"@type":"Person","name":"admin","url":"https://businessnewspress.com/author/admin/","sameAs":["https://businessnewspress.com"],"articleSection":["China"],"image":"@type":"ImageObject","url":"https://businessnewspress.com/wp-content/uploads/2022/03/220303-china-gold.jpg","width":1260,"height":710,"publisher":"@type":"Organization","name":"","url":"https://businessnewspress.com","logo":"@type":"ImageObject","url":"","sameAs":["https://www.facebook.com/","https://twitter.com/","https://www.instagram.com/","https://www.youtube.com/channel/UCTbnI-2FWMWzUaS2kkwXZeA","https://www.pinterest.ie/businessnewspress/"]}

[ad_2]

Source link