Gold coin sales rise as ETF holdings chalk up another record

Summary

- The Perth Mint sold 72,651 troy ounces (oz) of gold and 1,632,323 oz of silver in minted product form during February.

- The Perth Mint depository saw gold holdings increase by 1% during the month, while silver holdings remained steady.

- The Perth Mint’s listed ETF, ASX:PMGOLD saw holdings increase for the sixth straight month, ending February at a new all-time high above 250,000 oz.

“Gold prices rose by 6% in February, ending the month trading back above USD 1,900 oz. The conflict between Russia and Ukraine was a key factor driving this increase, while a 4% decline in the S&P 500, volatility in cryptocurrencies, and building inflationary pressures also helped to boost gold.”

Minted Products

The Perth Mint sold 72,651 oz of gold and 1,632,323 oz of silver in minted product form in February.

The table below highlights how these numbers compare to sales seen one month, three months and one year ago, and against monthly average sales dating back to mid-2012.

Current month sales of gold and silver sold as coins and minted bars (troy ounces) and change (%) relative to prior periods

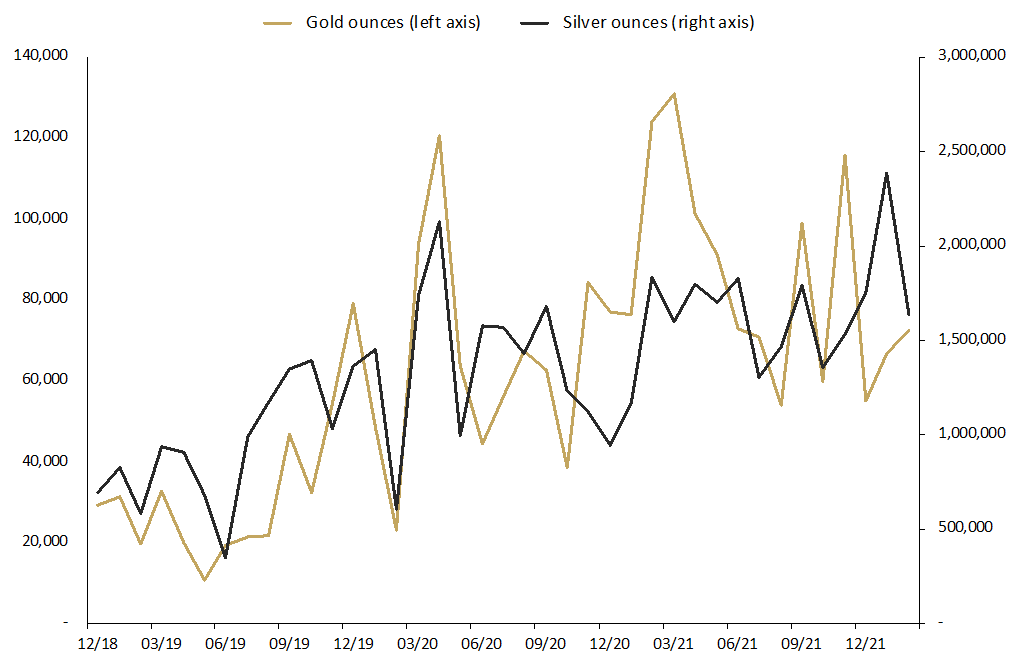

Troy ounces of gold and silver sold as coins and minted bars December 2018 to February 2022

General Manager Minted Products, Neil Vance said February sales reflected the global appetite for trusted bullion products. “Demand for Australian silver coins remains extremely high worldwide and our authorised resellers would gladly take more product than we can currently supply. As many people would expect in the current crisis situation, interest in physical gold is also strengthening and this is reflected in rebounding sales of The Perth Mint’s leading gold coins and minted bars.”

The Perth Mint manufactures and markets the Australian Precious Metal Coin and Minted Bar program. Trusted worldwide for their purity and weight, the coins include annual releases of the renowned Australian Kangaroo, Kookaburra, Koala and Lunar series. For more product information visit perthmint.com/bullion.

The Perth Mint Depository

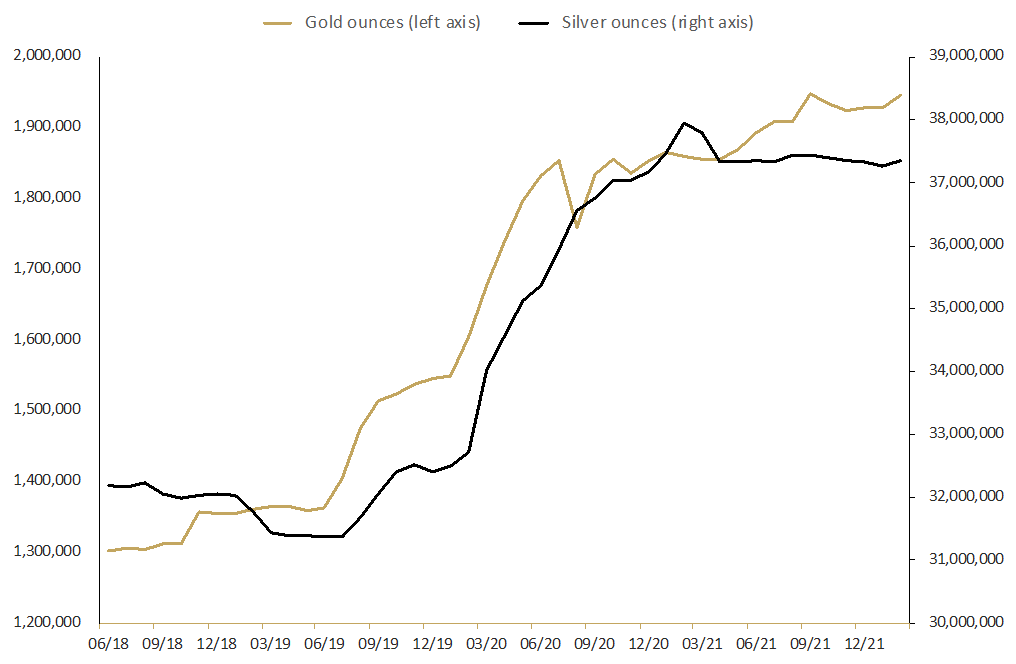

Total gold holdings in The Perth Mint depository rose by 1% during February, while silver holdings remained flat. Over the last 12 months, total holdings of gold have increased by 5%, while silver holdings have fallen by 2%.

Since the end of 2018, holdings of the two metals have increased by approximately 43% (gold) and 17% (silver), with the strong growth evident in the chart below.

Total troy ounces of gold and silver held by clients in The Perth Mint depository June 2018 to February 2022

The Perth Mint depository enables clients to invest in gold, silver and platinum, with The Perth Mint storing this metal in its central bank grade vaults. Operated via a secure online portal, a Depository Online Account allows investors to buy, store and sell their metal 24/7. For further information visit perthmint.com/invest/depository-online.

Perth Mint Gold (ASX:PMGOLD)

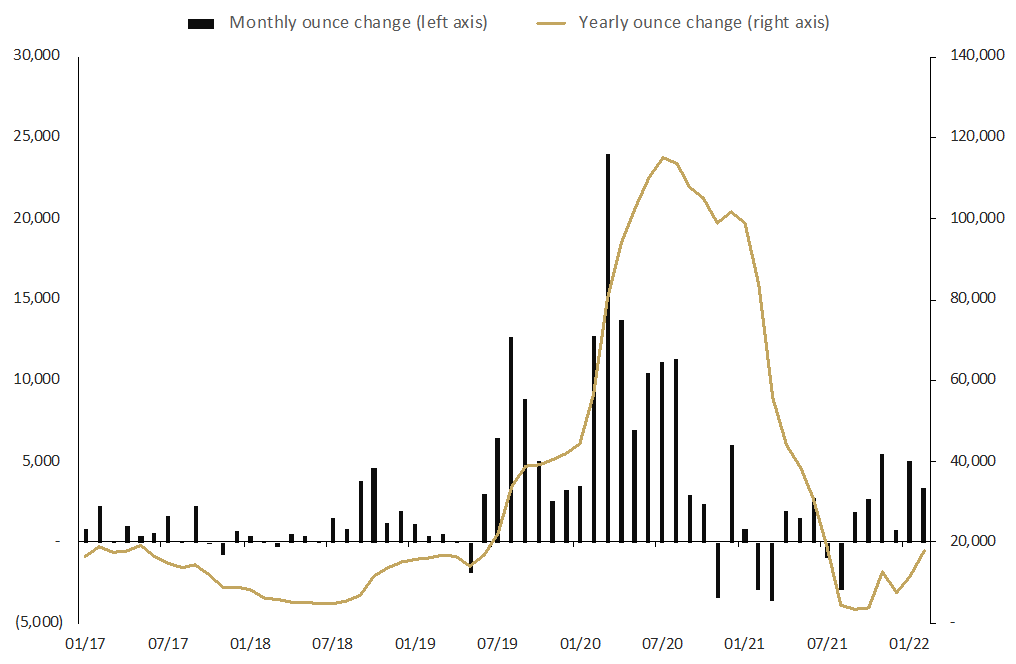

Perth Mint Gold (ASX:PMGOLD) saw continued inflows during February, with holdings increasing by more than 3,300 oz (+1.3%). Total holdings have now topped 250,000 oz for the first time ever, a new all-time high, with investors increasing holdings in each of the past six months.

Monthly change in troy ounces held by clients in Perth Mint Gold (ASX:PMGOLD) January 2017 to February 2022

Source: The Perth Mint, ASX, World Gold Council

The total value of PMGOLD holdings ended February at AUD 669 million, also a new all-time high, with the AUD gold price ending the month trading just above AUD 2,650 oz.

To learn more about investing in PMGOLD, download our PMGOLD Factsheet.

[ad_2]

Source link