ZeroHedge/Tyler Durden/3-16-2022

“Several studies have looked at the connection between margin calls and market stress, and most have focused on a margin call ‘doom loop’ in which higher margin requirements force fire sales into an already illiquid market where prices were gapping lower, which in turn triggered more margin calls, and so on. At the same time, these assets become harder to finance in repo, and with less access to financing, investors are forced to sell assets, which in turn increases the market dislocation, re-triggering the asset price and funding loops. Absent a central bank liquidity injection ‘circuit breaker’, such a self-reinforcing doom loop could have catastrophic results.”

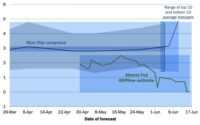

USAGOLD note: Volcanic rumblings below the placid surface…… Will the Fed be forced back to quantitative easing before quantitative tightening gets off the ground?