Trouble With The (Yield) Curve! 10Y-2Y Slope Approaching Inversion As Fed Plans Rate Hikes And Bitcoin Falls – Confounded Interest

The US Treasury yield curve (10Y-2Y) is rapidly approaching inversion at 20.5 bps (where the 10-year yield is lower than the 2-year yield). But the 10Y-3M curve is generally steepening at 173.33 bps.

Of course, the driving force behind the flattening of the 10Y-2Y curve is the rapidly rising 2-year Treasury yield (orange line). The last time the 10Y-2Y curve inverted was in 2019, prior to the COVID outbreak in early 2020.

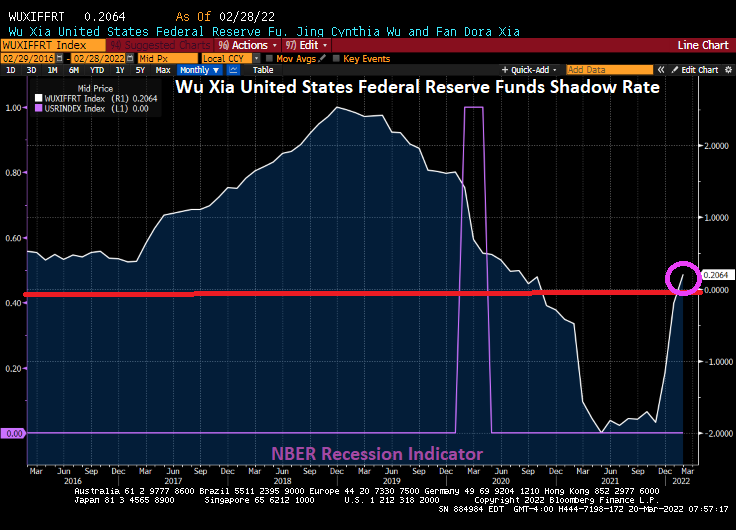

The Wu Xia United States Federal Reserve Funds Shadow Rate has finally climbed back into positive territory.

At last look, The Federal Reserve is forecast to raise their target rate 7 times over the coming year. And with the increasing forecast of rate hikes, we are seeing the cryptocurrency Bitcoin fall from near $70,000 to $41,817.

President Biden announced that he will be issuing an executive order to combat rising energy prices (the rising energy prices that he caused in the first place with … executive orders). Let’s see what happens next.

Hello t-r-o-u-b-l-e.

[ad_2]

Source link