Russian Central Bank Starts Buying Gold

A day after Biden and his pals in Brussels discussed ways to stop Russia utilizing its gold reserves to maintain some stability in an increasingly chaotic economy, the Bank of Russia has just announced plans to begin buying gold from its banks at a fixed price.

This could serve two purposes: 1) provide a path to liquidity for SWIFT-constrained banks, and 2) centralize more of the nation’s gold as Putin accelerates his de-dollarization plans.

Full Bank of Russia statement:

In order to balance supply and demand in the domestic precious metals market, the Bank of Russia will buy gold from credit institutions at a fixed price from March 28, 2022.

The price from March 28 to June 30, 2022 inclusive will be 5,000 rubles per 1 gram.

The established price level makes it possible to ensure a stable supply of gold and the smooth functioning of the gold mining industry in the current year.

After the specified period, the purchase price of gold can be adjusted taking into account the emerging balance of supply and demand in the domestic market.

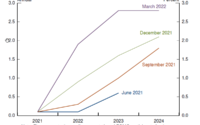

The buying price, as the chart below shows, is significantly below the current market price…

This implies Bank of Russia believes the Ruble should be higher relative to the dollar.

Remember, Russia has been de-dollarizing for years…

Remember ‘nothing lasts forever’… especially reserve currencies.

[ad_2]

Source link