Why Gold’s History as Rates Rise Suggests More Room to Run

What he was doing was buying protection against further weakness in the dollar. So even in a rising rate environment where there may be an opportunity cost to holding gold versus certain assets, the precious metal is still serving its purpose as a safe investment — in that instance, a haven versus the dollar.

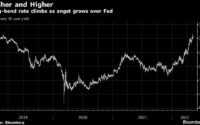

In this context, it is also interesting to note that Fed Chair Powell has recently moved to persuade the markets to dial back their expectations of what the Fed might do in response to persistently high inflation. Market commentators initially suggested the Fed might feel forced to raise rates between its regular meetings, yet Powell has made it clear that he doesn’t expect anything of the kind.

There has also been market chatter that we could see six or seven rate increases this year, as opposed to the previous consensus of three or four hikes. It remains to be seen whether that will prove feasible given Powell’s dual mandate of presiding over monetary stability and ensuring full employment.

As Powell has pointed out numerous times, while the employment situation in the country is improving, he remains acutely conscious that there are some 4 million fewer people in the workforce today than there were before the onset of COVID.

In light of all this, State Street’s Gold Strategy Team put together three separate potential gold price ranges through 2022 at the start of the year. Our base case called for gold to range between $1,800 and $2,000, with a 50% probability of this happening. Our bullish case suggested a range between $2,000 and $2,200, with a 30% probability of occurring, and our bearish case indicated a range between $1,600 and $1,800, with just a 20% probability.

Our outlook for these scenarios was based on there being no dramatic changes in the economic and political environment at the time, but clearly, we have witnessed substantial events since then. U.S. inflation has continued to rise, recently hitting a 40-year high, and Russia’s invasion of Ukraine has brought a significant increase in political tensions around the world.

With these developments paired together, the allure of gold as an investment has never been stronger, and my bullish case for gold to trade between $2,000 and $2,200 is becoming a more substantial possibility — proving once again that gold always responds well to uncertainty.

George Milling-Stanley is chief gold strategist at State Street Global Advisors.

[ad_2]

Source link