“This Is Shocking”: Quant Guru Calculates Fed Can Only Hike To 1% Before It Must Halt The Cycle

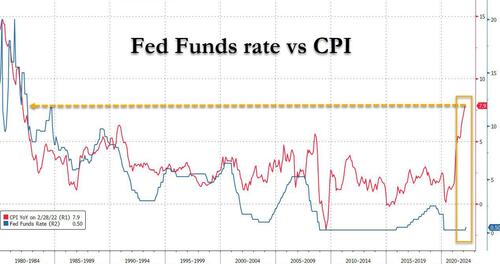

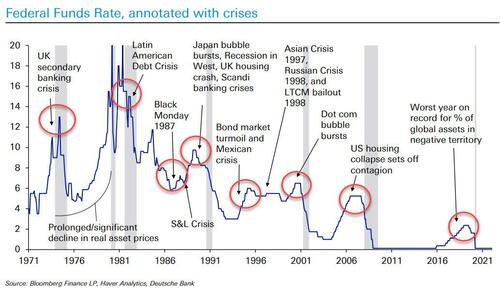

Earlier today, futures slumped to session lows (before an algo driven meltup sent stocks soaring to session highs) when the Fed’s resident uberhawk and FOMC dissenter, James Bullard, poured more overpriced gasoline on the tightening fire when he said that “the current policy rate is too low by about 300 basis points” according to a version of the Taylor rule which showed that the Fed has a long way to go to catch up to where it should be if, somewhere around 3.5%, it has any hopes of denting runaway inflation around 8%, which as shown below sounds about right considering the last time inflation was here, the fed funds rate was 12%.

While Bullard’s comments were not surprising – we already knew that he had dissented in favor of a 50bps rate hikes in March – comments by Lael Brainard, regarded as the most dovish of all Fed Governors, shocked the markets on Tuesday when she highlighted the likelihood the Fed will undertake a more rapid shrinkage of its balance sheet than markets were expecting.

Here, one obvious question is whether the Fed can hike anywhere close to 12% – or even 3.5% – without crashing the entire financial system. Another question is whether the Taylor rule is applicable in such a unique situation where not only are rates still at rock bottom but the Fed has some $9 trillion in securities on its balance sheet. Indeed, while the prevailing hawkishness across the FOMC means monetary policy will be tightened faster than expected, a third question is how much faster, or in other words, “what is the trade-off between QT and higher Fed Funds? Surely the faster the balance sheet is shrunk, the fewer rises will be needed in Fed Funds.”

According to at least one Wall Street strategist, the answer to these questions is also the reason why the Fed Funds rate won’t climb beyond 1.0%!

We refer to SocGen’s resident permaskeptic, Albert Edwards, who today writes that “the prospect of the Fed engaging in rapid balance sheet shrinkage (QT) has spooked the markets.” But, as we muse above, how does one combine the concurrent impact of QT with the Fed Fund hikes to get a handle on where Fed Funds might peak?

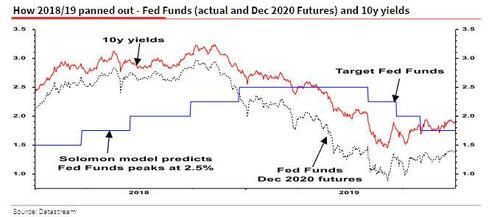

Well, Edwards believes he may have the answer, or rather he says that his “learned colleague”, SocGen’s in house quant guru Solomon Tadesse has an answer. While few in the mainstream have ever heard of Solomon, back in mid-2018, not long before the Fed’s rate hike plans blew up spectacularly, the SocGen quant made waves on Wall Street trading desks when he went against the consensus view, and in May 2018 pinpointed the peak in Fed Funds at a lowly 2½%. He was absolutely spot on.

The problem: his latest analysis for this cycle puts the peak of the Fed Funds at just below 1.0%, or less than 3 more rate hikes before the Fed is forced to reverse! That, as Edwards notes, “is so far away from the current consensus that it deserves some serious analysis.”

* * *

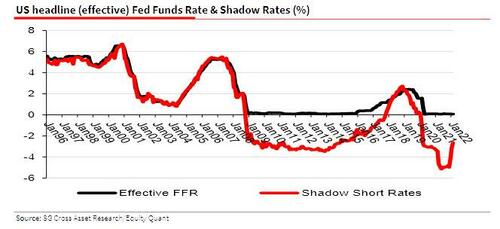

First, for those curious about the details some background: Solomon’s explanation of the first generation Shadow FFR based on Wu and Xia (2016) and his second generation estimate from De Rezende and Ristiniemi (2020) are in this note here. For those pressed for time, what the analysis says is that the pace of QE or QT can be combined with the headline Fed Funds rate to calculate a Shadow FFR.

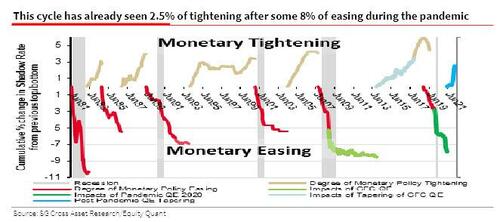

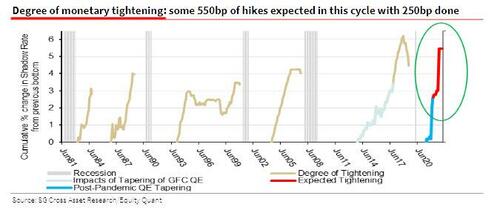

So combining the expansion of the Fed’s balance sheet from sub-$4 trillion at end 2018 to almost $9 trillion was the equivalent of the FFR falling to minus 5% (charts below)! But now that the Fed has reveresed, ending QE combined with just one ¼% hike in the headline FFR means the Shadow FFR has already jumped from minus 5% to minus 2.5% – a 250bp hike (blue line below).

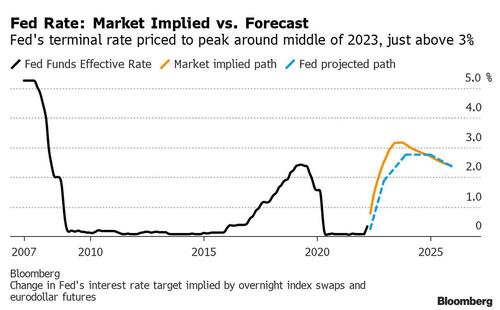

We now take a brief tour down memory lane to remind readers how when Solomon made his mid-May 2018 call that the FFR would peak at 2½%, the market was looking at something nearer 3% (see chart below). Not much difference you might think, but as the Fed enacted its final hike to 2½% in Dec 2018, expectations of easing were rapidly taking hold as investors realized that the Fed had clearly overdone the tightening cycle (as we had said previously, the Ghost of 1937 has emerged right on schedule and the Fed has overtightened) even though just back in October 2018, Powell said that “we are a long way from neutral.”

Meanwhile, as Edwards reminds us, the US bond rally from mid-Nov 2018 onwards was typical of the situation when yields tend to peak before the last rate hike. By comparison, currently the market expects the Fed to tighten rates rapidly and the peak in the FFR to be close to 3½% by March 2023.

On that basis, you should wait until the back end of this year before dipping your toe into the bond market. But with inflation considered rampant, many investors believe the headline FFR will peak nearer 4%, despite recession fears mounting, and earlier this week, Deutsche Bank became the first large broker to forecast a US recession.

Needless to say with market consensus expecting rates to rise as high as 3% before the Fed starts cutting around the next recession, if Solomon is right that the Fed will struggle to raise FFR to 1% or above, this is a huge divergence with consensus. One can see clearly in Solomon’s chart below how the recent 250bp Shadow FFR hike compares to the cumulative easing and tightening in previous Fed cycles:

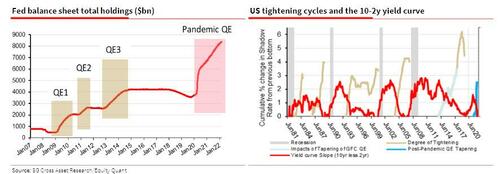

As depicted in the chart above, Solomon constructs a Monetary Tightening to Easing ratio (MTE, the ratio of the degree of tightening to the degree of easing in the preceding cycle). The charts below show how the MTE ratio declined in the 1980s as disinflation became the dominant theme. Hence since the mid-1980s the tightening cycle has topped out at around 70% of the previous easing cycle. But shouldn’t this ratio now return to 1.5x given CPI inflation has comprehensively overshot, Edwards asks and answers: Maybe…

You see, the main reason why Solomon’s MTE ratio has been consistently lower (at 70%) recently is that tightening cycles have been halted because financial market bubbles, created by excessive Fed easing, then blow up and prevent the Fed from further tightening. Another way of visualizing this is the infamous chart showing that every Fed tightening cycle ends in crisis (and this one will be no different);

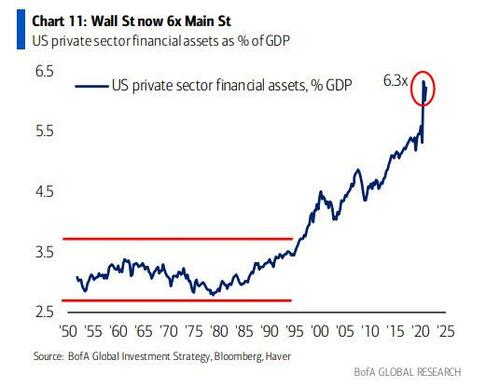

So putting it all together, if we take the 70% MTE ratio above, Solomon calculates that the Shadow FFR will likely top out with 550bp of tightening (70% of the 800bp easing), and even though the Fed will fail to tame inflation the crash in markets and the recession (or depression) that will hit the hyperfinancialized US economy, with its 6.3x financial assets to GDP…

… will force the Fed to not only end tightening early but to rush into an easing cycle

The final point: prior to Lael Brainard’s comments, the remaining 300bp hike in the Shadow FFR was split between a headline FFR rise to only 1½% with the remainder being QT. But now that the Fed minutes confirmed that the pace of QT will accelerate accelerate to $95BN (or more) per month, Edwards concludes that “the actual FFR will struggle to get to 1% before the Fed needs to halt the tightening cycle. That is shocking.”

The full notes, both Edwards and Solomon’s are available to pro subs in the usual place.

[ad_2]

Source link