Fed Losing Control As Gloom Spreads, Consumer Inflation Expectations Soar To A Mindblowing 6.6%

Last September, when the Fed was still busying lying to the people that soaring inflation would prove to be “transitory” (today even the Fed is humiliated and embarrassed by the historic amounts of bullshit it was shoveling last summer and is willing to risk a market crash just to contain the same inflation it failed to notice less than a year ago), we warned that the “Fed Was On Verge Of Losing Control As Consumers Expect Inflation To Soar”, an article which was based on the NY Fed’s own monthly survey of Consumer Expectations, and in which we warned that the Fed’s biggest nightmare was about to come true: with prices relentlessly soaring, the central bank was on the verge of losing control over near-term inflation expectations.

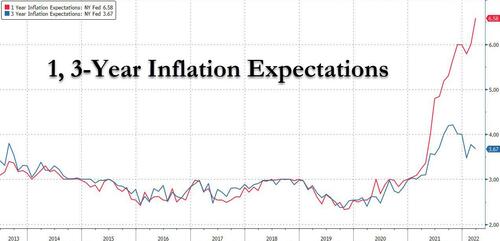

Unfortunately more than half a year later, things are just going from back to worse for the Fed, because in its latest Consumer Expectations survey, the central bank found that inflation expectations at the one-year horizon soared to a new all time high of 6.58% in March from the previous month’s 6.00%, a new series high and the third biggest one-month spike on record.

According to the NY Fed, the increase in short-term expectations was broad-based across age, education, and income groups.

The median inflation uncertainty rose at the short-term horizon, reaching a new series high as disagreement across respondents (as measured by the difference between the 75th and 25th percentiles of inflation expectations) increased at both horizons to new series highs. As a result, the median point prediction hit a staggering 8.5%!

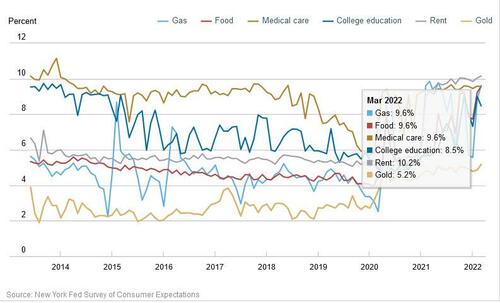

Expectations about year-ahead price changes were roughly flat for rent (at 10.2%) and medical care (at 9.6%), increased by 0.8 percentage point for gas prices (to 9.6%) and increased by 0.4 percentage point for food prices (to 9.6%). The median one-year-ahead expected change in the cost of a college education decreased by 0.5 percentage point to 8.5%.

Even more concerning is that inflation expectations soar without ending, median one-year-ahead expected earnings growth remained unchanged at 3.0% in March for the third consecutive month and the lowest since August 2021, confirming that real incomes continue to slide and that the US consumer is headed for a world of recessionary pain.

The silver lining: 3-year inflation expectations dipped again, and are now seen as rising “only” 3.7% (vs 3.8% last), which of course is still about double the Fed’s steady-state inflation estimate of 2%. However, there is a big caveat here: the decline in medium-term expectations was driven by respondents with no college education and with annual household incomes under $50,000. In other words, those most susceptible to lies from the Biden administration that inflation is under control when it clearly it is not.

Some other highlights from the latest survey:

- The median expected change in home prices one year from now increased to 6.0% from 5.7%. The measure, which has been elevated for the past year, remains well above its pre-pandemic reading of 3.0% in February 2020.

- Over the next year consumers expect gasoline prices to rise 9.62%; food prices to rise 9.58%; medical costs to rise 9.55%; the price of a college education to rise 8.47%; rent prices to rise 10.15%

- The median expected growth in household income fell by 0.2 percentage point in March to 3.0%, its lowest level since August 2021.

- Median year-ahead household spending growth expectations jumped by 1.3 percentage points to 7.7%, a new series high. The increase, the largest month-to-month increase in the series, was broad based but was largest for respondents with a college degree and with annual household incomes above $100,000.

- Perceptions of credit access compared to a year ago deteriorated in March, with more respondents finding it harder to obtain credit now than a year ago. Expectations about future credit availability deteriorated as well, with more respondents expecting that it will be harder to obtain credit in the year ahead.

- The median expectation regarding a year-ahead change in taxes (at current income level) was unchanged at 4.5%.

- Median year-ahead expected growth in government debt decreased 0.4 percentage point to 10.7%, its lowest reading since December 2020.

- The mean perceived probability that the average interest rate on saving accounts will be higher 12 months from now increased from 31.3% in February to 32.6%, its highest level since March 2019.

And here are the most concerning trends, showing once again that the US economy is headed for a very pain landing, the only question is whether it is recessionary or stagflationary:

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased by 1.7 percentage points to 36.2%, its highest level since February 2021. The increase was broad based across age, education, and income groups.

- The mean perceived probability of losing one’s job in the next 12 months rose to 11.1% from 10.8%, but remains well below its pre-pandemic reading of 13.8% in February 2020. The mean probability of leaving one’s job voluntarily in the next 12 months also increased to 19.2% from 19.0%.

- A larger percentage of consumers, 11.08% vs 9.20% in prior month, expect to not be able to make minimum debt payment over the next three months, above the 12-month trailing average of 10.0%.

Hilarious, the mean probability that U.S. stock prices will be higher 12 months from now increased by 0.3 percentage point to 37.3%. Spoiler alert: stocks will be lower 12 months from now unless the Fed freaks out

The bottom line, from the NY Fed: “More respondents reporting being financially worse off than they were a year ago. Respondents were also more pessimistic about their household’s financial situation in the year ahead, with fewer respondents expecting their financial situation to improve a year from now.”

With Democrats set to lose the midterms by an avalanche, the above is a fitting epitaph to their domination of executive (and congressional) power since the 2020 election.

[ad_2]

Source link