US Equity Bulls Have A “Valuation Problem” As Bond-Bulls Face ‘Last Line Of Defense’

Having deleted his account on Twitter for the 237th time (approximately), Michael ‘Big Short’ Burry re-entered the social media fray last night with a big warning for US equity bulls that stocks are overvalued and could plunge in price.

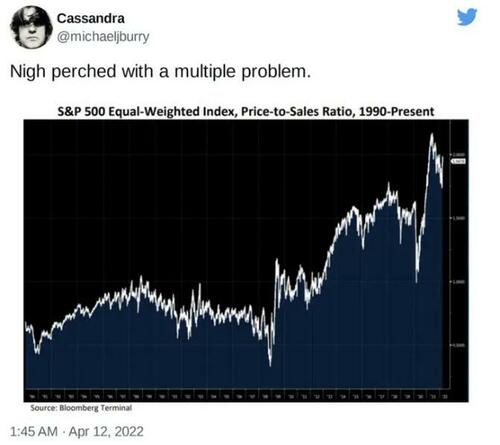

“Nigh perched with a multiple problem,” Burry tweeted, attaching a chart tracking the price-to-sales ratio of the S&P 500 equal-weight index.

As the chart below shows, the ratio was below 1.0 for most of the 1990s and 2000s, but it has nearly doubled over the past decade to more than 2x. While the extreme valuation has been in a downtrend since June 2021, the recent rampage higher in index prices has sent the price-to-sales ratio soaring back towards 2x once again.

This is not the first such warning from the famed investors.

Burry declared in June 2021 that this was the “Greatest Speculative Bubble of All Time in All Things”, predicting “the mother of all crashes” that month, and cautioned the market was “dancing on a knife’s edge” in February 2021.

At the same time, bond bulls are facing their own crisis of faith as Bloomberg succinctly notes that the last line of defense for the purists has now been reached.

As Carter Worth noted, “the all-data log chart for US 10-Year Treasury Bond yields is the most important trend line of all time, ever, in any and all markets.”

While 10Y yields rose above 2.80% in early trading this morning (before plunging after the CPI print), they need to close above 2.83% to mark the moment of no return for the world’s most-watched interest rate.

As Goldman Sachs’ Technical Strategist MacNeil Curry pointed out last week, it is worth noting that it’s not just the 10yr.

The 5yr & 2yr yields are also fast approaching or testing significant long term trendlines which have defined their downtrends since the yield highs of 1982…

Curry suggests that the balance of evidence increasingly suggests that these levels are likely to hold, but a failure to do so would be a significant warning that the long term bull trend is in the process of turning.

While Curry notes that the 1yr1yr Libor Swap ending its secular downtrend is a significant development, the technical strategist notes that does not mean that US rates market in aggregate is reversing its secular bull trend from the yield highs of 1982. For that to happen we need to see US Treasuries break their 2018 highs (30s: 3.463%, 10s: 3.262%, 5s: 3.100%, 2s: 2.989% )

These levels need to be watched closely, he concludes ominously.

[ad_2]

Source link