Surging US inflation expectations defy Fed’s efforts to tame price growth

Buyers’ expectations for US inflation have shot to their highest stage in many years even because the Federal Reserve indicators an aggressive tightening of financial coverage is imminent, underscoring the problem central banks face in convincing markets they will tame runaway worth progress.

A historic bond rout has intensified this week as officers from each the Fed and the European Central Financial institution stepped up their inflation-fighting rhetoric. However the hawkish message has achieved little to arrest an increase in long-term inflation expectations, that are watched carefully by central bankers involved that they will grow to be self-fulfilling.

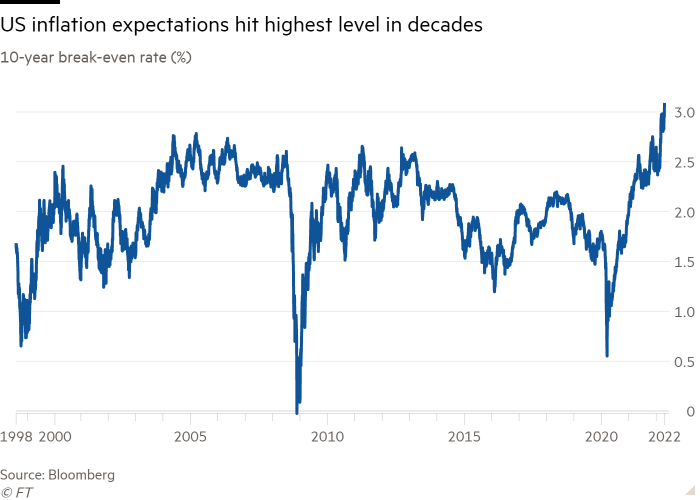

The US 10-year break-even — a carefully watched gauge of market inflation expectations over the following decade — climbed to three.08 per cent on Friday, the very best stage in at the very least 20 years.

The transfer got here after Fed chair Jay Powell mentioned at an IMF panel that “it’s applicable for my part to be transferring just a little extra shortly” to fight inflation, which is at present operating on the quickest tempo in 40 years.

“Central bankers appear to be at this level of most stress on inflation,” mentioned Mark Dowding, chief funding officer at BlueBay Asset Administration. “The market is giving the message that you just had been complacent on inflation for too lengthy, it’s time to get on with it.”

Markets are actually pricing in extra-large 0.5 proportion level fee rises at every of the Fed’s subsequent three conferences.

Even so, Powell has additionally pushed again towards the concept that the Fed might want to provoke a recession with a purpose to deliver inflation again to its 2 per cent goal, saying on Thursday that a “comfortable touchdown” for the economic system stays the central financial institution’s objective.

That message has left some traders questioning whether or not the Fed will enable inflation to stay elevated for longer, in keeping with analysts at Barclays.

Very excessive inflation expectations in markets are partially a mirrored image of the present fee of shopper worth rises within the US, which reached 8.5 per cent in March following a surge in the price of vitality and meals. However even five-year five-year inflation swaps, a special measure favoured by central bankers which strips out present inflation ranges and appears on the second half of the following 10 years, have hit their highest since 2014 at 2.84 per cent.

The image is comparable within the eurozone the place five-year five-year inflation trades at 2.45 per cent, the very best since 2013. ECB president Christine Lagarde recommended on Thursday that the bloc’s financial institution might be much less aggressive than the Fed in appearing to tame inflation as she appeared alongside Powell on the IMF panel.

Nonetheless, current feedback from some the ECB president’s colleagues have alerted markets to the potential for earlier tightening than beforehand thought. Vice-president Luis de Guindos mentioned earlier this week that a fee enhance — the ECB’s first since 2011 — may come as early as July.

German two-year bond yields, that are extremely delicate to ECB fee expectations, climbed to their highest stage since 2013 on Friday.

[ad_2]

Source link