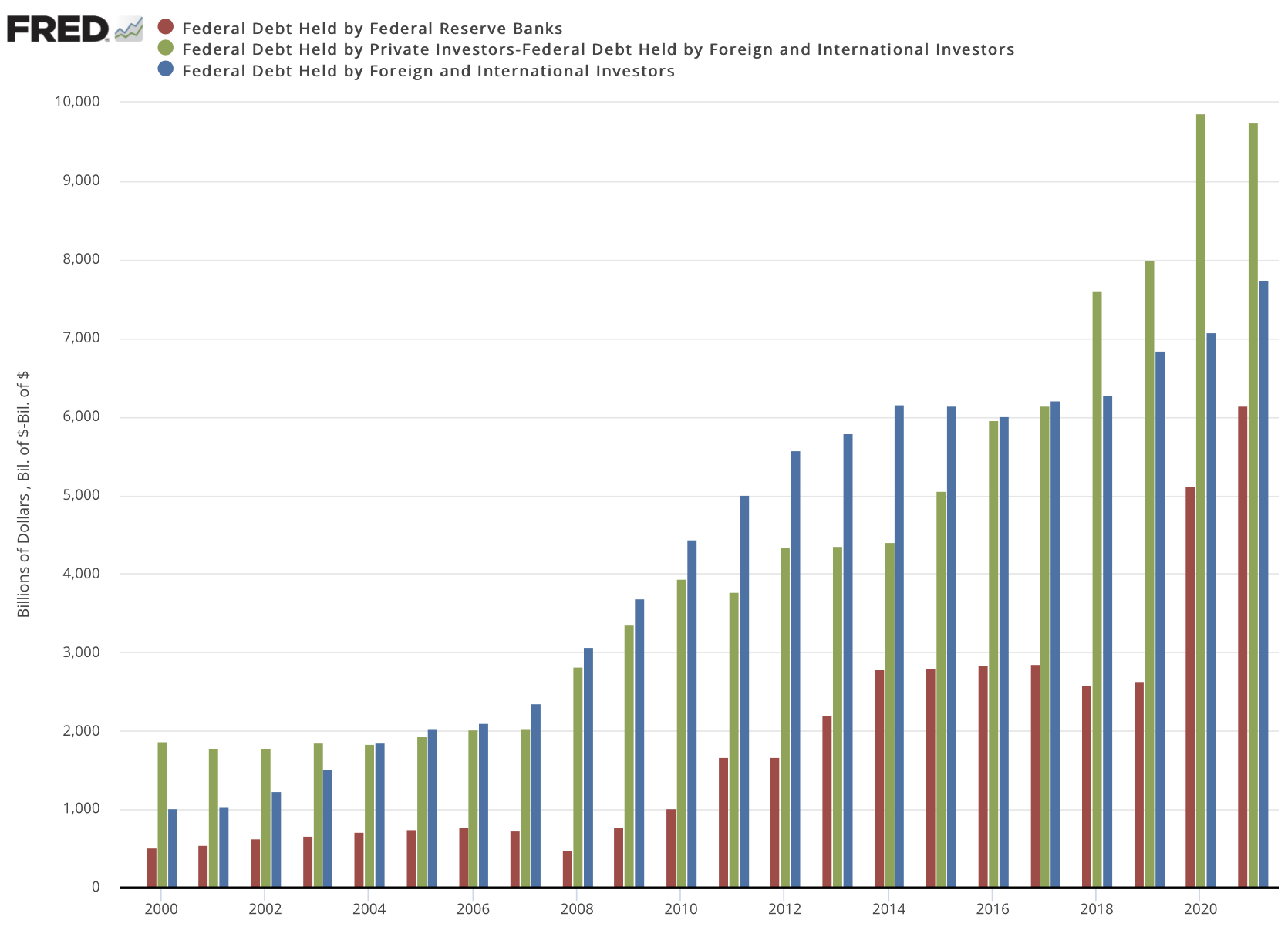

OpenMarkets/Erik Norland/4-25-2022

“As the budget deficit shrinks, more U.S. Treasury issued debt is finding its way onto the market, possibly putting upward pressure on long-term borrowing costs.”

USAGOLD note: What Norland foresees as a future problem is already occurring, which is why yields are rising. When the Fed begins liquidating its holdings, It will only add to the existing pressure on rates – perhaps significantly if foreign participation in the market also begins to level off or, worse, shrink. This short piece offers a quick overview for those looking to understand the developing problems in the market for U.S. Treasuries.

Sources: St. Louis Federal Reserve [FRED], U.S. Department of the Treasury Fiscal Service