The Great Reset … In Housing? Typical Buyer’s Monthly Payment Up 39.4%—The Biggest Annual Gain on Record (Mortgage Rates SOARING With Anticipated Fed Monetary Tightening) – Confounded Interest

We now have the proverbial double whammy happening … soaring home prices AND soaring mortgage rates.

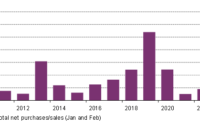

The theory is, of course, that The Federal Reserve will slowly remove its staggering monetary stimulus leftover from 1) the financial crisis of 2008 and 2) the Covid recession of 2020. As you can see, the sheer volume of monetary stimulus remains outstanding and it is the EXPECTATIONS of The Fed tightening that is caused the 30-year mortgage rate to rise.

So, The Federal Reserve is participating in The Great Reset by helping send mortgage rates to the moon. But with soaring mortgage rates and still red-hot home price growth, a typical buyer’s monthly payment is up 39% —the biggest annual gain on record.

While I used the Case-Shiller National Home Price Index YoY, Redfin shows more contemporaneous home price data with April 24 median home sales price at 16.8%.

Thanks to The Fed, we are seeing homebuyer mortgage payments are up 39.4% YoY.

As inflation continues to damage America’s middle-class and low- wage workers, we may see regulations going into effect from the Consumer Financial Protection Bureau protecting consumers from … themselves.

[ad_2]

Source link