Institute of International Monetary Research/Tim Congdon/April 2022

“Many observers expect the peak in annual US consumer inflation to come quite soon (say, with the publication of the May numbers in June) at a little less than 10%. The Ukraine-related oil and food price increases are now hitting hit the indices. Note, as is basic in the context, that the US producer price final-demand index increased 1.4% in March, to take the annual rate of increase up to 11.2%. However, three considerations suggest that the peak in US inflation is still some months away – and may even be recorded in 2023.”

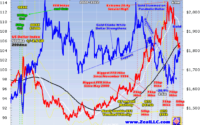

USAGOLD note: Congdon is the widely respected, UK-based economist who advised the Margaret Thatcher government as one of the so-called economic “wise men.” In this essay (which for the most part is a technical treatise addressed to “fellow macroeconomics and monetary analysts), he takes to task those who say that inflation is the result of external influences like energy prices, shortages, supply problems, etc. “Supply shortages,” he says, “are a symptom of inflation, not a cause.” As a long-time advocate of the monetarist school, he sees money creation – the quantity of money and inflation of asset prices – as the root causes of goods and services inflation.