Labor Market Starts To Crack: Jobless Claims Rise To 3 Month High

One week after we learned that in Q1, US GDP had “shockingly” contracted, just one pillar was left holding up the “strong” US economy, the same economy that the Fed’s record tightening cycle is hoping to push into recession: the labor market. However, that too has now turned, and after a big ADP private payrolls miss, after the ISM manufacturing employment index printed just shy of contraction where the ISM Services employment index already is, and after the first positive print in the Challenger job cuts index since Jan 2021…

Canary? @ChallengerGray job cuts go positive for first time since January 2021, +6% y/y vs. -30.1% in prior month; per Andrew Challenger, “job cut plans appear to be on the rise, particularly as companies assess market conditions, inflationary risks, and capital spending” pic.twitter.com/ABCJrkZZQw

— Liz Ann Sonders (@LizAnnSonders) May 5, 2022

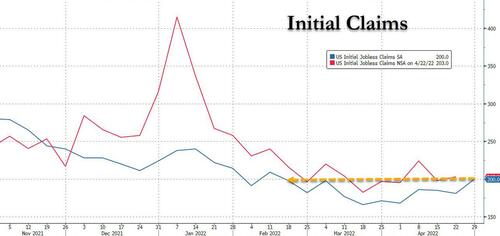

… it now appears that the labor market has also officially peaked, because moments ago the BLS reported that in the week ending April 30, initial claims jumped 200,000, an increase of 19,000 from the previous week’s revised level, 20K more than the 180K consensus forecast, and the highest print since February 11, a troubling confirmation that the best days for the US jobs market are now behind us.

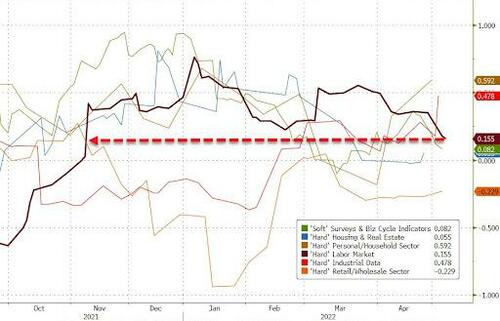

Indeed, looking at the “hard” labor market data shows that it has just dropped to the worst level since November 2021.

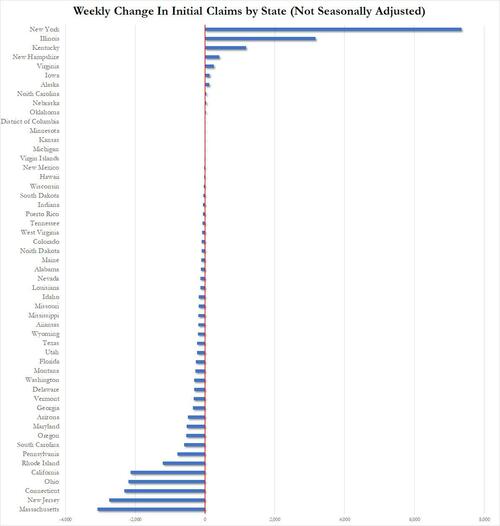

The breakdown by state did not show any notable outliers with the exception of New York State which saw the biggest increase in claims by a large factor.

That said, even though the labor market has peaked, there is clearly still a ways to go before the US jobs market is in freefall, although now that weakness is starting to set in, keep a very close eye on tomorrow’s April payrolls and especially the hourly earnings print – any big disappointment there, and the Fed’s tightening campaign will prove much shorter than virtually anyone expects, and if anything, will segue right into easing and QE some time in late 2022 – around the time the next recession hits.

[ad_2]

Source link