Lack of audits undermine Lebanon’s claim to be Middle East gold heavyweight

With claimed gold reserves of 286 tonnes, Lebanon’s central bank – Banque du Liban – trumpets itself as being one of the Middle East’s largest sovereign gold holders. In fact, on a regional basis, only the claimed gold reserves of Saudi Arabia are larger.

Indeed, Banque du Liban governor Riad Salameh, made this very claim as recently as 8 April 2022 to Egypt’s Middle East News Agency (MENA), saying that Lebanon has the second largest gold reserves across the Middle East and North Africa.

However, what Salameh didn’t mention in his interview is that the portion of Lebanon’s gold claimed to be held in Beirut has not been audited for at least 30 years or even longer, nor did he clarify anything about the remainder of Lebanon’s gold which is said (by a media narrative) to be held in the basement gold vault of that veritable and ever trustworthy privately-owned institution, the Federal Reserve Bank of New York (FRBNY).

In fact, given the choice, it’s difficult to say which is worse, not being able to prove a claim that you have 100s of tonnes of gold stored domestically, or not being able to prove if the other 100s of tonnes of gold which you claim was entrusted to the New York Fed is actually still there. But unfortunately for the citizens of Lebanon, the Lebanese central bank ticks both boxes.

But that’s just the beginning, because the situation on the ground is even murkier.

Trust Us, We’re Central Bankers

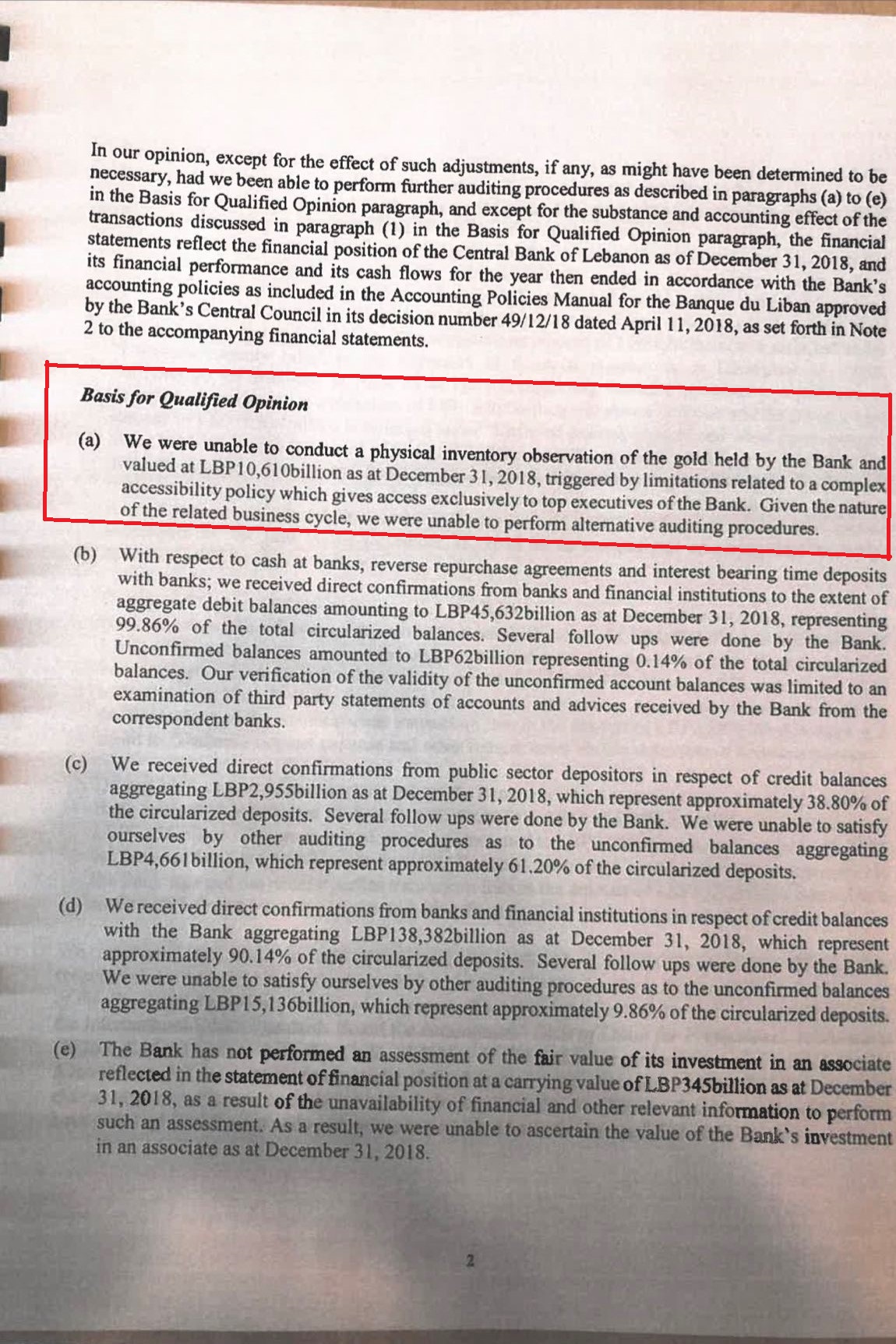

In July 2020, a Reuters article revealed that in the 2018 audited accounts of Banque du Liban (which were never published but which were seen by Reuters), the Bank’s external auditors, Deloitte and EY, had only signed off the central bank’s accounts by adding some “qualifications” (warnings), one of which was that Deloitte and EY had been “unable to conduct an in-person inventory of the bank’s gold reserves”.

This inability to perform a physical inventory was due to what the auditors described as a “policy which gives access exclusivity to top executives of the bank”.

Specifically, page 2 of the auditors report, in a section titled “Basis for Qualified Opinion” said that:

“(a) We were unable to conduct a physical inventory observation of the gold held by the Bank and valued at LBP 10,610 billion as of December 31, 2018, triggered by limitations related to a complex accessibility policy which gives access exclusively to top executives of the Bank.

Given the nature of the related business cycle, we were unable to perform alternative auditing procedures.”

In other words, the Central Bank of Lebanon prevented its own external auditors from even going to look at the gold bars which the central bank claims to have in its vaults in Beirut. Or in other words, “you don’t need to see the gold, but trust us, it’s there”.

While this should have immediately raised red flags and led to Deloitte and EY walking out of the building straight away, in the world of complicit corporate accounting by the big auditing firms, all it led to was a ‘qualification’ to the accounts, and a large invoice for giving their “Qualified Opinion”.

Even though this auditors report was never published, someone kindly tweeted the relevant page on Twitter, and you can see the full page 2 of the Deloitte and EY audit report below:

At this point it’s useful to back up slightly, and look into how much gold the Banque de Libon claims to have had over time, and where and in what proportions this Lebanese gold was said to have been distributed geographically.

According to the World Gold Council’s central bank gold holdings data (which is based on data reported to the IMF by each central bank), the Lebanese central bank is the 19th largest central bank / official institution gold holder, and claims to have 286.6 tonnes of gold which represent 50.5% of the Bank’s total reserve assets. This equates to about 9,220,620 troy ounces. The general narrative across the media is that the size of Lebanon’s gold holding hasn’t changed in a long time. So let’s try to verify this.

A World Bank report from 1991 about the reconstruction of Lebanon following the end of the civil war (1975 – 1990) states that between 1985 and 1991, Lebanon’s gold reserves stayed constant at 9.2 million ozs:

Table 1, page 4 – “Lebanon – Selected Economic, Social and Demographic Indicators, 1985-90”:

“gold holdings which have been constant over the period at 9.2 million fine troy ounces.”

Going back further to the 1980s, an economic history of Lebanon states that:

“Throughout the 1980s, the Central Bank maintained a tight grip on the country’s gold reserves and tried to do the same with its foreign currency reserves. The government held 9,222,000 ounces of gold”

Source here

Going back even further to the 1970s, there is a 3 December 1976 US State Dept cable from the Beirut office to other regional US State Dept offices stating that:

“2. CENTRAL BANK SOURCES TELL US THAT RECENT STATISTICS ON LEBANON’S GOLD AND FOREIGN RESERVE STATUS ARE NOT AVAILABLE, BUT THAT SITUATION IS STILL ABOUT AS IT WAS IN AUGUST 1975.

AUGUST 1975 STATISTICS AS FOLLOWS (ALL FIGURES IN MILLIONS):

GOLD (AT OFFICIAL US $42 PRICE) – US$ 383

FOREIGN EXCHANGE – US$ 1,208

IMF RESERVE POSITION – US$ 2.7

BANK AUTHORITIES BELIEVE THAT ABOVE GOLD FIGURE STILL PROVIDES ABOUT 80 PERCENT COVERAGE OF CURRENCY.

Source – Wikileaks

A gold valuation of US$ 383 million, at the official price of US$ 42 per troy ounce would be equal to 9,119,047 troy ounces as of August 1975.

So over time, we can see that various official sources more of less agree that Lebanon claimed to hold about 9.2 million ounces of gold, and that this figure hasn’t varied much in over 47 years. However, 1975 is an awfully long time ago, and vast upheavals have been experienced by Lebanon over that time – politically, economically and militarily – that could have impacted the ownership, possession, control and actually existence of the nation’s gold reserves.

Location of Lebanon’s gold reserves?

Turning to another US State Department cable, this time from 29 December 1976 (after the Lebanse civil war had begun), the US State Dept office in Beirut wrote to the US State Dept and Secretary of State in Washington D.C., saying that:

“IT IS GENERALLY BELIEVED THAT EIGHTY PERCENT OF THE LEBANESE CURRENCY IN CIRCULATION IS BACKED BY GOLD AT AN OFFICIAL RATE OF EXCHANGE OF ABOUT $42 AN OUNCE.

THE MAJORITY OF THESE GOLD STOCKS ARE REPORTEDLY LOCATED ABROAD.”

Source – Wikileaks

So at the end of 1976, according to the US State Department, more than 50% of Lebanon’s 9.22 million ozs of gold (more than 4.66 million ozs) was located outside Lebanon, which from a security perspective would make sense, given that there was a civil war in Lebanon at that time.

Fast forward to the 2000s and based on some notes that I had made in 2013, three online sources had articles saying as follows:

Al-Shorfa (2010): Two thirds of Lebanon’s gold in Lebanon and one third was at the Federal Reserve Bank of New York. Dead link.

Executive Magazine (2011): Lebanon’s gold is held in the New York Fed, and at the Bank of England in London and in Lebanon. Dead Link and no issues prior to 2016 archived.

BOLD Magazine (2012, Issue 6): Lebanon’s gold is held in the New York Fed and in the Banque du Liban. Dead Link. Not Archived

With an unchanging gold holding total since the early 1970s and with a majority of the gold held abroad in 1976, then two thirds of Lebanon’s gold could only be held in Lebanon in the 2000s if some of Lebanon’s gold was moved backed to Lebanon from abroad after 1976. Otherwise someone is lying.

It’s also interesting that one source (Executive Magazine) stated that some of Lebanon’s gold was at the Bank of England in London. That would mean that some of Lebanon’s gold was held across two non-domestic vaults. While we’re on the subject, its also possible that due to given the historical connections between the Banque de Liban and the French Treasury, that some of Lebanon’s gold was at some point in the vaults of the Banque de France in Paris.

Slow Motion Bar Count

Fast forward now to 2020. Bizarrely, the Banque du Liban’s refusal to allow its own external auditors to even look at the Bank’s claimed gold reserves while they were auditing the Banque’s 2018 financial accounts only became known to the Lebanese government during March 2020. That’s at least according to UAE newspaper, the National, which on 7 April 2022 published a very interesting article about this subject.

In it’s article, the National quotes two Lebanese senior civil servants, one of whom said that:

“The government requested an inventory in March 2020 after it was made aware that another auditor, Deloitte, had been unable to conduct one”.

“The demand, which was accepted by central bank governor, Riad Salameh, came amid increasing public scrutiny of the central bank’s finances.”

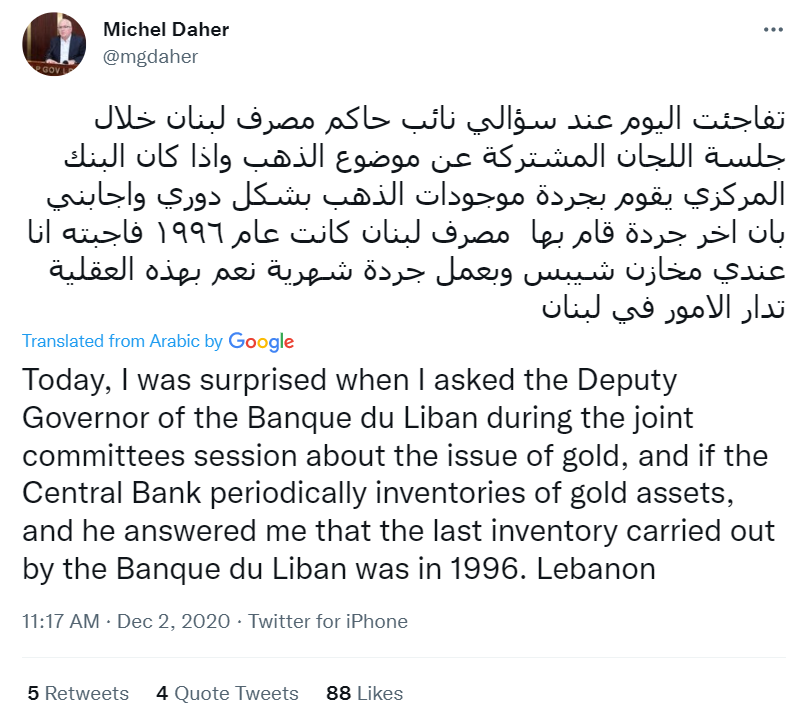

So kind of the central banker Salameh to accept the demand from mere mortals in the Lebanese government to conduct a gold inventory of the nation’s gold. This ‘demand’ then led to the start of a ludicrous and conflict ridden counting of Lebanon’s “gold reserves for the first time in at least three decades” by the central bank’s own staff.

Unbelievably, only about “20 per cent of the time-consuming exercise has been completed in the past two years, two senior civil servants told The National.” Why? Because in the global scam which keeps on giving, the Banque du Liban blames Covid for the slow progress.

“Banque du Liban employees, who are supervised by a government representative, had to pause their work for months owing to Covid-19.

They have descended into the bank’s vaults several times a week to weigh 12-kilogram gold ingots that are believed to number 13,000 in total<. One by one, the metal bars are placed on a scale.

“It’s a very physical job,” said one of the sources.

Civil servants have yet to start on the estimated 700,000 coins the bank also holds.”

You couldn’t make this up. Just 20% of the inventory has been competed during 2 years, so does that mean another 8 years for the other 80%? The National article is worth reading in it’s entirety, but here are some further nuggets.

As to why it’s claimed that a gold bar count has not been done in over 30 years?

“The [civil service] sources believe this is the first physical count of gold held at the BDL since the Lebanon civil war, which raged from 1975 to 1990. Politicians say an audit may have occurred in the 1990s.”

May have? Nobody even knows.

“I assume that Central Bank Governor Elias Sarkis, who bought most of the gold in the second half of the 1960s, counted it. But then there was the civil war, which made it difficult” said economist Kamal Hamdan, who heads the Beirut-based consultation and research institute.”

Presumably the counting of 100s of tonnes of gold during a 15 year civil war between 1975-1990 was not the biggest problem. The biggest problem surely would be how, during nearly constant wars and conflicts including the 1975-1990 Lebanese civil war and since then and with countless marauding armies passing through Beirut, could anyone be sure that any of this gold was still safely sitting in a vault in Beirut all these years, and had not been seized or commandeered.

Hezbollah

Beirut is not unknown for murky and very large gold bar transactions, and for example, a US State Department Beirut Office cable from “Feltman” dated September 2007 describes an intriguing 50 tonnes of gold offer involving Hezbollah:

LEBANON: IRANIAN GOLD FOR SALE?

Iraqi businessman Dr. Sabah Hashem Allawi, brother of former Iraqi Prime Minister and current Iraqi MP Iyad Allawi, told DCM and Econoff on 9/11 that he had been asked to broker a sale of gold that he later learned was registered to Iran.

Emboffs met Allawi at a lunch in Beirut arranged by prominent local Lebanese businessman Abdel Wadoud Nsouli.

Allawi is the chairman of the board of the Trans Iraq Bank, and moves frequently between Baghdad and Beirut. He said that in the recent past he was contacted by someone (NFI) and asked to broker the sale of 50 tonnes of gold bars, and was provided with the serial numbers and markings on the bars. He was told that the gold belonged to Hizballah, who wished to sell it all at once, with a 10 percent discount.

Allawi said he contacted USB [he means UBS], a major Swiss commercial bank. USB [UBS] researched the markings on the bars, and learned that they had originated in South Africa, and were produced and sold to Iran.

Feeling confident about the gold’s origin, USB [UBS] offered to make the purchase and was in the process of sending a representative to Lebanon to complete the transaction, Allawi said.

At that point the sellers reneged on the deal. Allawi said that they are apparently bleeding off the gold through smaller sales, but he offered nothing to substantiate that.

FELTMAN

Source Wikileaks

Why does no one seem to definitively know when the last audit of Lebanon’s gold was actually conducted?

“The National was unable to verify the time period in the absence of a response from Banque du Liban and Deloitte, the central bank’s long-time auditor until it withdrew last year. A physical inventory of a central bank’s gold should normally be done regularly as part of its audit.“

Deloitte and EY Exit Stage Left

So Deloitte jumped ship in 2021. And there are no external auditors attending the gold bar inventory count. According to the National:

“One source said the BDL’s former auditors, Deloitte, and EY, started to attend the inventory before pulling out completely for reasons that remain unclear.”

So Deloitte and EY jumped ship after they started to attend the inventory count. You can’t make this stuff up. What did Deloitte and EY see? An empty vault?

But wait, after Deloitte and EY exited, their competitor KPMG came to the rescue, but only to audit pieces of paper.

“The Finance Ministry in August 2020 asked KPMG to conduct an audit of the central bank’s financial statements starting in 2018. Another auditing company, Alvarez & Marsal, is conducting a forensic audit of the bank.“

“The inventory is limited to checking that the expected amount of gold is present. Audit company KPMG will then step in to evaluate the metal’s worth, the source said.”

And why is the massive KPMG, which has 236,000 professional employees worldwide, not helping with the gold inventory, but merely looking up a price on the LBMA website?

“Mr Shami [Deputy prime minister of Lebanon] said on television this week that KPMG did not have the expertise to assist with the gold inventory and would “hire experts”.

Asked during a brief phone call to clarify whether the experts would count the gold as well as evaluate its worth, he said: “I have no idea.”

Again, you can’t make this stuff up.

Personal Fiefdom

Back to the 7 April 2022 article from The National. Is it just coincidence that there has been no inventory or audit of Lebanon’s gold since the current governor of the Banque du Liban, Riad Salameh was appointed to the role in 1993?

نائب حاكم مصرف #لبنان لم يخجل من الاعتراف بأنه لم يتم عد الذهب منذ عام ١٩٩٦ وهذه جريمة موصوفة وغير مقبولة. كما اتحفنا سلامة امس ان أموال المودعين موجودة في المصارف فلماذا تمتنع الاخيرة عن الافراج عن ودائع الناس؟ فإلى متى ألاستمرار بهذه مهزلة! pic.twitter.com/T8a4JWTv4S

— Fouad Makhzoumi (@fmakhzoumi) December 2, 2020

According to the Bank’s website, in an extensive and flattering bio which looks like Salameh wrote himself:

“Riad T. SALAMÉ is the Governor of the Banque du Liban, Lebanon’s Central Bank, since August 1, 1993. He was reappointed three times for a six-year term of office in 1999, 2005 and 2011. Governor Salamé manages all aspects of the Central Bank and is assisted by four vice-governors and the Central Council.”

Where are the term limits for central bank governors? In Lebanon’s case, they don’t exist. This was also the case for the government’s commissioner to the central bank, who was in the role for 20 years. The National writes:

“Mr Salameh was appointed shortly after the end of the war, in 1993. The request for an inventory can come from the government’s commissioner to the central bank, which, until 2016, was a job held by the same person for around two decades, sources say. He died in 2021, and it remains unclear whether he never made the request or whether it was refused.

and that:

The Banque’s 60% – 40% claim

According to the same article in the National, Deloitte and EY ‘thought’ that 60% of Lebanon’s gold was in Beirut, and 40% was at the US Federal Reserve:

“A leaked report by Deloitte shows that four years ago, it evaluated Banque du Liban’s gold reserves at close to $18 billion, of which 60 per cent is held in Beirut, and the rest at the US Federal Reserve.”

How though would Deloitte know anything about Lebanon’s gold given that it wasn’t even allowed into the Bank’s vault in Beirut to look at any gold? While this was a case of Deloitte flying blind and repeating what it had been told by the Banque du Liban, you can see that the narrative being pushed is that 60% of Lebanon’s unchanging gold holdings is in Beirut.

So what about the fact that ‘a majority’ of Lebanon’s gold was said to have been stored abroad in 1976. Did some of the gold come back to Lebanon? And why no mention of the Bank of England and London?

In their audit report, Deloitte and EY also use a valuation for Lebanon’s claimed domestically stored gold of “LBP 10,061 billion as of December 31, 2018″. At the fixed exchange rate of £L1,507.5 per USD (the Lebanese pound is officially pegged to the USD at this rate), this equates to US$ 7,038,142.

The LBMA Gold Price of 31 December 2018 fixed at $1281.65. This would imply that Deloitte and EY were valuing a quantity of 5,491,470 ounces of gold. Out of a total claimed holding of 9,222,000 ounces, this would mean that the Banque du Liban told Deloitte and EY that 59.55% of its gold is stored in Beirut, and would mean that the Banque du Liban told Deloitee and EY that the remaining 3,730,530 ounces of the Lebanese gold is stored at the Federal Reserve Bank of New York, or 40.45%. This 3,730,530 ozs equates to 116 metric tonnes.

Conclusion

The Banque du Liban is the only central bank in the world which controls a casino – the Casino Du Liban. It also owns an airline – Middle East Airlines. That in itself show cause concern as to what kind of wild west show the Banque du Liban really is and how its long serving governor Riad Salameh controls the show.

In short, the Lebanon’s gold could be anywhere by now. There is no record that it has ever been audited. The last external auditors in Beirut were denied access to even see the claimed gold. The inventory count is being conducted by Banque du Liban employees, not by external auditors. The Banque de Liban governor is under investigation in both Lebanon and across Europe.

Lebanon has had the misfortune of suffering year after year of wars, economic mismanagement and political corruption. And the Lebanon central bank wants people to believe that all the gold it claims is in its vaults in Beirut is actually there. According to a November 2020 Wall Street Journal article titled “Lebanon’s Central Bank Fuels Corruption, Extremism Concerns”, the “US and allies seek a forensic audit to check for money laundering, corruption and ties to Hezbollah“.

And this is not even taking of the Lebanese gold which is said to be in the New York Fed. Any gold that the Lebanese entrusted to the Fed vault in Manhattan could have long ago been sold, swapped, leased, used as collateral for US and international loans to Lebanon over the years, or has the potential to be seized by the US if Lebanon does not pay it’s foreign debt obligations.

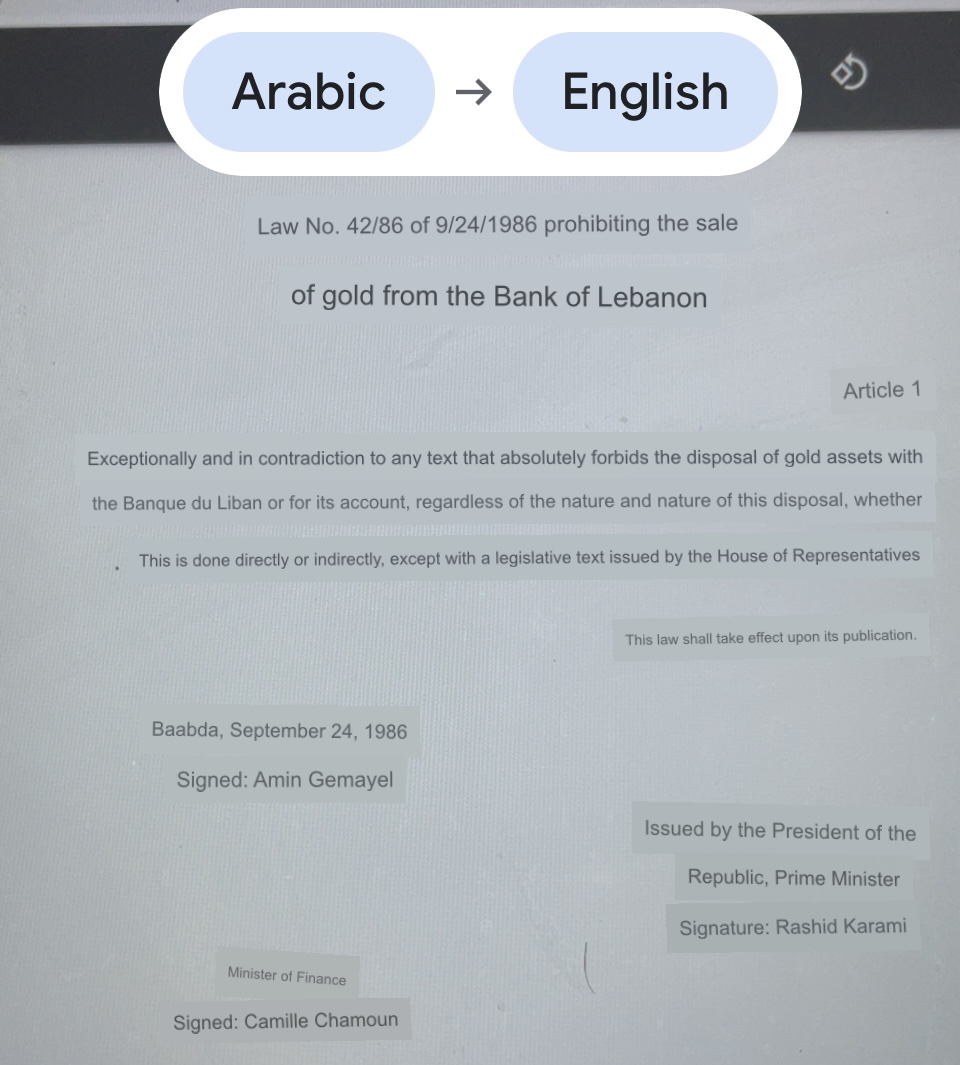

While Lebanon passed a law “Law 42″ in 1986 prohibiting the sale of the Banque du Liban’s gold without parliament approval, does anyone seriously think that a bunch of central bank executives who ride roughshod over international auditing standards and prevent external auditors seeing actual gold in a vault in Beirut will care one iota about a parliamentary law?

The International Monetary Fund (IMF) has also been sniffing around Lebanon’s gold, maybe wanting a piece of the gold action. And anytime the IMF is involved in gold transactions, everything is murky and secretive.

Last month (April 2022), the IMF reached a deal with the Lebanese government on an economic reform program, where the government agreed to a number of measures “prior the IMF Board’s consideration” including “completion of the special purpose audit of the BdL’s foreign asset position, to start improving the transparency of this key institution“.

According to the National:

“The IMF did not answer when asked whether it had requested an external auditor to oversee the BDL’s gold inventory.”

To find an example of real physical purchases of gold by Lebanon, you have to go all the way back to the second half of 1949, when:

From June 20, to December 31, 1949 Lebanon bought:

“1. – 100,000 ounces of fine gold from the Federal Reserve Bank of the United States at the official price of 35 dollars per ounce.

2. – Gold ingots and coins as follows (price in Lebanese pounds):

A) Ingots; 6,195 Mexican pesos at the average uniform buying price of 182.617

8,879 Rothschild ingots at 275.778 each

882.8722 kilograms of fine gold in ingots at 4,364.66 per kilogram

B) Gold coins;

38,315 gold pounds sterling (kings) at 38.616 each

16,000 gold pounds sterling (queens) at 38.318 each

58,200 gold Turkish pounds at 31.60 each

17,000 gold Iranian pounds at 34.27 each

Where any of the above gold is now is anybody’s guess.

However, there is some light at the end of the tunnel for Lebanon’s gold from a political / civic group in Lebanon called Mmfidawla (website, Twitter), who have called for transparency on Lebanon’s gold holdings, and even called for a repatriation of Lebanon’s gold claimed to be stored abroad. The group’s website has an entire section (in Arabic) about the Lebanese gold and some articles and videos.

Intriguingly, one article (in Arabic) on the Mmfidawla site is written by deputy governor of the Banque de Liban, Ghassan Ayyash, who thinks that most of the Lebanese gold is held abroad, and specifically in Fort Knox’:

“the bulk of gold stock is outside the control of the Lebanese state and its laws, because it is deposited in the American castle “Fort Knox”, which does not return the gold to its owners at the first request

One video (in Arabic) features Lebanese journalist and upcoming election candidate Jad Ghosn asking how much of Lebanon’s gold is in the US and how it can be brought back.

Another video (in Arabic) features Charbel Nahas talking about the Lebanon’s gold and can be seen below and on YouTube.

Gold bar audits are not rocket science and are relatively simple. In fact, the external auditors of the giant SPDR Gold Trust (GLD) conducts two gold bars inventory counts per year, neither taking more than a few weeks. BullionStar employees five methods of bullion inventory auditing including live audit reports, third party physical inventories, customer walk in audits, and stock inventory audits. If the GLD and BullionStar can do do physical audits, so can the Banque de Liban.

The fact that the Banque du Liban is going to extremes not to do an external gold bar audit shows that it has a lot to hide. Lebanese citizens should be very concerned as to what has happened to Lebanon’s gold.

[ad_2]

Source link