An embattled Biden calls fighting inflation a ‘top priority’ as consumer prices soar

Former D.C. Democratic Party Chairman Scott Bolden and Gianno Caldwell, Fox News political analyst, weigh in after Biden’s speech on America’s inflation problem.

President Biden on Tuesday called combating the hottest inflation in 40 years his top domestic priority as he sought to reassure Americans over sky-high consumer prices, which have become a major political liability for Democrats.

“I want every American to know that I’m taking inflation very seriously,” Biden said in remarks from the White House. “It’s my top domestic priority.”

BANK OF AMERICA ANALYSTS SLASH S&P 500 PROJECTIONS AS ‘SPECTER OF RECESSION’ LOOMS

American consumers are grappling with the hottest inflation in a generation, with the consumer price index climbing 8.5% in March from a year ago, according to a Labor Department report released last month, marking the fastest increase since December 1981. The CPI – which measures a bevy of goods, ranging from gasoline and health care to groceries and rents – jumped 1.2% in the one-month period from March.

Biden highlighted efforts that his administration is taking to reduce the price spike, including releasing 180 million barrels of oil – a record-setting amount – from the nation’s strategic petroleum supply, calling on companies to reduce prices and urging car and tech industries to bring supply chains back to the U.S.

“Families all across America are hurting because of inflation,” the president said. “I understand what it feels like. I come from a family where if the price of gas or food went up, we felt it.”

Rising inflation is eating away at strong wage gains that American workers have seen in recent months: Real average hourly earnings decreased 0.8% in March from the previous month, as the 1.2% inflation increase eroded the 0.4% total wage gain, according to the Labor Department. On an annual basis, real earnings fell 2.7% in March.

The inflation spike has been bad news for Biden, who has seen his approval rating plunge as consumer prices rose. Biden on Tuesday again blamed the price spike on supply chain bottlenecks and other pandemic-induced disruptions in the economy, as well as the Russian war in Ukraine. Republicans have pinned it on the president’s massive spending agenda.

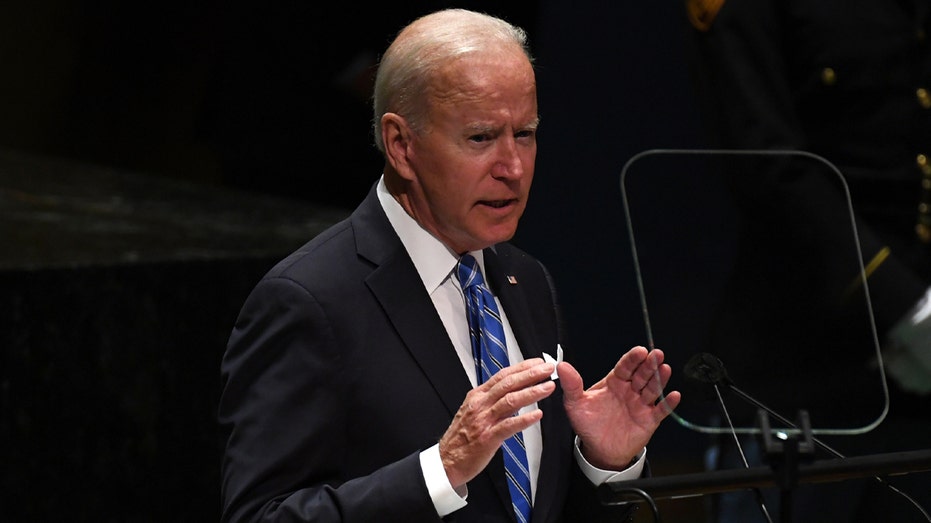

President Joe Biden addresses the 76th Session of the General Assembly on Sept. 21, 2021, at U.N. headquarters in New York City. (Timothy A. Clary-Pool/Getty Images / Getty Images)

But Biden said tackling inflation ultimately starts with the Federal Reserve, which is tasked with a dual mandate: Full employment and price stability. Biden tapped Fed Chairman Jerome Powell for a second, four-year term at the helm of the central bank in November, but Congress has yet to approve his nomination.

The Fed nominees are languishing in the Senate because Democrats were unsure they had the necessary votes to confirm Lisa Cook, a Michigan State University economist who also worked on the Council of Economic Advisers during the Obama administration.

Biden urged the Senate to confirm the Fed nominees “without delay.”

“I believe that inflation is our top economic challenge right now,” he said. “And I think they do too. I agree with what Chairman Powell said last week: The No. 1 threat to the economic strength we built is inflation. The Fed should do its job and will do its job. I’m convinced.”

Federal Reserve Chair Jerome Powell pauses during a news conference in Washington on Jan. 29, 2020. (AP Photo/Manuel Balce Ceneta, File / AP Newsroom)

Fed policymakers voted unanimously last week to raise the key benchmark rate by 50 basis points for the first time in two decades as they look to curb consumer demand. Officials also announced they will start reducing its massive $9 trillion balance sheet, which nearly doubled in size during the pandemic as the central bank bought mortgage-backed securities and other Treasurys to keep borrowing cheap.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Collectively, the steps mark the most aggressive tightening of monetary policy in decades as the Fed races to catch up with inflation.

The president’s comments come just one day before the Labor Department releases the latest consumer price index reading, which is expected to be another doozy. Economists expect the gauge to climb 8.1%; although that’s down a bit from March’s recording of 8.5%, it’s still near a record high.

[ad_2]

Source link