Why demand for gold is rising, and expected to continue amid volatility

“Many exposures were bubbling up before the pandemic. They just took a backseat as the world focused on it. But, now, many of these risks are resurfacing, and I think investors are choosing where they want to put their dollars to ensure they have proper risk mitigating strategies and asset allocation.”

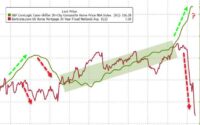

Artigas said the council saw a $50 billion gold ETF in-flow in 2020, but when sentiment started to improve in 2021, there was a $9 billion outflow, “which tells you that there’s a lot more strategic buying for the long-term.” In Q1 2022, there was another $12 billion in-flow.

“What’s interesting from our perspective is it has been consistently increasing for various reasons,” he said, noting many investors use high-quality assets, like gold to diversify, mitigate risk, and provide good long-term returns.

Artigas noted gold’s dual nature – as an investment, but also for jewellery and electronic consumption – allows it to capture some of the upside, when there is positive economic growth, which spurs on jewellery and electronics demand, but also protect the downside by providing a safe haven during periods of risk, and the Q1 results for 2022 show that mix.

During that time, The World Gold Council reported that, gold ETFs jumped by $69 trillion (US) in Q1, recording their strongest quarterly inflows since Q3 2020.

[ad_2]

Source link