Financial Times/Richard Bernstein/5-9-2022

“The Federal Reserve claims to be fighting inflation, but before one proclaims the central bank ‘hawkish, it seems appropriate to paraphrase (former NFL coach Bill) Parcells: you are what your real fed funds rate says you are.”

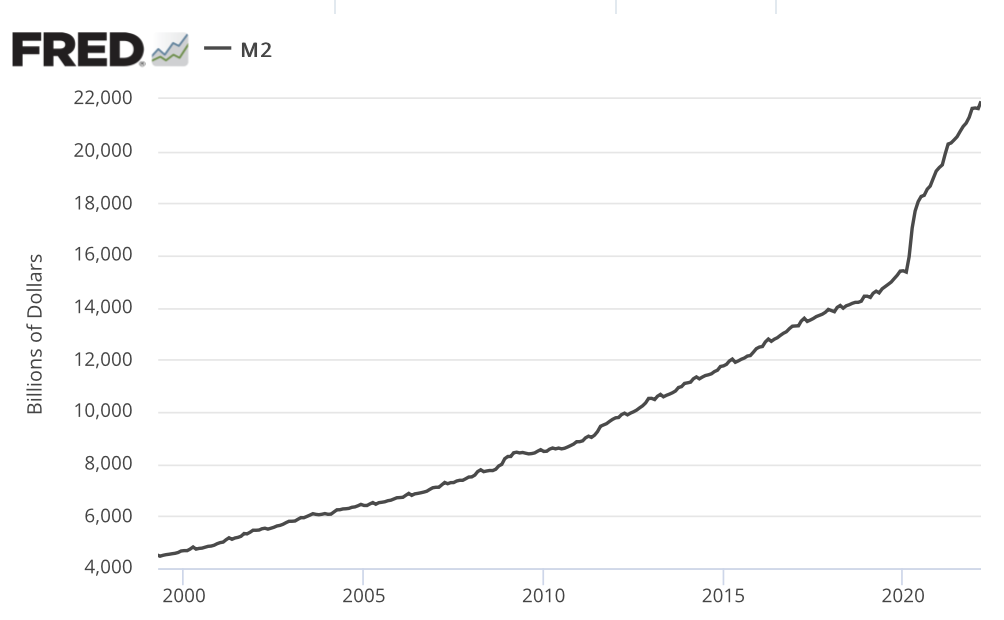

USAGOLD note: Bernstein says the real fed funds rate – now at minus 7.5% versus a 1% 50-year average – is a long way from hawkish. He challenges a number of market assumptions on Fed policy and says the current investor “underweighting in pro-inflation assets seems to present an investment opportunity.” He goes on to mention gold as one of several alternatives. One of gold and silver’s most appealing qualities at this juncture – and probably the most responsible for the strong coin and bullion demand – is their low price compared to the amount of money that has been pushed into circulation over the past two years.

Money Supply

Sources: St. Louis Federal Reserve, Board of Governors of the Federal Reserve System (US)