BusinessInsider/Harry Robertson/5-10-2022

“It said clearinghouses, key middlemen institutions in financial trading, have sharply increased so-called margin calls in key markets such as oil futures, adding to the pressure on major buyers and sellers. A margin call is a demand to cough up more cash to cover potential losses. The central bank also said liquidity conditions have worsened notably elsewhere, meaning traders of key global assets are finding it harder to buy and sell without moving the market.”

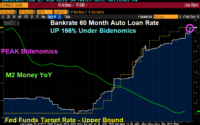

USAGOLD note: Commodities markets are only one area where a high degree of leverage creates vulnerabilities. The bond market also comes to mind. The margin debt on stocks is at an all-time high. We recall Jeff Gundlach’s warning at the beginning of the year: “My suspicion is that they’re going to keep raising rates until something breaks, which is always the case.” In short, there are a lot of places where something could break, and the commodities market is just one of them.