Seeking Alpha/JD Henning/5-8-2022

“The correlation between rate hikes and S&P 500 returns indicates that it is not the number of hikes that impacts the market as it is the level of interest rates that suddenly trigger outflows from the market to other securities like bonds. With five proposed rate hikes in the remaining 9 months of the year a similar adverse market reaction could be triggered by the end of the year. However, I submit the larger concern will be the liquidity drain from the Federal Reserve’s aggressive quantitative tightening schedule.”

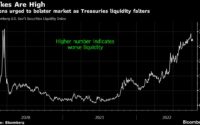

USAGOLD note: Henning offers an in-depth look at quantitative tightening, i.e., how it will unfold and its potential impact, particularly on stock market volatility. He points out that the Fed now holds 25% of the overall Treasury market. The Fed has purchased 52% of the Treasury Department’s debt issuance in each of the last two years, as shown in the interactive chart below. There are two critical aspects to quantitative tightening the bond market will now be forced to digest. First, the Treasury Department will no longer be depending on the Fed to buy what it cannot place elsewhere forcing it into the open market. Second, the Fed will suddenly turn from net buyer of Treasury debt to net seller. Gapping rates, a tantrum, and in the worst case, a financial panic are all possibilities.