Bloomberg/Niall Ferguson/5-19-2022

“In the same way, a belated tightening of monetary policy by the world’s most important central bank, the Federal Reserve, inflicts a sort of regime change not only on US households and businesses, but on the rest of the world, too. All the consequences of these two shocks — one geopolitical, the other economic — are very hard indeed to predict, but I am confident that we have seen only a small proportion of them so far.”

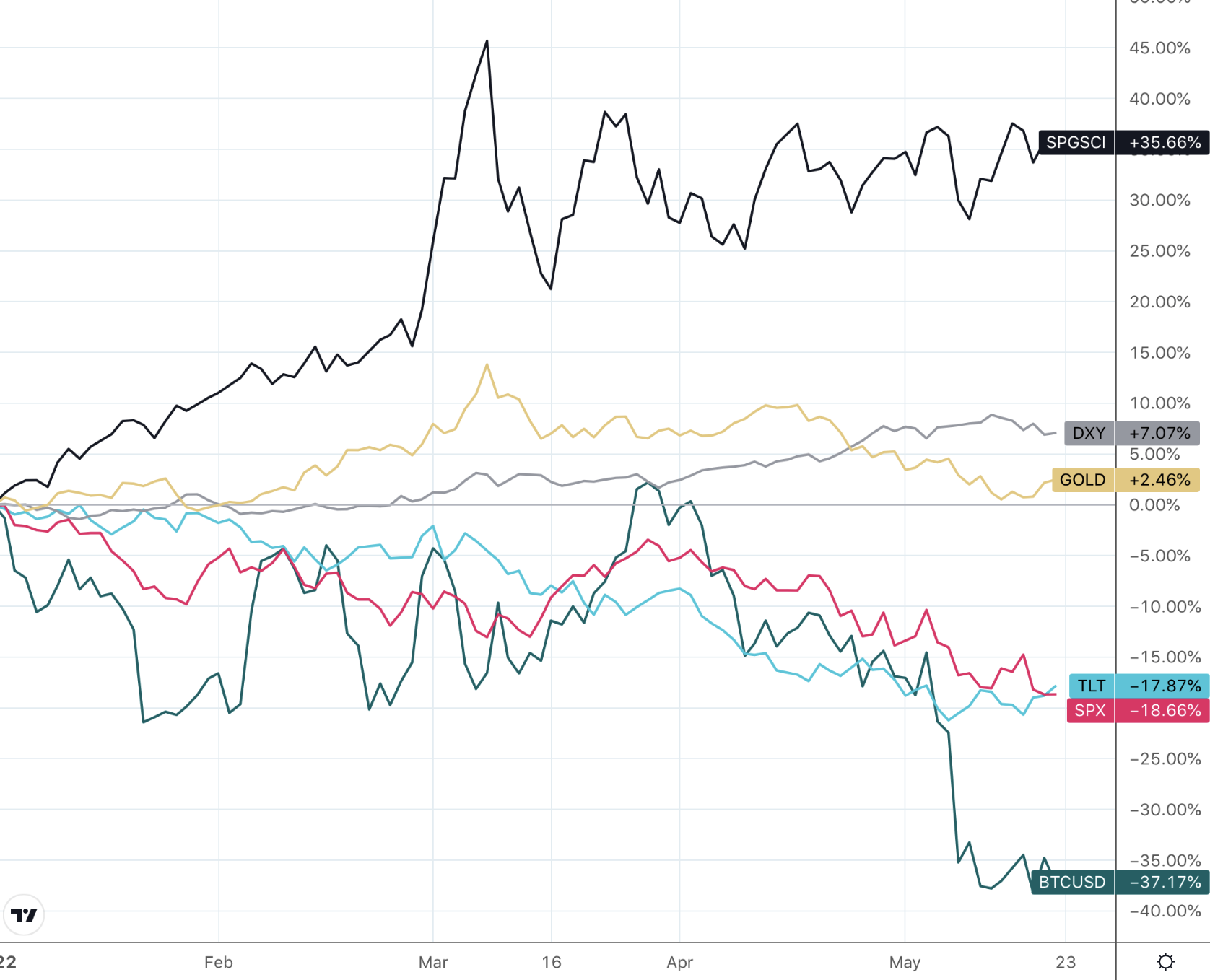

USAGOLD note: Ferguson goes on to say that “owning gold has preserved capital, but owning dollars has been a superior strategy.” That logic applies to investors in countries outside the United States but not to Americans who already own dollars by default. U.S.-based investors who have diversified with gold and commodities have preserved capital in the early stages of this new stagflation. On the other hand, unhedged (or inadequately hedged) owners of stocks, bonds, and cryptocurrencies have suffered the double whammy of market losses and the loss of purchasing power to inflation. Historically, Ferguson identifies the 1970s as the closest comparison to the present period but says “the analogy is far from perfect.” Like the 1970s, he says, we should not “expect a rapid return to stability, whether in macroeconomic or geopolitical terms.” The full analysis is highly recommended at the link.

Investment performances 2022

(%, year to date)

(SPGSCI = Standard & Poors Goldman Sachs Commodity Index; TLT = Bond ETF; SPX = S&P 500; BTCUSD = Bitcoin)

Chart courtesy of TradingView.com