The New York Sun/Scott Norvell/5-20-2022

“The plan is to simply let the securities — bundles of home mortgages purchased from the banks that initially lent the money to homeowners — roll off its balance sheet as they mature. If the bank can’t meet its reduction targets through attrition, however, it may have to resort to selling those securities on the open market, which could nudge mortgage rates up even higher than they already are and put home buying out of reach for more Americans.”

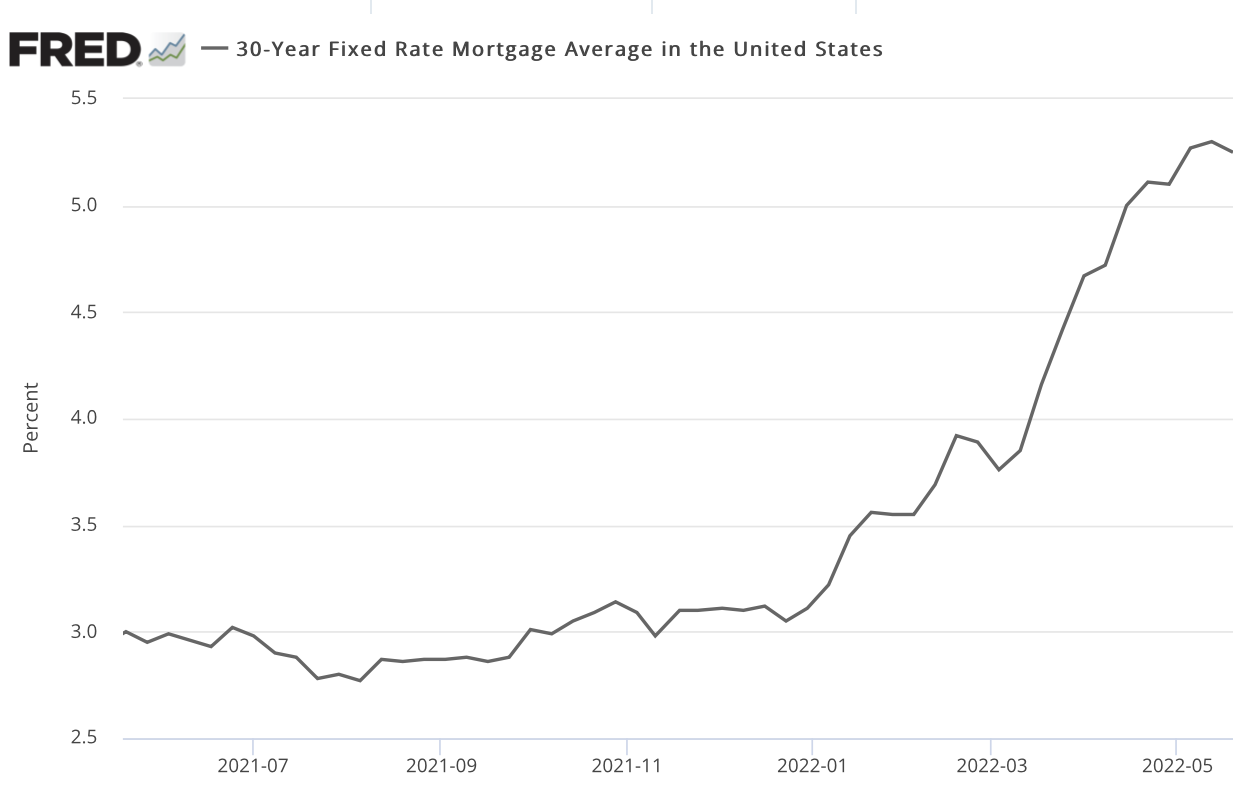

USAGOLD note: Mortgage rates have already gone from 3% to 5.25% since the beginning of the year pushing a good many out of the housing market.

Sources: St. Louis Federal Reserve [FRED], Freddie Mac