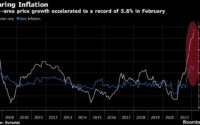

NewsMaxFinance-Reuters/Staff/5-24-2022

“The Fed’s stock of Treasury bonds and mortgage backed securities is projected to decline by roughly $2.5 trillion by mid-2025, to about $5.9 trillion, when the central bank’s run-off of assets is likely to be halted to maintain an adequate level of bank reserves, the New York Fed said on Tuesday.”

USAGOLD note: These numbers appear to be a projection rather than an actual schedule of reductions. The great debate at the moment is whether or not the Fed can stay the course on quantitative tightening or if it will be forced to throw in the towel if and when the economy tightens and financial markets register a negative response. The most interesting revelation comes at the end of the article when Reuters reports that the Fed intends to hold its Treasuries portfolio until maturity. In other words, the Fed will reduce its balance sheet through natural attrition. If that turns out to be the case, it will temper the impact on rates from the sell-side of the equation. The most consequential impact, though, will come from the buy-side of the equation as the Fed withdraws its bond market support as the buyer of last resort.

(Chart note: Some years ago we constructed the interactive chart above at the St. Louis Fed’s FRED portal. You can track it at our Monetary Trends and Indicators page, along with several other charts of interest to precious metals owners.)