XAU/USD bulls pile in as the US dollar melts

- Gold bulls are moving in again as the US dollar continues to bleed out.

- The bears are lurking on the longer-term time frames.

The gold price pared some early losses overnight as investors continued to move out of the US dollar making it cheaper to buy the safe-haven precious metal. At $1,853, XAU/USD is a touch higher in Asis, chalking up 0.18% of gains at the time of writing as it moves in for a fresh high on the day at $1,854.27 so far.

”The prospects of an economic slowdown driven by lockdowns in China and the Russia-Ukraine war have boosted safe-haven buying,” analysts at ANZ Bank explained. ”However, this is being offset by concerns of an aggressive rate hike cycle by the US Federal Reserve. Ultimately what inflation does over the next couple of months will have a big part to play in gold’s performance.”

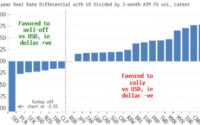

Minutes of the Fed’s May 3-4 policy meeting highlighted that most participants favour additional 50 basis point rate hikes at the June and July meetings. This is arguably a thorn in the side for the gold bugs because higher short-term US interest rates and bond yields raise the opportunity cost of holding bullion, which yields nothing. ”Without the conviction that the Fed could blink, there are few participants remaining to buy gold, which still leaves a liquidation vacuum as the playbook in gold,” analysts at TD Securities argued.

However, US Treasury yields were subdued after the benchmark 10-year note hit a fresh six-week low. Traders and investors will weigh the inflation risks but the concerns are continuing to dissipate as economic data and corporate announcements point to slower growth. Additionally, the dollar index (DXY) is set for a second straight weekly decline, making bullion less expensive for buyers. At the time of writing, DXY is down some 0.32% at 101.437.

From a more bearish perspective, analysts at TD Securities argued that ”trend followers have completed their buying program, and still remain long, which argues for additional downside on the horizon as momentum persists to the downside, with the macro narrative sapping investment demand for gold”.

Gold technical analysis

This week’s candle is bullish and the bulls have corrected to a 38.2% ratio milestone with prospects of a 50% mean reversion in due course.

[ad_2]

Source link