Gold Still Poised for Best Run Ever, US$3,000 in the Cards

David Garofalo VRIC 2022youtu.be

Gold’s performance so far this year has disappointed some market participants — is it set to improve?

Speaking at the recent Vancouver Resource Investment Conference (VRIC), David Garofalo, CEO and chairman of Gold Royalty (NYSEAMERICAN:GROY), said the yellow metal is still on track to reach US$3,000 per ounce in 2022.

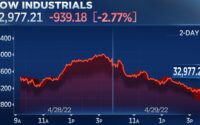

“At the onset of a bear market, which we’re experiencing in the equity markets right now, it’s the baby and the bathwater — everything is getting thrown out, including gold equities and gold,” he said.

“But eventually more discerning investors will start to buy defensive asset classes, and gold clearly is that in this type of inflationary cycle,” Garofalo continued. “I still believe gold is poised for the strongest run it’s ever had — I do believe gold will achieve US$3,000 in this cycle.”

While the US Federal Reserve has now hiked rates twice in 2022, with plans for additional increases at its June and July meetings, Garofalo believes the central bank will become more tentative due to high levels of debt.

“I think they’re going to try to find a soft landing, (but) I expect they’re going to reverse course on interest rates in the medium term,” he noted. He sees that happening in the next six to 12 months.

For him, the reality is that inflation is accelerating, with reported numbers understating what’s actually happening.

“We’re going to see a similar dynamic (to) the last major inflationary cycle in the ’70s and ’80s, when nominal rates started to get tightened, but inflation continued to accelerate and gold galloped to all-time highs,” he said.

Watch the interview above for more from Garofalo on the gold market, including financing for juniors and Gold Royalty’s 2022 plans. You can also click here for our full VRIC playlist on YouTube.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

[ad_2]

Source link