Bloomberg/Enda Curran/6-15-2022

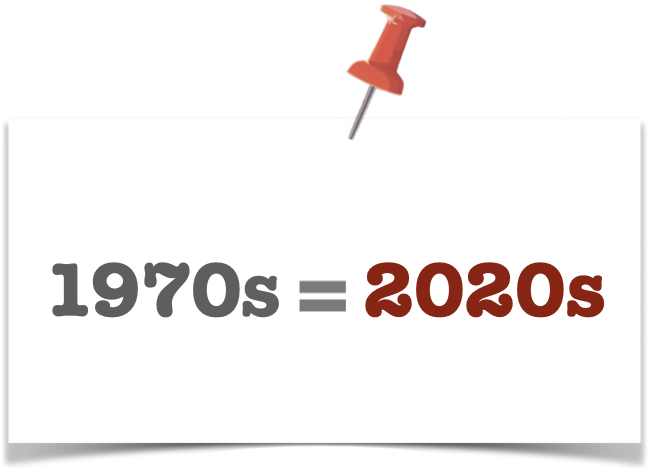

“In either case, such a shock would be on the scale of what the world experienced during the early 1970s oil crisis, when taken as a share of global GDP, the analysis found. ‘The longer the commodity shock persists, the bigger the negative impact on commodity consumers and on net, global growth and equities,’ the analysts wrote.”

USAGOLD note: If we do get the 1970s all over again, gold and silver might be a couple of the prime beneficiaries. During the 1970s, gold rose 1800% in value, and silver by almost 1700%.