MarketWatch/Rex Nutting/6-18-2022

“A year ago, the Federal Reserve turned a blind eye to the gathering storm of inflation. Now the Fed is missing another big problem: A rapidly slowing economy. In an effort to appear strong on inflation, the central bank can’t recognize that the economy is already downshifting to a slower growth rate. If it doesn’t wake up to this new threat, a job-crushing recession is inevitable.”

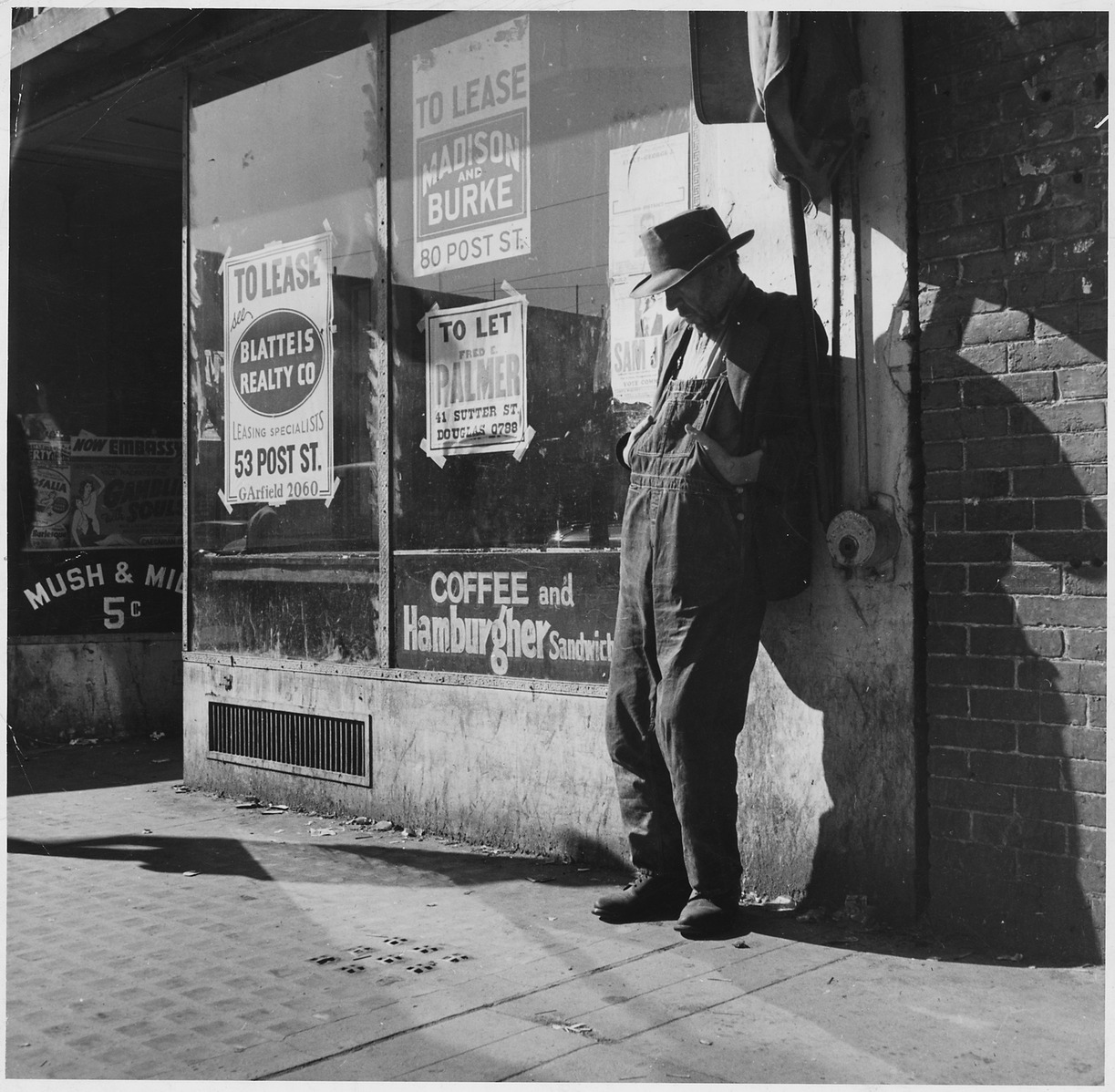

USAGOLD note: That about sums up the current state of affairs for the Fed and the rest of the population. Nutting is concerned the Fed will be late on the recession, just as it was late on inflation. As one critic put it: “They’ll kill inflation for sure. And create a lot of collateral damage.” We may already be seeing the first signs of that collateral damage among highly leveraged speculators and the housing market. As we have mentioned in the past, the Fed tightened into a slowdown in the late 1920s – a policy stance many economists feel triggered the Great Depression of the 1930s.