Why Food Inflation Is Only Getting Started

Take a look at this:

The US has just experienced an 8.8% increase in food prices. The problem (and there are many, actually) is that this doesn’t take into account the spiraling costs farmers are now experiencing.

It’s worth remembering that because farmers pay upfront and only recoup their expenses at the point of sale/harvest months later, all the opex they’ve experienced has a lag.

This lag is dependent on produce but certainly, we’re looking at a tsunami of food inflation 12 to 18 months out.

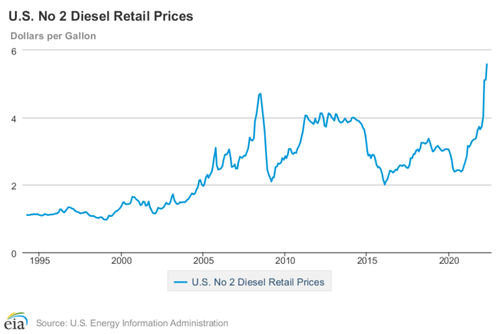

Then there is the fuel and fertilizer. You’ll hopefully recall our bullish call on both fuel and fertilizer in order to play the entire food cost explosion that is now kicking off. Fuel and fertilizer together are the two largest input costs to farmers, typically exceeding in aggregate 50% of their total costs.

Here’s diesel:

Then we have fertilizer, itself a by-product of natural gas:

Fertilizer has tripled and in some cases quadrupled. What are governments doing to “fix” this? Playing with interest rates. How cute!

Sticking with supply-side economics…

New Zealand to price sheep and cow burps to cut greenhouse gases

There is no question that we need to cut the amount of methane we are putting into the atmosphere, and an effective emissions pricing system for agriculture will play a key part in how we achieve that,” said James Shaw, climate change minister.

James, dear boy, you are either a complete abject moron or you are too cowardly to tell your handlers to go chew on thorns.

I won’t bore you with the details. It’s a tax. Surprise! A tax is administered to the most productive sector of the New Zealand economy.

When New Zealand can’t export the volumes of food it does, then it will quickly experience a widening trade deficit, weakening currency, and an explosion in the price of anything not domestically produced, which includes the coal it now imports (after shutting down natural gas facilities), diesel (which its farmers all use), and fertilizer (again, which its farmers use).

Quickly, New Zealand becomes less competitive on the global agricultural market. It’s just what’s going to happen. This isn’t some hypothetical situation. This is what happens. Watch!

What else?

If you price people out of the necessities of life, two things happen:

- They become desperate, and

- In desperation, they are susceptible and malleable to “solutions” which would have previously been out of the question.

When the World Economic Forum talks about eating bugs, they aren’t merely suggesting it in the sense that a company marketing a new product would. No. They are telling you.

There will be no choice since via a combination of supply destruction as New Zealand is showing, leading to higher costs and thus pricing more and more people out of the market so they can blame the price increases on the greedy farmers who are killing mother earth.

Think it makes no sense?

It doesn’t have to make any sense. What we learned over the last two years is that a never-ending stream of propaganda will lead the masses to demonize and ostracise those they are told to.

This time it isn’t ‘the unvaccinated’, though that will not go away. It is farmers. How dare they provide us with food?

And so it goes. Energy will be demonized. Hence the UK’s most recent 25% “windfall tax” on energy firms in the UK amidst the worst energy crisis of our lifetimes.

This just highlights the importance of why we spend so much energy and time attempting (not always getting it right, mind you) to invest not just in those sectors which benefit (energy and food), but doing so in jurisdictions where this murderous ideology isn’t gaining traction.

It also highlights the reason why we have a disproportionate amount of fertilizer stocks in our “ag” position.

Fertilizer companies can sell their product all over the world and are somewhat less constrained by local politics in any one place.

They are also, as we’ve pointed out many times before, like bloody firecrackers when they have a bull market.

How Our Fund Is Frontrunning The Economic Madness In 2022 And Beyond

- Copper – Copper prices have to rise to address a huge supply deficit looming on the horizon.

- Shipping – Shipping is vital for the functioning of the modern world, yet is priced for bankruptcy.

- Eastern Europe – Position for the long-term trend of capital moving from the West to the East with Polish and Russian equities markets.

- US Dollar – We’re bearish all paper currencies, but believe that the USD will outperform all others.

- Base Metals – Clean energy targets require more battery metals than existing global supply.

- Off Shore Oil & Gas – Offshore oil investment has been smashed, yet consumption continues to grow.

- Rare Earth Metals – A play on geopolitics and a cycle that should see a repricing of these commodities.

- Uranium – The looming supply deficit promises to pay handsomely when the market inevitably reprices.

- Gold – Gold sees the perfect storm; the turn of a cycle, supply issues, and lack of faith in sovereign currency.

- Coal – Modern society is dependent on coal, with supply continually growing. Is there a more hated investment?

- Personal Defense – Order is breaking down in the US, and the unrest is giving us an opportunity to position for asymmetry.

- Agriculture – Lockdowns and monetary stimulus have ensured food prices will rise, providing deep value.

- Natural Gas – Supply and demand dynamics coupled with dependency from the US provides a great opportunity.

- Plus much much more…

If these themes make sense to you then click the link below to learn more about Capitalist Exploits and how you can become an Insider member.

———–

🚨 Stay Informed And Model Our Portfolio By Going Here And Signing Up >>

———–

Contributor posts published on Zero Hedge do not necessarily represent the views and opinions of Zero Hedge, and are not selected, edited or screened by Zero Hedge editors.

[ad_2]

Source link