Russia lines up its State Fund of Precious Metals for Military Mobilization

Amid heightened tensions between Russia and Lithuania over access to Kaliningrad, Russia’s Ministry of Finance has this week published a draft bill to create a new ‘Reserve Fund’ of gold and precious metals within the existing State Fund of Russia (Gosfund). This Reserve can be used in the event that the Russian government moves to a state of ‘mobiliziation’ (i.e. if Russia moves to a general war footing).

The draft amendment bill is to the existing law “On mobilization and mobilization training in the Russian Federation”. As a reminder ‘Mobilization’ in the context of a military means:

“the organization of the armed forces of a nation for active military service in time of war or other national emergency. In its full scope, mobilization includes the organization of all resources of a nation for support of the military effort.” Source – Britannica

The Gokhran – State Fund for Precious Metals

The State Fund of Russia (full name “State Fund for Precious Metals and Precious Stones of the Russian Federation“, in Russian – Госфонд России) is a fund established in 1996 by federal legislation and which is, as the name suggests, a Russian state repository which buys, stores, and sells precious metals and gems.

The State Fund of Russia, which is sometimes called the Gosfund, is managed by a Russian state institution called the Gokhran (an entity which reports to the Russian Ministry of Finance). See BullionStar discussion of the Gokhran here, and also the Gokhran website here. The Gokhran’s State Fund of Russia can hold a variety of precious metals (gold, silver, platinum and other platinum group metals) as well as precious stones (such as natural diamonds, emeralds, rubies, sapphires, alexandrites and natural pearls).

The Gosfund should not be confused with the Russian monetary gold reserves, which are distinct and separate, and which are administered by Russia’s central bank, the Bank of Russia. The Gosfund should also not be confused with Russia’s National Wealth Fund (sovereign wealth fund), which is also authorised to hold gold.

According to Russian business news website RBC (www.rbc.ru) which first highlighted this news on 20 June 2022, Russian’s Ministry of Finance is proposing to expand Russia’s mobilization legislation with measures which will:

“form and usestocks of precious metals and precious stones that are part of the State Fund of Russia, which will be designed to meet state needs in the field of maintaining the defense capability, economic and financial security of the Russian Federation, arising during mobilization preparation and mobilization”.

RBC also says that Russia’s president Vladimir Putin will have the power to decide how this Reserve fund is used. So basically, if this bill is adopted and implemented, precious metals and gem stones in the State Fund of Russia can be allocated to, added to, or moved to the new ‘Reserve fund’, and Putin can then decide how, in the context of a military mobilization, this Reserve fund of precious metals will be used.

The Ministry of Finance draft bill also proposes that ‘mobilization training’ include the ‘protection, safety and security’ of precious metals and precious stones held by the Gokhran’s State Fund of Russia. As RBC says:

“The president of the country will determine the tasks for protecting and forming stocks of precious metals and stones of the State Fund of Russia intended for mobilization needs, as well as making decisions on their use.”

Mobilization: Pre-Planned in 2021

Interestingly, although this legislative bill to use precious metals of the Gosfund in a general Russian mobilization is now appearing in June 2022 in the middle of the Russia-Lithuania (NATO) standoff, the bill itself was perceptively planned over a year ago back in mid 2021. Which begs the question, has a widespread Russian – NATO war been planned all along, or is it just preceptive pre-planning?

On 22 July 2021, the website of the Federal Assembly of the Russian Federation published an article stating that “the Ministry of Finance of Russia proposes to create a reserve of precious metals and stones intended for the mobilization needs of the country”, and which explained that:

“Mobilization needs are the resources that are needed to prepare a country for a possible transition from peace to war. We are talking, for example, about gold and foreign exchange reserves to support the economy, food reserves, and so on.”

A few weeks earlier on 30 June 2021, the same Russian Federal Assembly website revealed that a government decree had come into force at the end of June 2021 that gave Russia’s Ministry of Finance powers to support the “protection, safety and security of precious metals and precious which are part of the State Fund of Precious Metals”.

And in another prong of Russia’s preparations to harness the Gokhran’s State Fund of precious metals in the event of a national emergency, the Russian State Duma just a week ago on 15 June 2022 passed an amendment to the law “On Precious Stones and Precious Metals“, so that the Russian President and the Russian Government can now make speedy decisions on selling precious metals from State Fund without amending federal budget law.

According to the TASS news agency, this amendment gives Putin a lot more flexibility to sell gold and precious metals from the State Fund as it:

“establishes that the issue of gold from the State Fund of Russia for operations in the foreign and domestic markets, as well as the issue of other precious metals and precious stones from the fund in excess of the volumes established by the plans approved by the Cabinet of Ministers and for purposes not provided for by these plans, is carried out only by decision of the President of the Russian Federation on the basis of a reasoned proposal from the head of government.”

TASS says that this amendment will “enable the President of the Russian Federation and the Government of the Russian Federation to make prompt decisions on the release of the values of the State Fund of Russia to meet the urgent needs of the state in emergency situations.”

Gokhran Gold – State Secrecy

While the bulk of Russia’s monetary gold reserves are managed by the central bank of Russia on behalf of the Russian Federation, and the magnitude of these gold reserves is known (assuming that the numbers from the Bank of Russia are accurate), the same is not true of the gold holdings and other precious metals holdings of the Gokhran’s State Fund of Precious Metals. This is because the Gokhran does not publish any holdings figures.

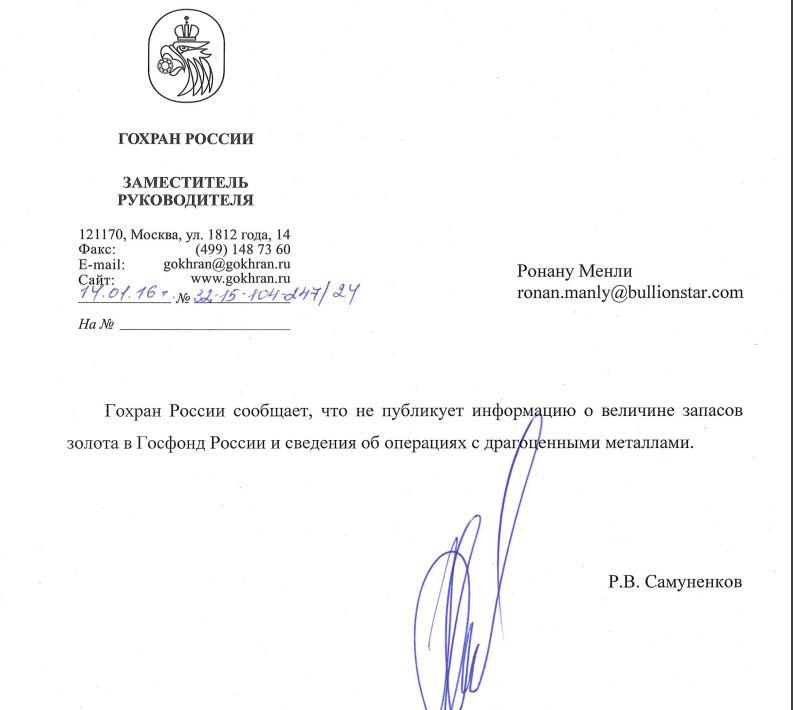

How do I know? Because knowing that the Gosfund was of strategic importance to Russia, I previously asked the Gokhran this very question back in 2016 about whether it published gold holdings, and they replied that:

“Gokhran does not publish information about the amount of gold reserves in the Russian Gosfund and data about precious metal operations.”

For those who speak Russian, see screenshot below.

But it is clear that the Gokhran buys gold into the Gosfund, because sometimes it even advertises this fact. For example, on 26 May 2022, the Gokhran announced that it wanted to purchase 2 tonnes of gold in standard ingots / bars form and wants the transaction completed by the end of July 2022. See announcement here.

Besides, the Gokhran also publishes a daily price list on its website of prices that it will pay for Gold, Silver, Platinum, Palladium, Rhodium, Iridium, Ruthenium, and Osmium – See the June 2022 Gokhran price list here.

Bank of Russia Gold – Upcoming State Secrecy

Additionally, this secrecy which is already applied to the Gokhran will probably also soon apply to the gold reserves of the Bank of Russia. Why? Because there is now a little known draft bill being tee’d up by the Russian Ministry of Economic Development which proposes to make information about Russia’s gold reserves and foreign exchange reserves a state secret.

Currently, the Russian law on state secrets (adopted in 1993) excludes Russian currency and gold reserves from being classified as state secrets. See Article 7 here where “the size of the gold reserves and state foreign exchange reserves of the Russian Federation” is excluded from being a state secret.

But this will all change if the Ministry of Economic Development’s planned amendment bill to the State Secrets law goes through. According to an article on this topic from business news site RBC, dated 7 June 2022, the Russian Ministry of Economic Development says that the intended upcoming secrecy about Russia’s gold reserves is “in order to reduce the negative consequences of unfriendly actions of foreign states and international organizations“, and that:

“In connection with the unfriendly actions of foreign states and international organizations, information on the size of the gold reserves and state foreign exchange reserves of the Russian Federation must be protected from the possibility of receiving it by unfriendly foreign states”

EU is going after Russian Gold

While Russian precious metals refineries have already been dropped from both the LBMA and COMEX good delivery lists for gold and silver and the LPPM good delivery lists for platinum and palladium, and while the US is trying to sanction Russian gold (see here), the ‘unfriendly actions of foreign states and international organizations” against Russia may be about to get even unfriendlier with EU officials leaking to Reuters on 21 June that:

“European Union leaders aim to maintain pressure on Russia at their summit this week by committing to further work on sanctions, a draft document showed, with gold among assets that may be targeted in a possible next round of measures.”

“Gold is one of the possible next targets, according to officials familiar with the discussions.”

And with Denmark, for some reason, being chosen to ‘propose’ the motion:

“At a closed-door meeting of EU envoys last week, Denmark suggested further sanctions could include gold, a spokesperson for the Danish ambassador to the EU said.

A person familiar with the work on sanctions told Reuters the European Commission was working on adding gold to a possible next round, although it was not yet clear whether the measure could ban exports to Russia, imports from Russia or both.“

Additionally, if the EU does move to ban gold imports from Russia and gold exports to Russia, someone needs to tell Switzerland since, when no one was looking, the Swiss recently resumed gold imports from Russia. According to a Bloomberg article, also dated 21 June:

“More than 3 tons of gold was shipped to Switzerland from Russia in May, according to data from the Swiss Federal Customs Administration. That’s the first shipment between the countries since February.”

Although Switzerland is not an EU member, it does have very close relations with the EU, and it would be interesting to see what Switzerland’s State Secretariat for Economic Affairs (SECO) thinks about these Swiss gold imports from Russia, given that SECO likes to mischievously meddle in the business of Swiss gold refineries importing gold from other jurisdictions such as the UAE.

Conclusion

From linking the Russian ruble to gold and energy, to preparing gold to be used in a general Russian mobilization under a war scenario, the yellow metal continues to be at the forefront of major geo-political and monetary developments so far in 2022. And now gold looks like it will play a leading role in a new round of reactive EU sanctions against Russia.

But given that Russia has created an extensive infrastructure to trade its gold with China and beyond, will EU sanctions against Russian gold be another own goal that restricts the EU economy while having little impact on Russia? And will Switzerland do what it has always done in times of war and continue to trade gold with all sides?

[ad_2]

Source link