Average Transaction Price for New Vehicles Hits Record $45,844 in June, as Consumer Still Pay No-Matter-What, amid Inventory Shortages, Record Per-Unit Gross Profits at Dealers

And despite the surge in interest rates for auto loans.

By Wolf Richter for WOLF STREET.

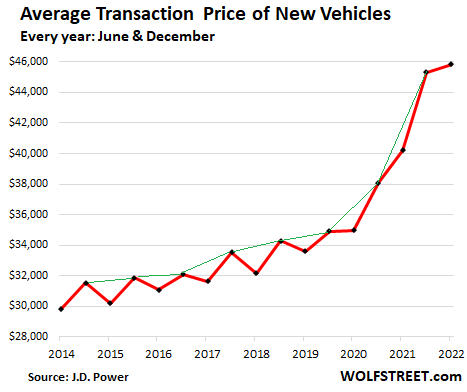

The average transaction price (ATP) of new vehicles sold by dealers to retail customers in June hit a new breath-taking record high of $45,844, up by 14.5% from a year ago, and beating the prior record set in May, according to estimates by J.D. Power, even as the pace of new vehicle deliveries to retail customers in June is expected to have plunged by 18% from a year ago, while many dealers were short or out of the models that would sell in large numbers, as automakers continue to struggle with semiconductor shortages, triggering production shortfalls.

With overall inventories near historic lows, and barely improved from the desperate levels last year, prices continued to surge, driven by historically low incentives from automakers and by addendum stickers from dealers, but also by the prioritization of the most expensive trim packages and models by automakers, and that’s how the ATP jumped to a new record.

Since June 2019, the ATP has spiked by 36%, or by over ten grand! The chart shows ATPs for December and June of each year. Note the pre-pandemic seasonality, where the ATP hit a high in December but dropped from there to June every year. But in June 2020, the ATP was level with December for the first time. From then on, the ATP just spiked without regard to seasonality, including this June. The green line connects the Decembers:

The inventory nightmare.

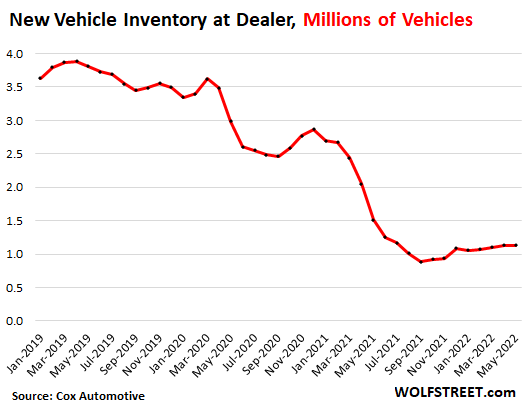

June started out with new vehicle inventories at desperately low levels as automakers continued to struggle with the semiconductor shortages that will now drag into 2023. Months ago, many automakers stopped taking orders for certain models for the 2022 model year, where waiting lists were so huge that they cannot be built this year, given the supply constraints. For example, Ford stopped taking orders and reservations for the 2022 Maverick baby-truck (hybrid), the F-150 Lightning (EV), and the Mustang Mach-E (EV).

So June started out with 1.13 million new vehicles in inventory on dealer lots and in transit, down by 70%, or by 2.68 million vehicles, from the beginning of June 2019, according to separate reporting from Cox Automotive, based on its Dealertrack data. In all of 2019, the new vehicle inventory averaged 3.66 million vehicles, with many models simply out of stock and not even orderable. Starting a few months ago, an additional inventory problem cropped up: Customers, mauled by spiking gasoline prices, started switching to more fuel efficient cars and compact SUVs that no one was prepared for, and dealers ran out.

So, record per-vehicle gross profits at dealers.

The combination of enough demand that cannot be built due to the semiconductor shortages and these historically low inventory levels that resulted in record high ATPs allowed dealers to make record per-vehicle gross profits.

Total gross profit per vehicle delivered – which includes gross profit from the vehicle plus the profit from finance and insurance sales (F&I) – jumped to a record of $5,123, up by $1,174 from the already sky-high levels of June 2021, according to J.D. Power estimates. This per-vehicle gross profit at dealers is over 2.5 times of what it was in the normal times of June 2019.

At the per-vehicle level, the amounts of money made by dealers are just astounding, as consumers pay no matter what, including big-fat addendum stickers. This is a reflection of the inflationary mindset, and dealers and automakers adjust pricing to take advantage of it. Consumers could just as well go on a buyers’ strike and refuse to buy or order at these ridiculous prices, which would end these price spikes, but they haven’t yet.

These massive per-vehicle gross profits allowed all dealers combined to make $4.9 billion in aggregate in their sales departments, up by 10% from June last year, and the fourth biggest profit for any month, despite the plunge in volume.

Automakers slashed incentives to record lows, lease incentives died.

The average amount that automakers spent on incentives, either paid to dealers or rebated to retail customers, dropped by 59% from the already lowest levels on record a year ago, to just $930 per vehicle on average, the second month in a row under $1,000, according to J.D. Power estimates. This includes incentives for leases, and those have been eliminated entirely.

Incentive spending as a percent of MSRP in June dropped to a record low of about 2% of MSRP. By comparison, back in 2019, incentive spending was in the range of 10% of MSRP.

Incentive spending is how automakers adjust prices since the MSRPs are set at the beginning of the model year and are not changed during the model year.

This massive reduction of incentive spending translates into huge per-vehicle gross profits for automakers.

Affordability? Forget it.

The average interest rate on new vehicle loans rose to over 5% in June, according to J. D. Power estimates. And despite record high trade-in value due to the ridiculous spike in used vehicle prices, which bring down the amount to be financed, the average monthly payment jumped by 12.8% from June last year.

But at this point still, consumers who can afford it pay no matter what to get a new vehicle, and many of them now order it, and they pay addendum stickers, and they pay higher interest rates, and demand still exceeds supply.

Most consumers could just as well drive what they already have for another year or two or five, which makes new vehicles a discretionary purchase, unlike food. And consumers could react to these prices and interest rates, but they haven’t yet, which shows that the inflationary mindset is running wild.

At some point, the Fed’s future rate hikes may finally lead to auto-loan interest rates that are so high that they will cut demand below the level of supply, allowing inventories to build, and prices to settle, and inflationary pressures to recede, but not yet.

It remains hard to see what actual demand would be under these conditions if supply were back to pre-pandemic normal levels. And all this shows is that inflationary pressures in new vehicles are not yet receding because enough consumers continue to play along.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

[ad_2]

Source link