Larry Summers Nailed Inflation. But Is He Right on What Comes Next?

In February 2021, Larry Summers was right and I was wrong. The former Treasury secretary warned that President Biden’s stimulus package was far too large and would lead to far too high inflation. I was less worried and thought the Federal Reserve would be willing to raise interest rates to head off any inflationary problem. My faith was misplaced, and it took me until June to realize my mistake. The Fed waited another nine months to act.

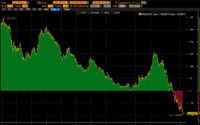

Markets are finally focused on whether the Fed’s newfound hawkishness will start a recession—Prof. Summers thinks it will. There is a longer-term question that matters, too: Once inflation is finally brought under control, do we return to the post-2009 secular stagnation, or will there be a new paradigm? Here again I find myself disagreeing with Prof. Summers, who thinks the likelihood is we return to the status quo ante. I think there is a greater chance of a new economic regime, with more inflationary pressure and higher real interest rates.

[ad_2]

Source link