Interest.co.nz/Stephen Roach/6-22-2022

“I should have listened to Alan Greenspan – at least when it comes to currency forecasting. The former chair of the Federal Reserve once told me it was a fool’s game, with the odds of getting currency calls right worse than a successful bet on a coin toss. Two years ago, I ignored the maestro’s advice and went out on a limb, predicting that the US dollar would crash by 35%.”

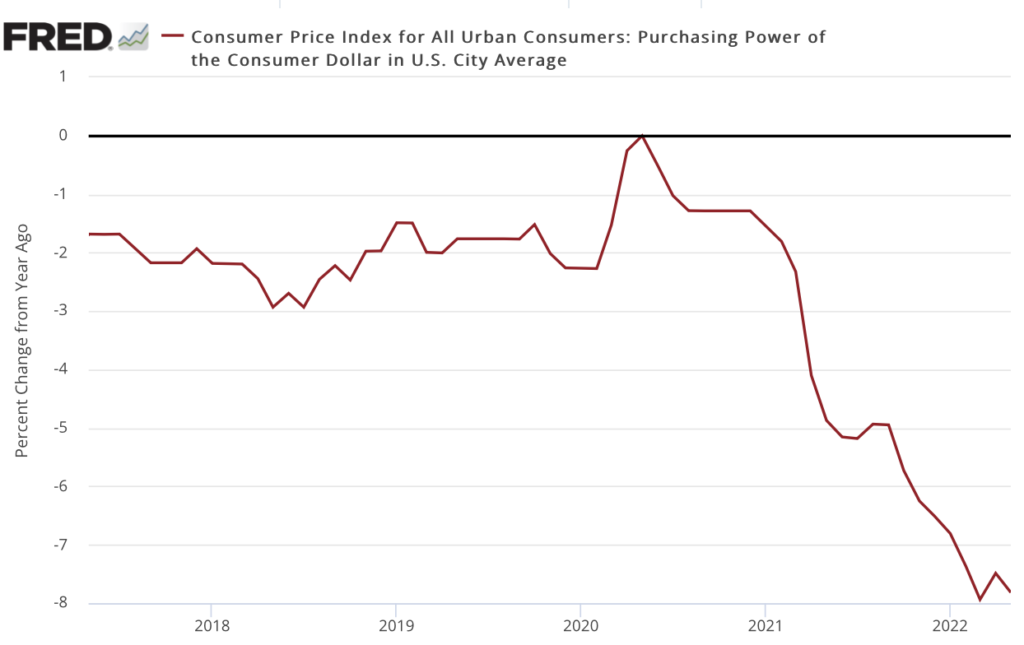

USAGOLD note: Roach says he got it wrong on inflation in 2020, but thinks the dollar is now overvalued. “I know, ” he says, “that’s what I said two years ago.” But did he really get it wrong? Roach’s error, if there was one, comes, in our view, from measuring the value of the dollar against other currencies rather than goods and services. Had he zeroed in on the dollar’s purchasing power in 2020 as the measure of value, his forecast would have been 100% on the money. (See chart below.) The dollar is down 8% over the period. The uncontrollable factor in currency analysis is being unable to reasonably predict what nation-states will do to move the value of their currency in one direction or the other against the dollar. Japan has been a good example in that regard. Any bets where we will be on the purchasing power of the dollar two years from now?

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics