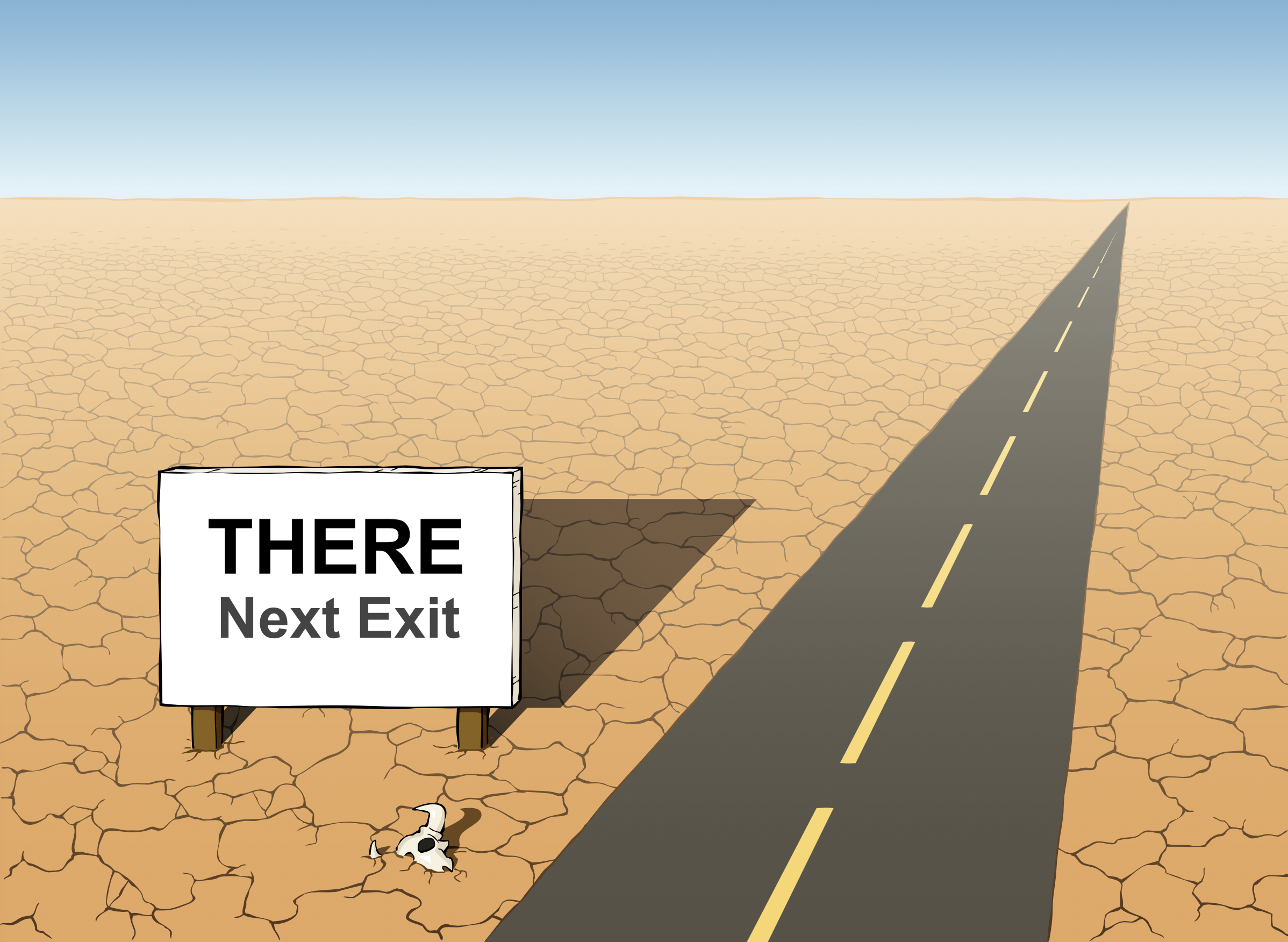

Are we there yet? | Today’s top gold news and opinion

Hussman Funds/John P. Hussman/July 2022

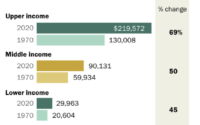

If ‘there’ means valuations anywhere near levels that are consistent with historically run-of-the-mill long-term returns; if ‘there’ means a monetary policy stance anywhere near something that would promote productive capital allocation without speculative distortion; if ‘there’ means financial market capitalizations that can actually be served by the cash flows generated by the economy, providing adequate long-term returns without relying on endless expansion in valuation multiples; then, no. We are not ‘there.’ The problem is that after a decade of deranged monetary policies that ultimately amplified speculation beyond 1929 and 2000 extremes, we are so far from ‘normal’ that arriving anywhere near that neighborhood will be a journey. The recent market decline has simply retraced the frothiest portion of the recent bubble, bringing the most reliable market valuation measures back toward their 1929 and 2000 extremes.”

USAGOLD note: To steal a phrase, Hussman sees the current set-up in the stock market as more the end of the beginning than the beginning of the end. In April, he projected an interim loss for the S&P 500 of between 50% to 70%. So from his perspective, the answer to the question is “No. We aren’t even close to being there yet.”…… Much to consider at the link above.

USAGOLD note: To steal a phrase, Hussman sees the current set-up in the stock market as more the end of the beginning than the beginning of the end. In April, he projected an interim loss for the S&P 500 of between 50% to 70%. So from his perspective, the answer to the question is “No. We aren’t even close to being there yet.”…… Much to consider at the link above.

[ad_2]

Source link