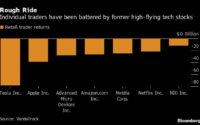

Bloomberg/Matthew Burgess and Daisuke Sakai/7-5-2022

“Japanese investors hold the largest pile of Treasuries outside the U.S., over $1.2 trillion worth, but have been cutting their overseas bond exposure amid the global debt selloff. Weekly data from the Ministry of Finance show just four weeks of net purchases of any significance this year.”

USAGOLD note: if Japanese institutional investors are out of the US Treasuries along with the Fed, it remove sthe two biggest buyers. You do not have to be among Wall Street’s Masters of the Universe to understand the implications. At the moment, concerns about the stock market have pushed investors into bonds for perceived safe-haven purposes, but those buyers are unlikely to fill the yawning supply-demand gap over the long run.