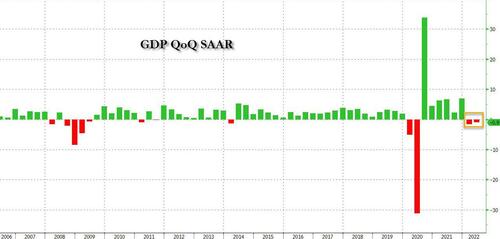

Welcome To The Biden Recession: Q2 GDP “Unexpectedly” Shrinks 0.9%, 2nd Consecutive Decline

Considering the dismal Atlanta Fed GDPNow prints in recent weeks, and considering the full-court press by the Biden admin to change the definition of recession, it will hardly be a surprise but in any case moments ago the Bureau of Economic Analysis confirmed what everyone has long known and that is that the Biden economy is now in a technical recession: the first estimate of Q2 GDP came in at -0.9% (technically -0.930%) far below the 0.5% consensus forecast (but right on top of the Atlanta Fed -1.2% tracker), and while an improvement from Q1’s -1.6%, this was still the second consecutive quarter of declining GDP which as far as the markets are concerned at least, is the definition of a recession.

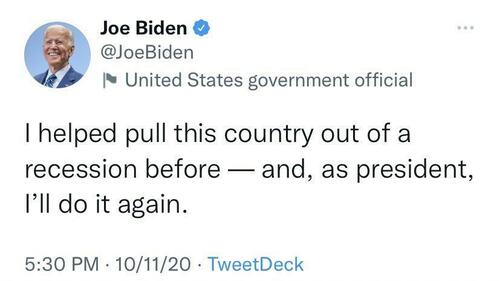

And yes, there is a tweet for that too, only in typical Biden fashion, it was upside down:

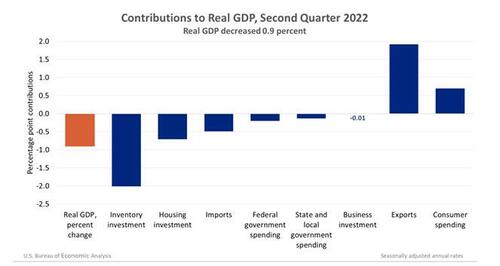

Digging into the data, after a big drop in Q1 GDP, the second quarter decrease in real GDP reflected decreases in inventory investment, housing investment, federal government spending, state and local government spending, and business investment. Exports and consumer spending increased. Imports, which are a subtraction in the calculation of GDP, increased.

According to the BEA the details were as follows:

- The decrease in inventory investment primarily reflected a decrease in retail trade (led by general merchandise stores as well as motor vehicle dealers).

- The decrease in housing investment reflected a decrease in brokers’ commissions.

- The decrease in federal government spending primarily reflected a decrease in nondefense spending that was partly offset by an increase in defense spending.

- The decrease in state and local government spending was led by a decrease in investment in structures.

- The decrease in business investment reflected decreases in structures and equipment that were mostly offset by an increase in intellectual property products

- The increase in imports reflected an increase in services (led by travel).

- The increase in exports reflected increases in both goods (led by industrial supplies and materials) and services (led by travel).

- The increase in consumer spending reflected an increase in services (led by food services and accommodations as well as health care) that was partly offset by a decrease in goods (led by food and beverages).

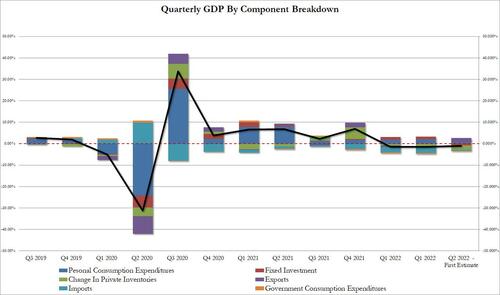

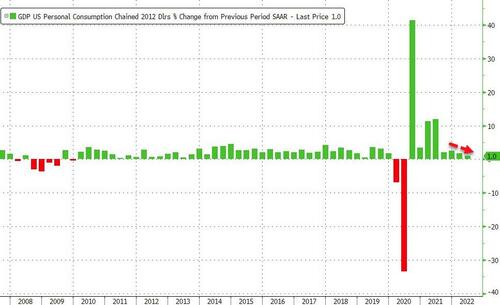

Quantifying the Q2 change we find that personal consumption rose just 1.0% in 2Q after rising 1.8% prior quarter and missing expectations of 1.2%. Unfortunately this is just the start as absent stimmies, the US consumer has long ago tapped out.

- As a percentage of GDP we get the following breakdown:

- Personal Consumption rose 0.7%, down from 1.24% in Q1

- Fixed Investment was an unexpected decline of -0.72%, down from 1.28% . Nonresidential fixed investment, or spending on equipment, structures and intellectual property fell 0.1% in 2Q after rising 10% prior quarter

- The change in private inventories subtracted -2.01%, also a sharp deterioration from the -0.35% in Q1 and right in line with our expectations of a reverse bullwhip inventory liquidation.

- Net exports added 1.43% (exports 1.92%, imports -0.49%). Good luck repeating this in Q3 when the dollar is at an all time high.

- Government consumption continued to be a drag, and subtracted -0.33 from the GDP bottom line. And now that Manchin is pushing for a debt/deficit reduction package, fiscal headwinds will only get worse!

Visually:

A quick look at that sharply lowered 1.0% increase in personal spending, it was all driven by services! Meanwhile goods spending – especially nondurable goods – the smaller day-to-day items as opposed to things meant to last a few years, like appliances, contracted. Here the pro-Biden admin Bloomberg media empire makes an amusing point:

Probably a better gauge of underlying growth is to look at consumption alone. Consumer spending surged from mid-2020 to mid-2021, more than filling the hole created by the initial blow from Covid-19.

Growth in the latter half of 2021 ran at a 2%, 2.5% pace for those two quarters. We have downshifted from that. Consumer spending grew an annualized 1.8% in the first quarter of this year, and now we’re down to 1%.

Yes, if you strip out everything except consumption, the US is certainly not in a recession, but it will be as consumption is slowing fast…

… with savings not only below pre-covid levels but at multi-decade lows!)

It’s not just the collapse in consumption and inventories: residential investment, which includes buying or building apartments and homes, also collapsed in the quarter. Aside from the first quarter of the pandemic, it fell by the most since 2010. Thank those 5% mortgage which have paralyzed the entire housing sector!

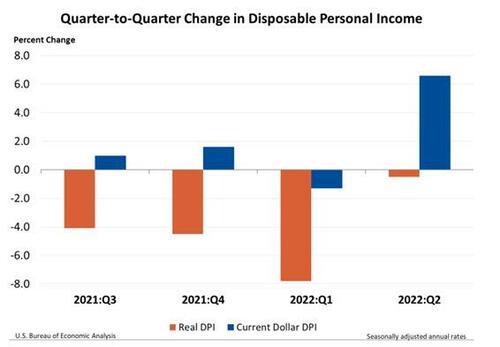

Some more details from the report: Real disposable personal income (DPI), or personal income adjusted for taxes and inflation, decreased 0.5% in the second quarter after decreasing 7.8 percent in the first quarter. Current-dollar DPI increased 6.6 percent in the second quarter, following a decrease of 1.3 percent. The increase in current-dollar DPI for the second quarter primarily reflected increases in compensation, proprietors’ income (both farm and nonfarm), personal income receipts on assets, and rental income. Personal saving as a percentage of DPI was 5.2 percent in the second quarter, compared with 5.6 percent in the first quarter.

While it is lagged, the GDP price index rose 8.7% in 2Q after rising 8.2% prior quarter as inflation continued to pick up; at the same time core PCE q/q rose 4.4% in 2Q after rising 5.2% in the prior quarter.

And while many will note that Q1 GDP should be a mulligan because of one-time events like inventory shrinkage and China lockdowns and what not, and consumer spending was actually solid, the truth is that while we may see a modest reversal in the big declines, we will also see continued deterioration in several key components such as net exports which will collapse in Q3 after contributing more than 1.4% due to the soaring dollar, as well as the continued slowdown in Consumer spending now that both stimmies and savings have been tapped.

Commenting on the data, Bespoke Investment Group said that “we now have seen two straight quarters of negative GDP, and while that may not meet the ‘official’ definition of a recession, it still doesn’t change the fact that the US economy shrank in the first half. Add to that, initial jobless claims remain right near their post-Covid highs.”

So we have a recession…. which means the political push back is about to go into overdrive, starting with Biden’s speech in a few hours where he desperately tries to convince Americans that according to the new and improved definition of a recession, the US economy is actually growing tremendously. Also expect support from Biden’s political backers such as Timothy Fiore, the ISM Mfg Business Survey Committee chair, who said that “Although Q2 GDP growth is slightly contracting, recording a technical recession, the manufacturing economy continues to expand at a respectable level. Companies continue to hire at strong rates with minimal signs of hiring freezes, managing headcount through attrition or layoffs.

New orders compared to production rates (book to bill) has been negative but this can be attributed to over-ordering and some concern for higher than planned inventory in the moderate term. Manufacturing companies have been dealing with record lead times and record prices for the last 12 months, causing companies to pause in anticipation of falling prices and shrinking lead times.

Labor markets remain tight and, according to June PMI data, supply chain performance is improving.

Yes, Tim, the labor market “remains tight” and is viewed as inflationary, which is why this recession will only get worse as Powell continues to tighten into it!

We leave off with some other kneejerk reactions from the “akshually this is not a recession” echo chamber”

Richard Flynn, managing director at Charles Schwab UK:

“Today’s announcement is concerning and reflects weaknesses in the stock market and the outlook for corporate profit margins. The US economy and stock market both struggled in the first half of 2022, as tighter monetary policy, faster inflation, and slower growth dented consumer and business confidence.

“The Fed doled out trillions of dollars’ worth of liquidity during the pandemic, boosting the economy. However, it is now aggressively raising interest rates in a bid to control inflation, meaning that liquidity has dried up. Tightening financial conditions point to a meaningful economic slowdown. Today’s announcement underscores this risk.”

Andrew Hunter, senior US economist at Capital Economics, argues that “Falling GDP not enough to prompt Fed pivot”:

“The 0.9% annualized fall in GDP in the second quarter is disappointing but doesn’t mean the economy is in recession. The decline was partly due to a huge drag from inventories, while most other coincident indicators, particularly employment, show continued expansion.”

Stephen Stanley, chief economist at Amherst Pierpont Securities, is quick to note that – surprise – we are not in a recession.

“The GDP release was definitely softer than expected. A second straight negative GDP figure will further encourage talk of recession, but I agree with Chairman Powell that the economy, while slowing, does not exhibit the characteristics of a downturn. Most notably, labor markets remain robust.”

“The term ‘technical recession’ is not a generally recognized economic concept. I don’t think I had ever heard it before a month or two ago. In my view, the economy is either in recession or it’s not.”

Seema Shah, global strategist at Principal Global Investors, also explains why we are not in a recession:

“Policymakers will no doubt be tying themselves in knots trying to explain why the US economy is not in recession. However, they make a strong point. While two consecutive quarters of negative growth is technically a recession, other timelier economic data are not consistent with recession. Certainly, with two job openings per unemployed worker and an average 375,000 jobs being added per quarter, the labor market is picture of strength.”

Jay Hatfield, chief investment officer at Infrastructure Capital Advisors, is also quick to defend Biden:

“We are not in a recession or technical recession as first quarter GDP estimates are empirically negatively biased. An alternative measure of GDP, GDI was up 1.8%. The weakness in this quarters report was due to a 2% decline in inventories, which is a positive indicator of demand and bodes well for an improvement next quarter. In addition, almost all US sectors have very low inventories including housing, autos and energy. If next quarter’s GDP is also negative, which we do not forecast, then that would indicate we are in a recession.”

Heidi Shierholz, president of the Economic Policy Institute, also doesn’t think we are currently in a recession:

“But one thing is clear — the economy has slowed substantially, and additional aggressive action by the Fed to slow growth in the name of taming inflation is very unlikely to be necessary. The consequences of additional rate hikes would be highly damaging, including increased unemployment, reduced living standards, and increased racial inequality.”

In other words, all of the economists and ‘experts’ who one year ago said inflation was transitory, again agree: this is not a recession because of the strong labor market. Well, uhmm, the (still) strong labor market is precisely why Powell will keep turning the screws until the recession goes from bad to worse to catastrophic, a point which Randy Kroszner, former Federal Reserve Governor and now a professor at the University of Chicago Booth School of Business, made when he said the GDP numbers won’t stop the Fed from hiking rates:

“Usually when you have sustained contraction, you have a weak labor market, but we don’t have it now. What we see is that consumers are being hit by a very high inflation. I think this is not going change the Fed’s approach. They’re aware of challenges for consumers and declining wages. But it’s not going to stop them from raising rates. Most likely they’re on track to hike by 50pb in September.”

There was just one credible hot take so far: that of Peter Boockvar, chief investment officer at Bleakley Financial Group, who said that recession or not, the US economy is notably slowing down — and will continue to do so in the second half of the year.

“Higher inflation and the coincident higher cost of capital is kryptonite to an economy that has been so accustomed to low inflation and cheap money for many years. The labor market is softening with the pace of firings now at the highest level in eight months.”

In the end however, the Biden (non) recession is a purely political concept, as Robert Hall, the head of the NBER Business Cycle Dating Committee — the official arbiter of recessions — confirmed recently in an interview to Bloomberg’s Steve Matthews: “I don’t think that the two-quarter idea has any merit.”

What he meant is that the two-quarter idea has no merit if a politician I approve of is in the White House; until then we can just keep changing the definitions of “vaccine”, “inflation”, “recession” and ultimately “liberty”.

[ad_2]

Source link