Wall Street Reacts To Today’s “Phenomenally Strong” Jobs Report

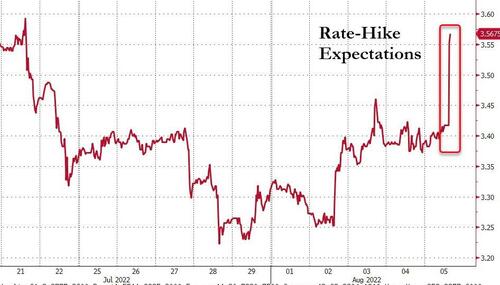

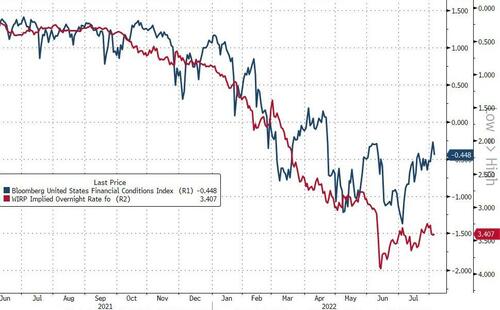

We already know how the markets have responded to this morning’s “good news” in the jobs data – rate-hike expectations soaring, bonds, stocks, and bullion crushed as the dollar spikes.

The market is now pricing in 70% odds of a 75bps hike in September (up from 25% at the start of the week) and over a notably7 more aggressive tightening cycle than was expected a week ago…

Now we hear from Wall Street’s best and brightest:

Omair Sharif, founder of Inflation Insights LLC, says 75 basis points next month from the Fed is now “the base case.”

Randall Kroszner, a former governor at the Fed and now an economics professor at the University of Chicago Booth School of Business, speaks on Bloomberg Television:

“I think it’s really clear that they are on a path to continue to raise those rates. Certainly 75 basis points will be on the table for the for the next meeting. The thing is not only the strength of the labor market, but it is also the significant increase in wages higher than expected upward revisions.”

Bloomberg’s Ven Ram:

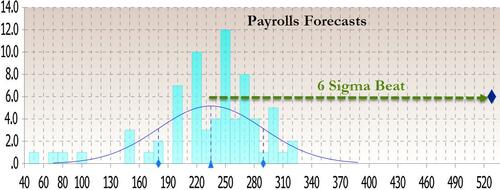

This is a phenomenally strong jobs report, way stronger than forecast and more than the average payrolls expansion for the year through June. This will increase chatter for a 75-bp move from the Fed, and the reaction should be along those lines

Neil Dutta, head of US economic research at Renaissance Macro Research LLC, warns we may be in for a hard landing now:

“This jobs report is consistent with an inflationary boom. The Fed has a lot more work to do and in an odd way, that the Fed needs to get more aggressive in pushing up rates, makes the hard-landing scenario more likely.”

Bruce Richards, chairman and CEO of Marathon Asset Management — a $24 billion global credit manager — thinks the Fed should be more aggressive:

“Tight labor conditions continue, growth in employment is hugely impressive, which will undoubtedly require the Fed to tighten financial conditions more than markets have assumed.”

Eric Theoret, global macro strategist at Manulife Investment Management:

“For the Fed, this report confirms the need to continue tightening and also endorses much of this week’s Fedspeak that sought to jawbone rate expectations. For markets, the report may pose a challenge for rate-sensitive equities like tech which had recently been leading in terms of sector performance.”

Mark Cabana, head of US rates strategy at BofA Global Research, says the report is truly strong and suggests more work has to be done by the Fed:

“It means a 75bp rate hike in September is very much in play. The market is saying if the Fed is truly data-dependent and if other data is similarly strong, the Fed needs to go faster.”

BI’s Currency Strategist Audrey Childe-Freeman sees today’s print as a “win-win for the dollar”:

“This is a dollar bullish report. As the market seems to focus more on recession fears, the indisputable strength in the US employment report suggests there’s still room in the US (despite the lags in the labor market) and this is a green light for Fed hawks.

“This confirms the overwhelming yield-driven dollar bull case, and if Fed hawkishness triggers renewed risk-off, the dollar should also benefit via safe-haven flows.”

John Bradyat RJ O’Brien says:

“The market is going to price in a more aggressive Fed, only raising the odds of a hard landing somewhere down the road.”

Florian Ielpo, head of macro research at Lombard Odier Asset Management, says:

“so much for the macro slowdown: This data point is clearly indicative of how tense is the job market these days. This means wages progressing and this also means the Fed is far from having done its tightening cycle.”

“Markets need to prepare for an hawkish Fed and an hawkish ECB alike: 4% in the US and 2% in Europe are no longer fantasies and the economy has so far barely reacted to the tightening. Time for central banks to act tough, time for markets to brace for tighter monetary conditions.”

Matt Maley, chief market strategist at Miller Tabak + Co.:

“The employment report means that the Fed can keep tightening to the degree they’ve been saying in their ‘Fed speak’ this week. The market has been pricing in a more dovish Fed in the near future. This report tells us that this is going to be very unlikely.”

Gregory Faranello at AmeriVet Securities says:

“Don’t fight the Fed, don’t fight Bullard,” and that the 2/10’s Treasury curve inversion is set to test -50 basis points.

Linda Duessel, senior equity strategist at Federated Hermes, says the jobs report erases Fed pivot hopes:

“Earnings surprise is highest since October. So, wage growth still strong. Biggest concern participation lowest since December 2021—evidence of structural tight as a drum labor market. Wage price spiral? 1970s? We will watch jobless claims, as the most important figure for when the Fed will stop—no time soon!”

Dennis DeBusschere, the founder of 22V Research, says of the release:

“In simple terms, this points to the Fed needing to tighten financial conditions more.”

Steve Sosnick, chief strategist at Interactive Brokers, says:

the jobs report “really disrupts the market narrative of expectations for a Fed policy pivot” and “the data is very market-unfriendly.”

Peter Boockvar, chief investment officer at Bleakley Financial Group, writes:

“This was a great number with the obvious big upside in hirings, but when this is happening at the same time GDP is declining, it means productivity is plunging. Also, as the pace of firings is at the highest level in 9 months, this pace of hirings is just not sustainable.”

Markus Schomer, chief economist at PineBridge Investments, says the jobs report raises recession risks:

“Makes me worry an ill-focused Fed will see that as vindication of rapid rate hike strategy. But I have called the current back drop a ‘tightly-packed economy’ where labor markets are the wrong indicator to look at to judge whether the economy is strong enough to withstand tighter monetary policy, but the recent Fed speakers suggest that’s the only thing they are looking at.

“So, in a nutshell, this was a bad report that actually raises recession risks because the Fed will feel rates can rise further which may push the economy into recession in Q3.”

And finally Academy Securities’ Peter Tchir notes that The Fed will not be able to ignore that wage pressure.

Weekly hours worked got to 34.6 and were revised higher last month, which tends to be another positive.

The Household survey “only” shows 179k jobs and still shows job losses last month.

The divergence continues to grow between the Establishment and the Household (as well as JOLTs data and Unemployment Insurance Claims).

Unemployment rate ticked lower, to 3.5%, though that was more driven by labor force participation dropping to 62.1% than the jobs created in the Household Survey.

I’m sure somewhere in the details, there might be some things to nitpick, but the report, especially the Establishment report puts the Fed firmly back in the hawkish camp.

Why the report is so much better than any estimate and seems inconsistent, to some degree with other jobs data, is a question to be asked.

[ad_2]

Source link