Credit Bubble Bulletin/Doug Noland/8-5-2022

“Powell provides an easy target these days. But when it comes to the ‘neutral rate’ discussion, the entire economic community is implicated.”

USAGOLD note: With that statement, Noland echoes the thinking of Larry Summers who put it bluntly in a Bloomberg interview last week:

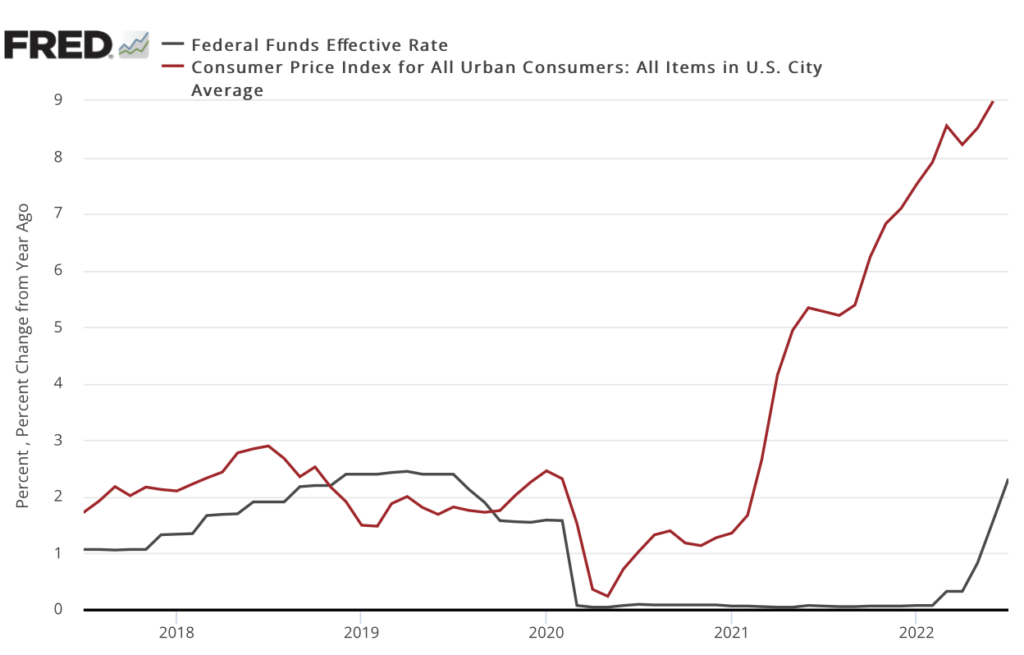

“I think Jay Powell said things that, to be blunt, were analytically indefensible. He claimed twice in his press conference that the Fed was now at the neutral interest rate – calling it 2.5%. It’s elementary that the level of the neutral interest rate depends upon the inflation rate. We’ve got on the most quoted measure a 9.1% inflation measure – if you extrapolate it off core it’s four or five percent inflation. There is no conceivable way that a 2.5% interest rate in an economy inflating like this is anywhere near neutral.” (Please see chart below.)

Mohamed El-Erian, he reminds us, called the presumption of neutrality at these numbers “comical.” Says Noland: “Fed policy, the markets, the U.S. and Russia, China and the U.S., China and Japan, Russia and Europe. The whole world seems on a collision course. Little wonder Treasuries are readily dismissing inflation and Fed tightening, apparently content to count down the months until rate cuts and the restart of QE.” We will know more about the inflation rate tomorrow morning when BLS reports the latest data.

Sources: St. Louis Federal Reserve [FRED], Bureau of Labor Statistics, Board of Governors Federal Reserve System