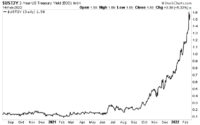

Weekend Update! US Treasury Yield Curve Inversion Worsens Screaming Impending Recession, 30Y Mortgage Rate Rises To 5.6% (5/1 ARM Rate Rises To 4.21%) – Confounded Interest – Anthony B. Sanders

August 9, 2022

Here is your weekend update on Treasury and Mortgage markets.

The current US Treasury 10Y-2Y yield curve just slipped further into reversion at -40.299 basis points, screaming impending recession. Oddly, The Federal Reserve has been leaving its balance sheet of Agency Mortgage-backed Securities (MBS) in tact (green line).

On the mortgage front, Bankrate’s 30-year mortgage rate index rose to 5.60% while the affordability-friendly 5/1 Adjustable Rate Mortgage (ARM) rate rose to 4.21%.

Currently, a 5/1 ARM borrower can save 139 basis points over the traditional 30-year mortgage rate.

Have a wonderful weekend!

[ad_2]

Source link