Mission Impossible! How The Fed Can Get To Their 2% Target? Taylor Rule Suggests Raising The Target Rate To … 22%! – Confounded Interest – Anthony B. Sanders

I scratch my head when I here Fed talking heads discuss how to get inflation back down to 2%.

Of course, the easiest way is to 1) remove Biden’s anti-fossil fuel executive orders that limit the supply of crude oil and natural gas, but that isn’t going to happen. 2) stop Federal spending, but Manchin and Sienma enabled Biden/Schumer/Pelosi’s “drunken sailors in port” spending sprees, so Federal spending is likely to not be stopped. 3) raise taxes (Larry Summer’s suggestion) to cool-off demand. And give MORE money our Federal government? No thanks. 4) raise The Fed target rate to 22%.

Yes, the Taylor Rule suggests a target rate of … 22% to tame the savage inflation beast, based on 8.50% CPI YoY.

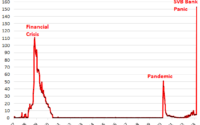

The problem, of course, is that 22% is higher than the previous high of 20% under Fed Chair Paul Volcker in 1981. And Volcker didn’t have the Bernanke Bonanza (aka, quantitative easing). Look at the monetary stimulypto, since 1981 and particularly since Covid.

Will The Fed raise rates to 22%? Well, Fed Futures is pointing at the target rate hitting 3.6% by March 2023, then falling again.

Its mission impossible to get to 22%, particularly since Biden/Schumer/Pelosi won’t cool it on Federal spending.

[ad_2]

Source link