Mexico, Peru, Argentina Set for New Rate Hikes: Decision Guide

(Bloomberg) — Mexico and Peru’s central banks are expected Thursday to hike their key interest rates to the highest point in more than a decade, as they continue their record tightening cycles to try to wrestle persistent inflation back under control.

Most Read from Bloomberg

Banxico, as the Mexican central bank is known, will raise its benchmark rate by 75 basis points to 8.5% — its highest since adopting a target rate in 2008 — according to all 23 economists surveyed by Bloomberg. Peru, in the meantime, will increase borrowing costs by a half-point to 6.5%, eight of nine analysts predict.

Both banks have been steadily boosting rates since mid-2021 as they, like their peers worldwide, struggle to contain a surge in consumer prices.

Separately, Argentina is also expected to boost its key rate Thursday even if no formal central bank announcement is set up.

Mexico: Record Rate

Mexico’s central bank is widely expected to take its rate past its previous record of 8.25%, following the US Federal Reserve in delivering a second straight 75 basis-point hike.

When announcing its unanimous June decision, Banxico’s five-member board said in a statement it “intends to continue raising the reference rate and will evaluate taking the same forceful measures if conditions so require.”

The board meets just after new data showed inflation hit its highest point in over 21 years in last month, despite the central bank boosting its target rate 375 basis points in the past 14 months.

Core inflation, which excludes volatile items like fuel, accelerated above expectations to 7.65% in July from 7.49% the previous month. Meanwhile, wages rose faster than any time since 2001 at 9.5% and far quicker than headline inflation of 8.15%.

Banxico targets inflation of 3% plus or minus one percentage point.

Read More: Mexico’s Inflation Hits 21-Year High Ahead of Rate Decision

“The inflation data were quite bad, especially core inflation,” said Jessica Roldan, chief economist at Casa de Bolsa Finamex, adding that the rate could hit 10% this year. History shows that “once we get to such a high level, inflation gets persistent,” she said.

On the positive side, US price increases slowed more than expected to 8.5% in July on an annual basis, boosting expectations that the slowdown will soon filter into Mexican costs. Some economists argue that part of the price pressures experienced by the Mexican economy derives from its main trading partner, the US.

A big question in Thursday’s decision will be whether Banxico will provide more forward guidance and if it’s another unanimous vote. The bank traditionally follows the Fed’s hikes to avoid destabilizing capital flows and hitting the peso, but it started tightening much earlier than its northern neighbor during this cycle.

“You have to deliver a hawkish statement that goes in the direction of another 75 basis-point increment but at the same time you have to communicate that at some point you will have to decouple from the Fed,” Gabriel Lozano, Mexico’s chief economist at JPMorgan Chase & Co.

Lozano also said Deputy Governor Gerardo Esquivel might split the vote by backing a smaller hike, giving a signal that Banxico may soon start to slow its tightening as it worries about the impact of costlier rates on growth.

“Growth in Mexico is going to be lackluster in the second half of the year,” he said.

MEXICO PREVIEW: Banxico to Continue Matching Fed Rate Hikes

Peru: Tightest Since 2008

Peru’s expected rate hike would be the 13th straight increase in a cycle that’s already added 575 basis points to borrowing costs since August 2021.

Policy makers are looking to cool prices as a deceleration in July inflation was mainly due to base effects and the number was still higher than expected. Inflation slowed to 8.74% year on year from 8.81% in June.

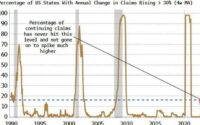

Excluding food and energy, inflation accelerated to 5.44% from 4.95%, signaling the price pressure is spilling over into prices of other goods and services.

What Bloomberg Economics Says

“We predict the central bank will raise its benchmark rate by 50 bps to 6.5% on Aug. 11 and reiterate plans for additional hikes to slowly normalize monetary conditions. Policy makers have signaled confidence that high inflation is transitory and are reluctant to accelerate the tightening pace with activity below potential.”

— Felipe Hernandez, Latin America economist

— Click here for Global Central Bank Decisions wrap

Some experts say the Andean country’s tightening cycle is approaching an end. Peru’s former finance minister, Alonso Segura, told Bloomberg News this week that he expects the central bank to increase rates a couple more times but by no more than 100 basis points in total.

The decision comes after recently appointed Finance Minister Kurt Burneo met central bank chief Julio Velarde this week to discuss macroeconomic stability.

“We require a joint effort by both entities, to avoid pressing the brakes and the accelerator of the economy at the same time. We must control inflation, but also promote productive activity that generates employment,” Burneo wrote on Twitter after the meeting, emphasizing respect for the bank’s autonomy.

Argentina: Hot Inflation

While there is no formal announcement scheduled, Argentina is also expected to boost its borrowing costs on Thursday as it faces one of the world’s fastest inflationary environments.

Inflation is seen having reached 7.3% in July compared to the previous month, taking the annual rate above 70%, according to an average forecast of economists in a Bloomberg survey.

The central bank’s board, which meets every Thursday, is likely to announce the increase after the July inflation data is released at 4 p.m. Buenos Aires time. Two weeks ago the bank delivered an outsized 800 basis-point hike, boosting its benchmark Leliq rate to 60%.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Source link